For people like you and me, Australian Taxation Office (ATO) franking credits are a tax credit, a refundable bonus of tax which can be used to offset taxes owed in an individual’s tax return. For people that already get tax refunds (or don’t pay tax because of low taxable income), franking credits can increase the size of the tax refund. Woohoo, free money!

Franking credits get attached to fully franked dividends, which are generated by companies when they pay income tax to the government.

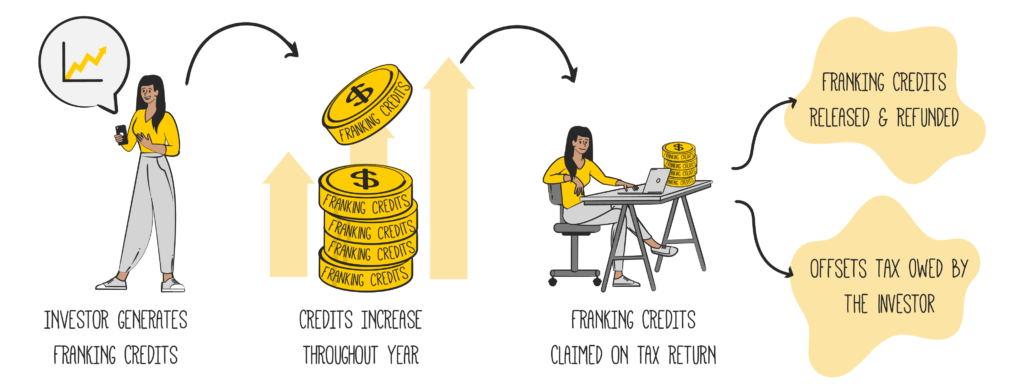

Companies allocate franking credits when dividends are paid, however, it is important to remember that the franking credits don’t provide any ‘real’ benefit until an investor does their tax return for that tax year.

How are ATO franking credits made?

