Ethical investing is a type of investing that has risen in awareness and popularity over the last few years. But what is it?

There is a growing movement of investors who don’t want to own shares or other assets that are, or might be, doing harm to the world.

The idea of ethical investing is that investors only own shares or other assets that fit their ethical framework of the world around them.

Investing ethically isn’t necessarily about trying to generate the best investment performance, though that can be a pleasing bonus. It’s much more about an investor’s values and what impacts they want the companies they invest in to have on the planet or society.

Ethical investing can involve finding some of the most ethical businesses that tick multiple ethical and investment requirements, or simply excluding the ‘worst’ ones that don’t count as ethical, according to the investor’s set of ethical criteria.

MoneySmart defines ethical investing as such:

An investment strategy that promotes positive environmental, social or ethical issues. Avoids investment in industries and companies that produce goods harmful to health, society or the environment e.g. chemicals, tobacco, armaments. Each fund will have its own interpretation of the values it wants to protect or promote.

Who decides what is ethical?

Beauty is in the eye of the beholder, and it’s a similar thing with ethics – ethical investing can mean different things to different people.

Everyone has different values, so for one investor, an alcohol business might be unethical, but Homer Simpson could think it’s the best thing since sliced bread.

There are many different ways to decide what’s ethical or not, and there are also plenty of options on how to actually invest in those businesses and assets.

You decide…

You get to decide what’s important to you.

Which industries are ones that tick the box for you? Technology? Healthcare? Renewable energy?

You can decide if you want to actively look at individual businesses trying to do the right thing.

Or, you can leave it to an ethically-focused fund or management team to do it for you, and invest in a way that aligns with your ethical framework.

But remember, there are no rules when it comes to investing ethically. If you believe that there’s nothing wrong with alcohol brands or retailers, then don’t let that put you off owning Endeavour Group Ltd (ASX: EDV) shares. If Star Entertainment Group Ltd (ASX: SGR) just seems like a fun entertainment destination business, you can still go for it.

If you’re stumped for what ethical investing means to you, then you can do the awesome (free) Rask Ethical Investing Course to learn how to approach ethical investing and what to consider.

Here’s an intro video to it…

Ethical certification

There are also some organisations that have gained a reputation for deciding whether a business has reached a certain level of social and environmental performance – B Corp and RIAA are two leading examples of this.

‘B Corp‘ certification is a badge of honour for businesses that are balancing purpose and profit. B Corps “make decisions to create a positive impact for their workers, customers, suppliers, community, and the environment”. Businesses need to pass a certification process to display the certification to their stakeholders and customers.

Some Australian and New Zealand businesses that are B Corp certified are: Australian Ethical Investment Limited (ASX: AEF), T2, Kelly Partners Group Holdings Ltd (ASX: KPG), Synlait Milk Ltd (ASX: SM1) and BWX Ltd‘s (ASX: BWX) Flora & Fauna.

Another organisation that we can look to for ethical guidance when investing, is the Responsible Investment Association Australasia (RIAA), which is an active network of over 300 members that manage more than $9 trillion in assets globally, including super funds. It’s engaged in responsible, ethical and impact investing across Australia and New Zealand.

RIAA says it’s dedicated to ensuring capital is aligned with achieving a “healthy society, environment and economy.”

Investment organisations can be RIAA members, and also certified (which is a smaller group of select investment groups).

So don’t worry, you’re not alone if you’re thinking about investing ethically.

What isn’t ethical investing?

There are many different methods and ‘levels’ of ethical investing.

