Bill Shorten’s announcement that the Labor party plans to remove franking credit refunds has polarised Australian investors, retirees, journalists and Super funds.

We covered Labor’s announcement in detail here: Are Franking Credits Going Bye-Bye?

Political News Sites Swing For The Fences

I started Rask Media in 2017 with a goal of providing ‘independent finance and investing news’.

If you need to know why we think Australia needs more independent finance news, here are some headlines from Australia’s most popular news sites:

- Shorten’s Class-War $59b Tax On Wealthy Shareholders, Retirees and Super Funds

- Bill Shorten’s Labor Party Throws Self-Funded Retirees To The Wolves

- Labor To End Share Dividend Cash Perk In $59b Grab

- Labor Wants To Scrap A Policy Which Means Some Who Pay No Tax Get $2.5 Million Refund

I’ll leave it up to you to decide if the headlines provide a fair representation of the proposals.

(All I say is I didn’t know we had wolves in Australia! But that’s another story)

What Are Franking Credits?

Here’s one of Rask Finance’s free financial education videos in which I detail Australia’s franking credits system:

It’s important to know that Labor’s proposal applies to the refunds only. Meaning, Australia’s system would still be better than the majority of OECD countries.

As Medium put it, of the 34 OECD countries, “We are the only country that refunds unused franking credits.”

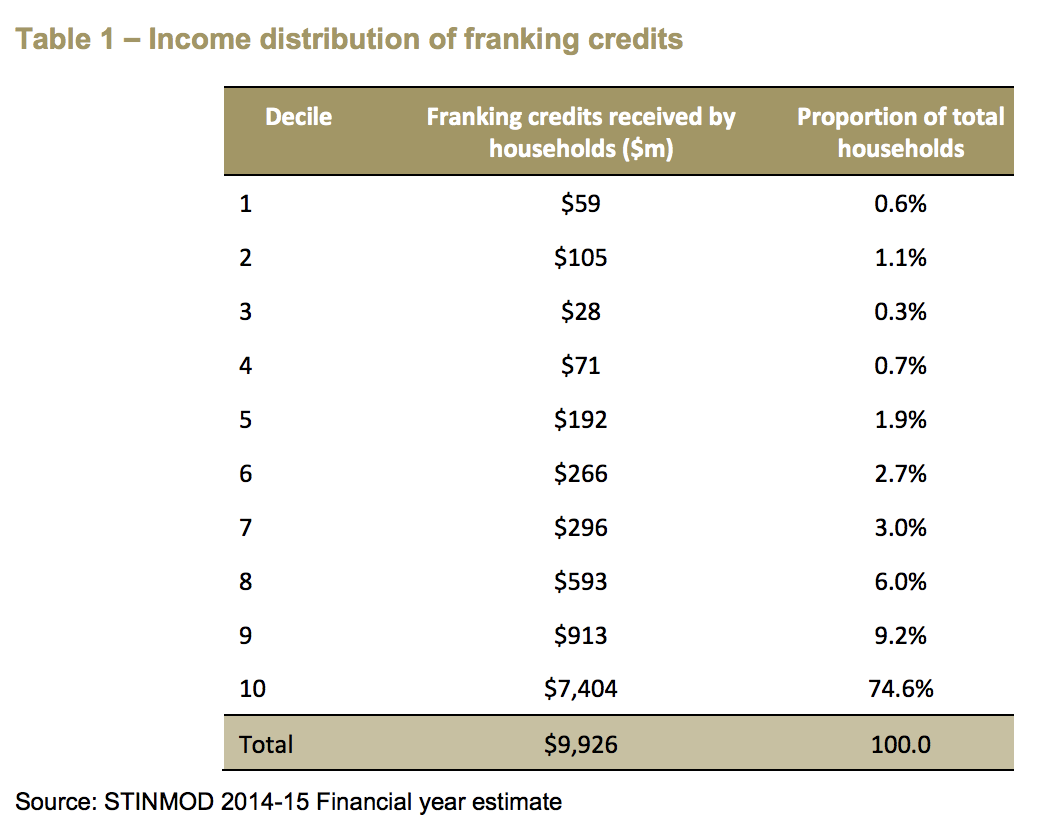

And as Matt Grudnoff of independent think tank The Australia Institute wrote in April 2015, the top 10% of income-earning households receive almost 75% of franking credits.

According to figures from the Australian Tax Office (aka “Wolves” – see above), 48.8% of franking credits went to people who earned more than $180,000 in a year. That suggests to me that the richest amongst us are reaping most of the benefit from franking credits.

For those of us who earn less than $180,000 and rely on tax refunds, it’s a tough proposition to stomach.

But the facts appear to point to one thing: the wealthy are taking advantage of the franking credits system. One figure being tossed around is that some Self-Managed Super Funds (SMSFs) received franking credit refunds over $2 million.

Quotes From Either Side Of The Debate

“According to the Opposition, more than nine out of ten taxpayers would be unaffected by its change,” the ABC reported.

“More than a million retirees, many of them pensioners or part-pensioners, will pay more tax under this proposal,” Senator Mathias Cormann said.

Saul Eslake, an economist, said 92% of Australian taxpayers will not be affected by the change.

An $11 Billion Injection

According to Parliamentary Budget Office numbers, the proposed changes would save $11.4 billion in 2020-2021 (presumably the first year when the policy would take effect).

I’ll be the first to admit (and agree with Kerry Packer’s famous quote) that the Government can’t be relied upon to invest money wisely. However, an $11 billion tax injection could be put to good use in other areas.

Sharemarket Effect

In 2017, Telstra Corporation Ltd (ASX: TLS), Australia’s premier communications business, returned about $3.7 billion in fully franked dividends to shareholders. Commonwealth Bank of Australia (ASX: CBA) paid around $6 billion.

Currently, it’s more efficient for companies to pay dividends to investors than it is for them to retain their profit and invest the capital for more growth. But just imagine if some of Australia’s largest companies spent an additional $1 billion on innovation or for the long-term benefit of our economy, communities and industries.

Takeaway

The proposals put forward by the Labor party would impact many Australians if they are passed. Unfortunately, many lower-income retirees would be hurt by the changes.

However, until we’re proven otherwise with independent data, I believe it cannot be said that the changes would be a negative for Australia overall.

As an aside, there are plenty of other ways to make money in Australia.

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.