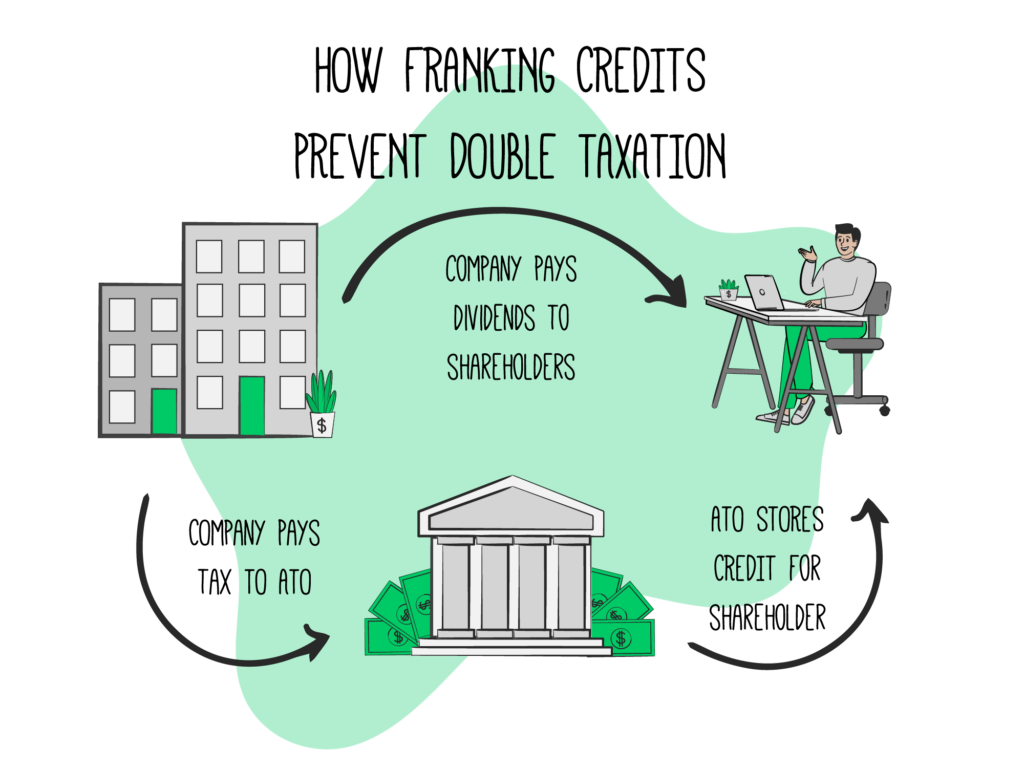

Australia’s taxation system is designed to try to ensure that individuals are not taxed twice on the profits that their own private company or ASX share makes. People don’t like being double taxed. For taxpayers in the highest tax bracket, it reduces their taxes owed. For people in lower tax rates, it can lead to some nice tax refunds.

When a company makes a taxable profit, it is required to pay tax to the ATO on that profit. Businesses can view paying taxes as a positive – they are making profit (good), helping society (good) and it generates franking credits for shareholders to benefit from through the tax return.

For example, if a large company makes $100 of profit, then it is obligated to pay $30 of income tax to the ATO when it does its tax return.

The $30 of income tax paid by, say, BHP Group (ASX: BHP), generates $30 of franking credits stored at the ATO. This happens when the company pays tax. Easy enough, right?

Well, companies keep track of their franking account balance so they know how many franking credits are available for distribution to shareholders when they do their tax return.

After paying the $30 of tax, the company can decide to pay a dividend of up to $70 – that’s the remaining net profit after tax.

Depending on how much the company pays as a dividend, franking credits of up to $30 can be attached to the dividend (in this scenario).

How do ATO franking credits benefit investors?

The franking credit provides the benefit of reducing the individual’s tax on their tax return. For people with lower tax rates, franking credits can result in tax refunds and boost their after-tax income from dividends. Ka-ching!