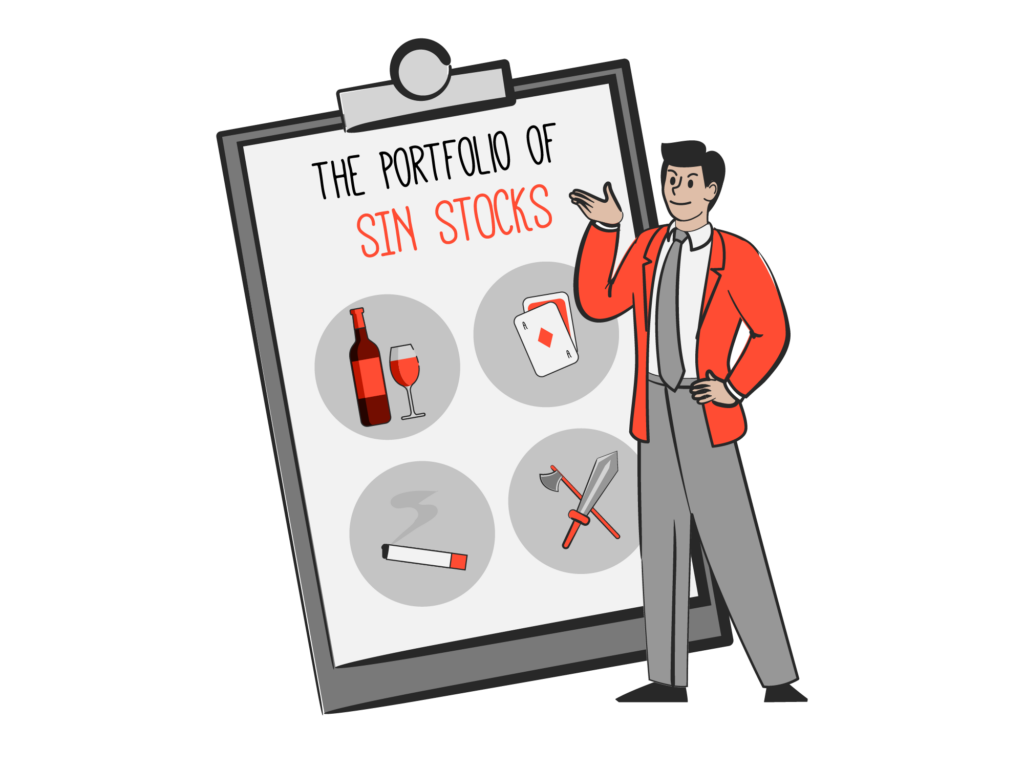

Whilst the decision about ethical investing is up to you, it’s common for ethical investing to exclude a certain group of sectors called ‘sin stocks’. These are businesses or industries that are typically seen as morally questionable.

What are some sin stock examples?

Companies that operate in industries like gambling, tobacco, weapons makers, sex-related businesses and alcohol often get included in the sin stocks list.

Most companies are generally looking to do the right thing when it comes to the environment and society. But it’s important to be wary of ‘greenwashing’. That’s when a business might try to present an image of being green or ethical and get customer kudos, but they’re actually still doing things that are part of the problem.

One major example of greenwashing was the “diesel dupe” by Volkswagen, where cars were being sold that could detect when they were being tested, and then cheat those tests by reducing emissions during the test. Those cars emitted a lot more emissions than Volkswagen was advertising.

Beware of fluff terms without clear outlines from the company, what the term means and how they’re going to achieve it. Then follow the progress, to ensure the company follows through.