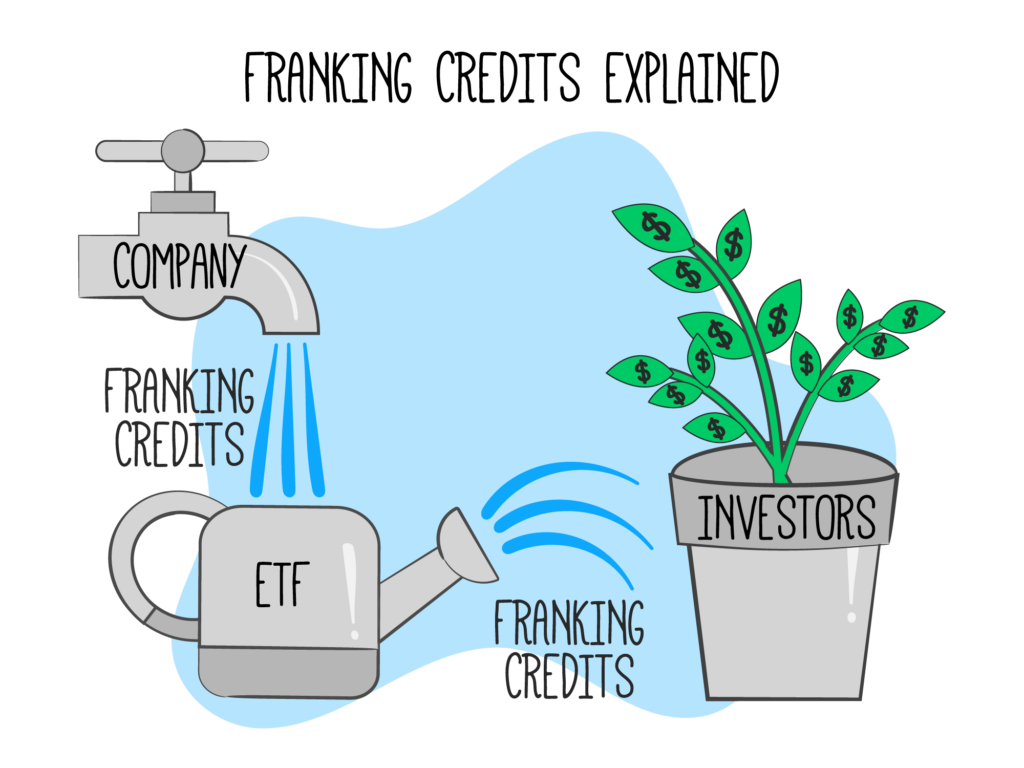

People can also benefit from company franking credits indirectly if an investment entity, like an investment trust, receives a fully (or partially) franked dividend from a company and then pays that onto investors.

Exchange-traded fund (ETFs) are some of the most popular and well-known investment trust structures. Investments like Vanguard Australian Shares Index ETF (ASX: VAS) and BetaShares Australia 200 ETF (ASX: A200) are examples of trusts that pass on franking credits because they receive dividends with franking credits.

What does fully franked, 100% franked and partially franked mean?

There are a few different ways that the investment world describes the level of franking credits attached to dividends or distributions. But some of them just mean the same thing.

Typically, many of the Australian companies that pay dividends to investors pay fully franked dividends. Another way of saying this is that the dividends are 100% franked.

However, there are several different situations where a business may only pay a partially franked dividend, or no franking credits at all.

Franking credits are only generated by companies making taxable profit in Australia when the tax is paid. A company doesn’t need to attach franking credits to pay a dividend in Australia. It only needs to have made some profit.

There are a number of ASX shares that make a profit outside of Australia and pay the required tax in other countries, such as Sonic Healthcare Ltd (ASX: SHL), CSL Limited (ASX: CSL) and Computershare Ltd (ASX: CPU). There isn’t enough Australian tax paid to make those dividends fully franked for those examples. This is something for investors to keep in mind when investing in ASX shares with international earnings.

Some businesses may not pay any franking credits, like ResMed Inc (ASX: RMD), because the company’s tax residency is outside of Australia.

Do managed funds and ETFs pay franking credits?

Trusts don’t generate franking credits themselves, but pass on the dividends and franking credits they receive – they are just the vehicle to deliver the franking credits to our bank account and tax return. It’s the companies inside the trusts that actually pay tax and make franking credits.

Investment trusts can pay unfranked, fully franked, or partially franked distributions. It just depends where the trust gets its dividends from.

For example, the A200 ETF currently says that its franking level over the last 12 months was 80.5%. That means it’s mostly franked, but not fully franked. The ETF’s franking credits are reliant on the amount of franking credits that the ETFs or managed funds receive themselves from company dividends.

Managed funds and ETFs provide investors with regular dividend information statements. These statements include information such as whether a distribution is franked or unfranked and the amount of franking credits that were paid in that distribution. They also provide an annual statement at the end of each tax year, which tells investors how many franking credits have been paid (as well as all the details that need reporting).

Those investment funds also pass on that info to the Australian Taxation Office for easy reporting in tax returns. Every year, I’m glad to see that all my investments make it easy to do my tax return through ‘pre-fill’. It provides a sense of relief if the ATO has already got most of the info and done most of the work.

Am I eligible for franking credits and how do I claim them?

Australian companies may pay dividends with franking credits attached, but not every investor is eligible to claim them.

To be eligible to claim franking credits, investors have to be Australian tax resident. It may be necessary to consult with a tax professional. I’m not a taxation expert, but if someone’s permanent home is in Australia then there’s probably a good chance they are an Australian tax resident. But don’t take my word for it, talk to a tax professional if there are any doubts.

Investors can be allocated franking credits throughout the tax year as investments pay out those awesome dividends. However, to claim the franking credits investors need to report them on their tax return. It’s after the return is lodged, that franking credits come into the real world.

Australian tax residents can use a tax professional to help them with their tax return, or do their own tax return on myGov and report the franking credits there. The more complicated the tax return, the more likely getting help from a tax professional is a good idea. Getting your taxes right is an important thing!