Ethical investing terminology

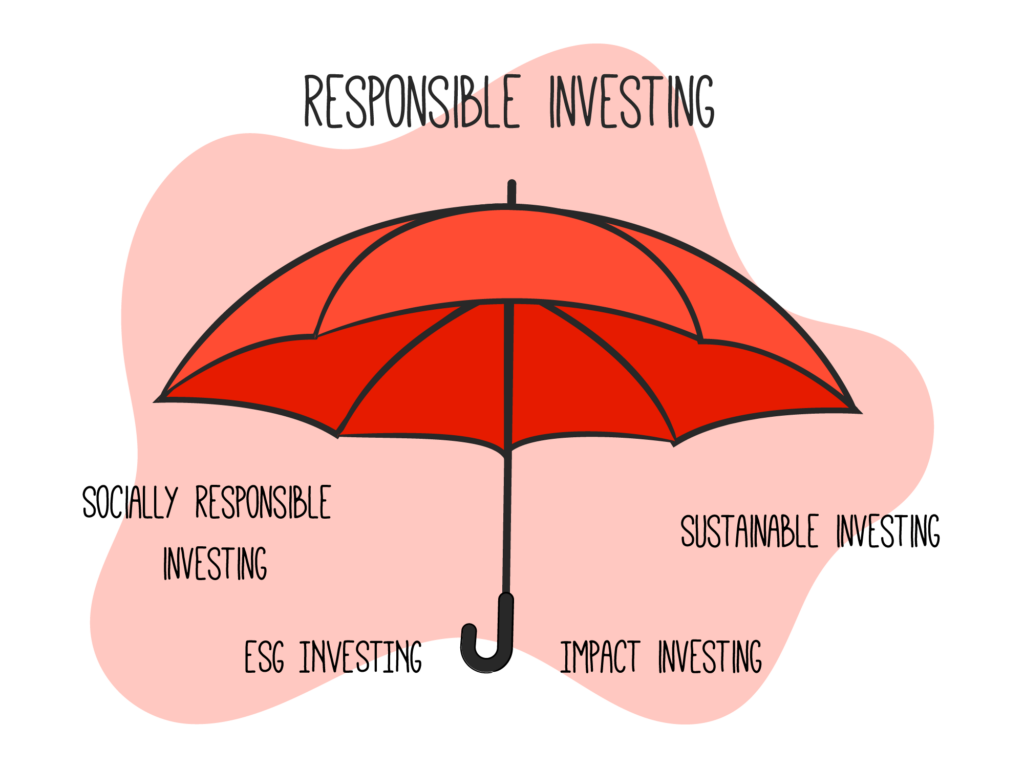

We have highlighted that ethical investing can mean different things. There are also other terms that are related to, or come under the umbrella of ethical investing.

The overarching umbrella term for all of this is responsible investing. But under that, there are many other terms. Some of them are very similar.

Socially responsible investing (SRI) is used to describe an investment process that generally focuses on a set of social values, and then excludes companies that don’t align with that. This might exclude those sin stocks that were previously mentioned.

This could also be called ethically conscious investing. Vanguard Ethically Conscious International Shares Index ETF (ASX: VESG) is an example of this method.

Sustainable investing is about picking businesses that are looking to help the world progress, creating new products or solving current issues.

Impact investing sounds pretty similar to sustainable investing. It’s about investing in companies, assets and initiatives that have a positive impact on the community and the world. So, this is certainly looking for social/environmental returns as well as financial.

Whatever way you prefer to invest, it’s about what feels right to you, helps you sleep at night, and aligns with your values.

What does ESG mean?

Perhaps you’ve come across this term before reading this guide today. But if not, let’s dig into what that means.

ESG stands for Environmental, Social and Governance.

With that one acronym, investors can judge a business in several different ways. If it ticks the ‘ESG’ box, then the ESG-focused investors may be happy to further consider the business for their portfolio.

Environmental

First up is the E part, environmental, of the ‘ESG’ thinking. It considers whether the business is doing the right thing related to the environment/climate change.

Consider the following questions:

- Is the company taking care of the area where it operates?

- Is it using renewable energy?

- Does the business have a goal of reaching ‘net zero’ emissions?

Social

Next is the S part, social, of ESG. This can be an area with a pretty wide scope.

One of the ways to frame this, is by considering whether the company is respectful of people and society.

Think about the following questions:

- Does the company treat its employees appropriately?

- Does they have employee workplace policies to ensure everyone is included and it actually follows the rules?

- Are there supply chain or human rights concerns about the business?

Governance

The final part is the G part, governance, of ESG.

As the name might suggest, it’s about how the business is governed.

Reflect on the following questions:

- Does it have suitable representation on the board?