How do dividend re-investment plans affect franking credits?

With some investments, it’s possible to re-invest those dividends to receive more shares, rather than receive the dividend as cash into the bank account. So what happens to the franking credits in that case? Don’t worry, they don’t disappear!

Investors are still allocated, and entitled to, the franking credits that are attached to the dividend or distribution. Phew! Australian tax residents still need to report it on their tax return. The only difference with a dividend re-investment plan is that the investors get their dividend as more shares, not a cash payment. There is no change when it comes to franking credits.

How to report franking credits in myGov

Australian tax residents have two choices when it comes to reporting their franking credits to the Australian Taxation Office.

The first option, which may be useful for those with more complicated taxation affairs, is to use an accountant or tax adviser to help complete the tax return. Tax professionals should be able to provide the best possible knowledge to know what to report, what deductions to claim and so on. Not every accountant is a superhero, but they can certainly help and do most of the work.

The other option is to use the myGov system to connect with the Australian Taxation Office service where Australian tax residents can complete their tax return themselves. Doing it yourself is a logical choice for people with straight forward tax affairs, but it would be a brave move for people whose finances look like a monopoly board.

For people doing their tax returns themselves, the ATO tries to help fill out the tax return as much as possible with the service called ‘pre-fill’. The ATO describes pre-fill as this:

To save you time and to help you get your tax return right, we partially complete your tax return with your financial information we receive from health funds, banks, employers, government agencies and more. You can check if we’ve received your information by starting your tax return with either myTax or a registered tax agent.

In other words, the ATO already knows most of the information because it has been reported to the ATO by your investments, the bank and so on. It makes the process a lot easier and quicker.

It would be useful if the ATO could do the whole tax return. Sadly, it doesn’t work like that. They may not know everything that needs to go on your tax return. Sole trader business profits, cryptocurrency and capital gains are some examples that the ATO needs input with to complete the tax return.

When will franking credits be pre-filled into a tax return?

The ATO says that pre-fill information is usually available by late July. However, it’s possible for some dividend and franking credit information to be unavailable for pre-fill for quite a while because it is reliant on that company or trust sending the information to the ATO, which might not happen until August, September or even later. Isn’t it annoying when your team project is relying on someone to do their bit, and they don’t do it until the last minute?

It is always important to ensure that all income tax information is accounted for in the pre-fill data (if that’s what is being relied upon). Tax returns may have to be edited and re-submitted if they are missing some information. It’s better to get it right the first time.

What if the tax return pre-fill franking credits are wrong?

The ATO also explains what to do if you think there is an error with the pre-fill info:

Pre-fill information is automatically loaded into your tax return and can be accessed through either myTax or your registered tax agent. If you believe there is an error in your pre-fill information, contact the organisation who provides the information. Ensure the organisation sends any corrections through to us.

However, the online tax return form does provide a section for taxpayers to enter their own dividend and franking credit information if the pre-fill information isn’t available (yet) for dividends and franking credits. So don’t panic if it’s not there! That’s why you should keep those dividend and distribution emails you get throughout the year.

20 ASX shares with 100% franked dividends

So, what ASX shares actually pay these fully franked dividends to investors? There are far too many for me to name here. The below 20 are leaders at what they do. However, the below ASX shares list is not a recommendation, just examples of businesses that have been paying 100% franked dividends.

Commonwealth Bank of Australia (ASX: CBA) – CBA is the largest bank in Australia. It generates billions of dollars of profit from lending to households and businesses.

BHP Group Ltd (ASX: BHP) – BHP is one of the biggest resource businesses in the world. Its portfolio of resources is focused on future-facing commodities like iron, nickel, copper and potash (a fertiliser).

Rio Tinto Limited (ASX: RIO) – Rio Tinto is one of the biggest miners in the world. It has a huge presence in the iron ore sector. It’s also involved with aluminium, alumina and bauxite. The business is also making progress towards having lithium operations.