- Do management think of shareholders (and other stakeholders), when they make business and financial decisions?

- Is the accounting designed to cover up issues or simply to give a true reflection of the business’ performance?

- Does the company do anything illegal?

Those are the three elements of ESG. It’s up to each investor to decide how much weight to put on each of these factors, and whether any of them become a deal breaker.

https://player.whooshkaa.com/episode?id=815852

Is everything that’s ‘green’ ethical?

There are plenty of businesses and activities out there, which are important for the world to decarbonise.

Renewable energy, hydrogen, being ‘net zero’, being more energy-efficient, and so on. All of those types of things are going to play a role.

However, green does not necessarily mean it ticks all the ethical boxes.

For example, mining for lithium is very useful for getting battery resources, but that mining company could treat its employees poorly, it could have a bad impact on the local environment and waterways, and so on.

Businesses that are ‘net zero’ could lack gender diversity on the board or treat their supply chain unethically.

There is also an interesting question about whether the world’s current petroleum leaders should now be counted as green, if they’re carrying out some activities that involve reducing their carbon footprint or increasing their green credentials.

It can be tricky to know where to draw the line.

How much do you exclude, perhaps to the detriment of some good investment ideas?

How to know if an ETF, managed fund or share is ethical?

It’s worth reiterating that being ‘ethical’ depends on your ethics. There are lots of investment managers that run funds which have some level of ethical filters involved.

But how are you supposed to know if an ETF, managed fund or share is ethical?

Individual shares

When you’re researching an individual share, it can take quite some time to decide whether it’s a good investment. Considering the ethical or ESG elements may not be easy either.

Some businesses make it very easy to find out about their values and actions. They may have a dedicated section on their website or publish reports, which are often titled ‘sustainability report’. Others may make it difficult to find, or not publish sustainability reports.

If ESG is important to a business, they’ll probably want to tell the investor world about it.

For example, Microsoft has a large section of its website dedicated to corporate social responsibility, which includes a sustainability segment.

Coles Group Ltd (ASX: COL) is an example of an ASX share that has a focus on sustainability, and is aiming to make that a selling point.

You can also look to see if a company has a B Corp certification, or perhaps whether a fund manager like Australian Ethical deems it to be investable. However, just because an ethical-focused manager doesn’t own a business, that doesn’t mean it’s not ethical – there could also be other factors at play such as valuation.

Investors can also use sites like Seek or Glassdoor to check out employee reviews of the organisation to get a glimpse of the culture there.

You can apply the same ethical thinking and screening to international shares (as we’ve mainly focused on ASX shares), though it’s certainly possible that in some regions of the world that ESG-type thinking is not a key priority.

List of ethical ETFs

There are loads of different investment funds out there. How are you supposed to know which one is ethical enough for you?

Sometimes the investment manager will put some sort of ‘ethical investing’ terminology in the name of the fund like the BetaShares Global Sustainability Leaders ETF (ASX: ETHI) or the Vanguard Ethically Conscious International Shares Index ETF.

The investment fund will outline if it applies any ESG considerations in its strategy, and if it does any positive or negative screening in its investment process.

Often, that ethical investment fund will have sought certification from the RIAA to outline its responsible investing credentials.

Investment funds that count themselves as ethical, will try to shout it from the rooftops because they know how much growing interest there is for this.

The BestETFs list of Ethical ETFs contains many of the ethical ETFs available to Australian investors.

Are ethical shares good performers?

Ethical investing does not mean having to accept lower returns. In-fact, there are some good examples of ethical investment strategies outperforming traditional investment funds, though past performance is no guarantee of future performance.

For example, at the time of writing, the Australian Ethical Australian Shares super option ranks number one on returns over 3, 5, 7 and 10 years according to the SuperRatings Fund Crediting Rate Survey.

At the time of writing, the ETHI ETF has outperformed the iShares S&P 500 ETF (ASX: IVV) by approximately 6% per annum over the last three years.