Telstra Corporation Ltd (ASX: TLS) – Telstra is the leading telecommunications company in Australia with its large market share of mobile phone and NBN connections. It is also involved in other areas like health and Asia Pacific telco services.

Fortescue Metals Group Limited (ASX: FMG) – Fortescue is one of the largest iron ore miners in Australia (and globally). It also has an increasing focus on green industrial areas such as green hydrogen production, green hydrogen & ammonia powered vehicles and renewable energy projects.

Wesfarmers Ltd (ASX: WES) – Wesfarmers is one of the biggest Australian retailers. It operates a number of market leaders including Bunnings, Officeworks and Kmart.

Coles Group Ltd (ASX: COL) – Coles is one of the largest supermarket chains in Australia. The company also has other operations related to Coles, including liquor outlets including Liquorland, Vintage Cellars, First Choice Liquor and First Choice Liquor Market.

Brickworks Limited (ASX: BKW) – Brickworks is a large manufacturer and supplier of building products, particularly bricks, in Australia and the US. It also has a 50% stake in an industrial property trust and a substantial holding of a large investment business through a cross-holding.

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) – WHSP is a really old investment house which is invested across numerous sectors including telecommunications, resources, financial services and agriculture. Brickworks is one of its biggest investment positions.

Metcash Limited (ASX: MTS) – Metcash is the business that supplies food to places like IGAs and Foodlands. It also supplies a very large range of independent liquor stores, including Cellarbrations, The Bottle-O, IGA Liquor, Duncans and Thirsty Camel. Finally, Metcash has a hardware segment which includes Home Timber & Hardware, Mitre 10 and Total Tools.

JB Hi-Fi Limited (ASX: JBH) – JB Hi-Fi is a leading electronics retailer in Australia and New Zealand with its retail stores, which includes The Good Guys.

Bapcor Ltd (ASX: BAP) – Bapcor is the largest auto parts business in Australia and New Zealand with a number of leading brands including Burson, Autobarn, Autopro, Midas, ABS, Truckline, WANO and BNT.

Collins Foods Ltd (ASX: CKF) – Collins Foods is a major franchisee of KFCs in both Australia and Europe. It is also growing a Taco Bell network in Australia.

Nick Scali Limited (ASX: NCK) – Nick Scali is one of Australia’s largest retailers of premium furniture with a national network of showrooms in Australia, as well as a growing network in New Zealand. It also recently acquired Plush-Think Sofas.

Adairs Ltd (ASX: ADH) – Adairs is a retailer of home wares and furnishings, through stores and online. It operates the online-only furniture brand Mocka. Adairs also recently acquired the furniture business Focus on Furniture.

WCM Global Growth Ltd (ASX: WQG) – This is a listed investment company (LIC). LICs invest in other shares and assets for shareholders. WCM Global Growth invests in global businesses which have growing competitive advantages and a culture that cultivates that improvement.

MFF Capital Investments Ltd (ASX: MFF) – MFF is another LIC that invests in global blue chip shares. Managed by Chris Mackay, it has a portfolio with large positions in companies like Visa, Mastercard and Amazon.

Australian Foundation Investment Co Ltd (ASX: AFI) – This is one of the oldest LICs around. It targets ASX shares and owns a portfolio of blue chips. Many of the largest miners and financial institutions are in the portfolio.

WAM Microcap Limited (ASX: WMI) – This LIC is focused on investing in ASX small cap shares. The investment team at Wilson Asset Management look for stocks with lots of growth potential.

Future Generation Investment Company Ltd (ASX: FGX) – This LIC invests in an array of funds run by fund managers who work for free so that Future Generation can donate 1% of its net assets to youth charities.

ATO franking credits calculator

If you’re thinking “How do I work out my franking credits?”, well it’s a complicated equation, so it could be best to talk to a tax agent about your specific circumstances.

However, the finance tech team at Rask have come up with a really cool franking credits calculator that can help figure out what level of franking credits might be attached to a dividend. It can also account for the amount of franking credits if a dividend is only franked, for example, to 50%, 30% or any other rate.