Performance of individual shares can vary significantly, but businesses wanting to do the right thing for the world may also be able to, on average, outperform the businesses that don’t make that a focus.

Do ethical funds have high fees?

It depends on the individual investment fund. Many ethical-focused ETFs may have higher fees than the cheapest ETFs out there like the iShares S&P 500 ETF.

However, it’s important to note that fees are only part of the equation. If the overall return is strong, then the fees are arguably worth it.

Besides, plenty of these ethical ETFs actually have cheaper fees than what active fund managers do.

Also, investors may decide that it’s okay to pay a bit more for an investment that has ethics they agree with.

Constructing an ethical portfolio

Investing ethically should still come with the same considerations that normal investing does:

- Does the potential investment make financial sense?

- Does the ethical fund provide you with enough sector diversification?

- Is this fund just ASX shares or international shares as well?

It’s certainly possible to mix and match different ethical ETFs to get the desired allocations.

For example, an investor could choose to allocate 30% or their portfolio to an ethical ASX fund and a 70% weighting to international ethical funds. It can be whatever mix you choose.

There are also some investing apps that allow investors to invest ethically.

Negative screening and Positive screening techniques

There can be different methods to ethically screen for companies to invest in.

You can start with the whole list of possible investments and exclude the ones you don’t like the look of (negative screening). Or, you could start with a blank list and only add ones to your watchlist that you think pass your ethical test (positive screening).

Negative screening is the method of cutting out ‘unethical’ investments.

This refers to excluding investments that are judged to be poor on environmental, social, and governance (ESG) issues. It could mean excluding certain industries from the investment watchlist such as fossil fuels or destructive weapons.

Positive screening is another way of investing where investors only choose businesses or investments that perform highly on ESG factors and come from certain industries such as green energy, waste management, healthcare, energy efficiency, technology, future-focused commodities or whichever sectors or businesses you like.

Something investors may consider, is choosing to invest in an ethical fund that matches your preferred method of screening.

For example, the BetaShares Global Sustainability Leaders ETF has been certified by the RIAA. It combines positive climate leadership screens with a broad set of ESG criteria. Only leading socially and environmentally acceptable businesses make it into the portfolio.

In other words, the ETHI ETF excludes a whole bunch of industries like fossil fuels, armaments, gambling, alcohol or junk food. It excludes companies that have human rights or supply chain issues. ETHI also excludes companies that lack gender diversity on the board. On top of that, companies that make it into the ETHI ETF have to be in the top one-third of performers in terms of carbon efficiency, or be involved in activities that can help reduce carbon use in other industries.

But there are also investment managers like Australian Ethical that only invest in businesses that are making a positive difference.

Deciding how ethical you want your portfolio to be

It’s up to each investor to decide how ethical they want their portfolio to be.

Do you want every one of your investments to fit within your ethical framework? Or…would it be enough simply cutting out the most questionable sectors, like fossil fuels or cigarette manufacturers?

Don’t worry, there isn’t a wrong answer to this question!

One strategy might be to make your core ETF portfolio ethically-based, then build a portfolio of individual growth shares around that core.

As mentioned above, being ethical doesn’t mean your investment returns are diminished. It could even be a benefit for long-term investment returns.

That’s the thing with investing, there is no single ‘correct’ way to invest. Can you imagine how boring the finance world would be if everyone invested the same?

Consider ethical investing in your superfund

It’s also possible to choose ethical investment options within some superannuation funds, though not every super fund offers that option.

First, before thinking about ethical investing, it’s worth making sure you’re up to speed on superannuation in general. So it might be a good idea to take the free Rask Superannuation course.

But after you know your stuff on superannuation, you can look at whether your current superannuation fund, or other super funds, offer ethical investing options.

The Rask team have done some of the work and created this shortlist of ethical superannuation funds to consider.

If you’re still feeling unsure, or have further questions about how to create an ethical portfolio, it would be worthwhile taking our ethical investing course. It’s free and suitable for investors of all experience levels.