Global markets – week in review

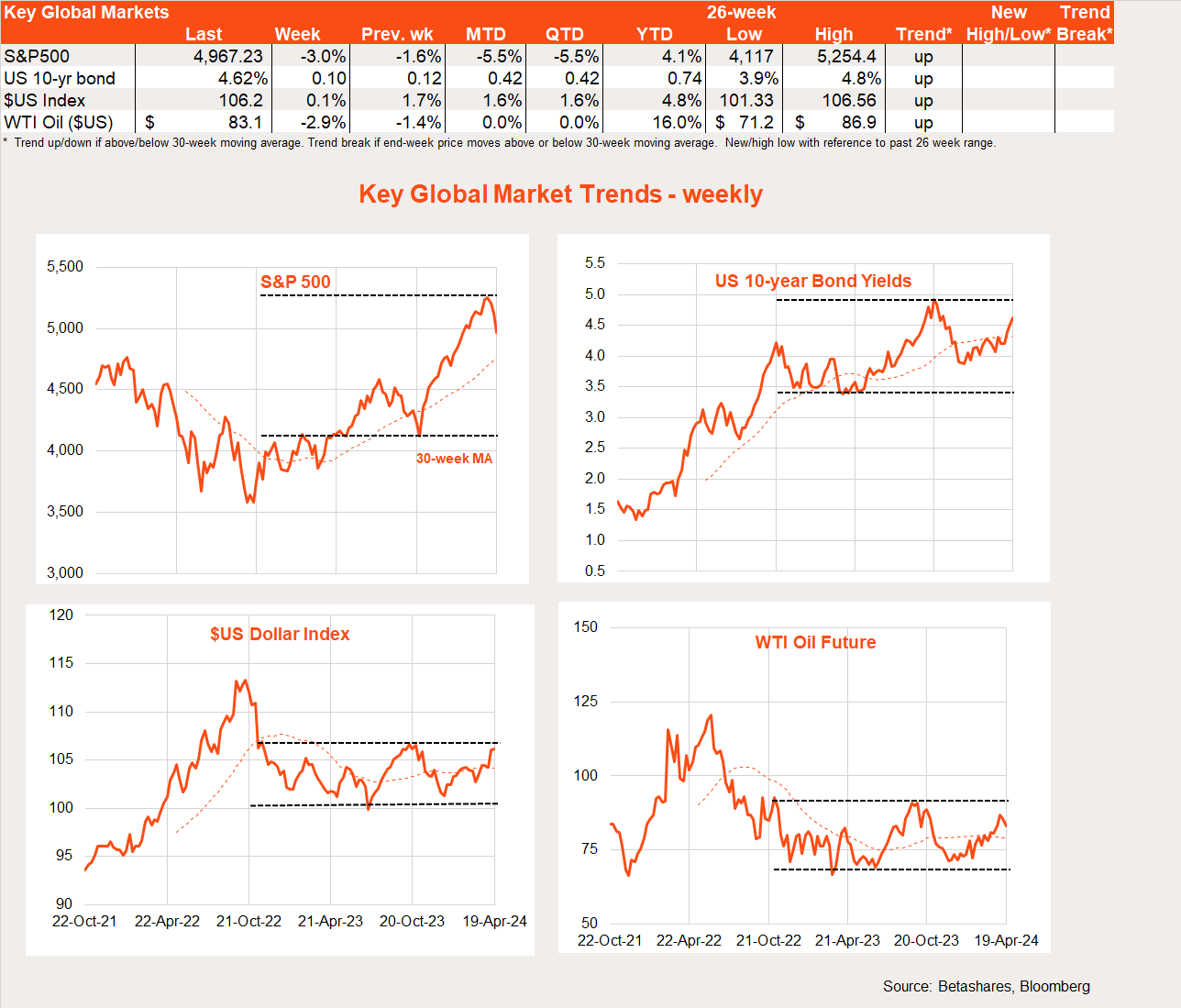

The S&P 500 (INDEXSP: .INX) correction continued last week, with a solid US retail sales report and a hawkish tilt by Fed chair Powell further unsettling bond and equity markets.

One market reprieve was signs that Iran is seeking to avoid further escalating its stoush with Israel.

The US economic juggernaut rolls on, with March retail spending up 0.7% – much healthier than the 0.4% market expectation.

As I warned last week:

“Wall Street remains vulnerable to a deeper correction if the bad run on inflation continues and/or the Fed starts to sound more hawkish.”

Last week the Fed did indeed turn hawkish – which should not be too much of a surprise after three consecutive higher-than-expected CPI reports.

Fed chair Powell noted that recent data had not given him “greater confidence” that inflation is falling in a way that could justify rate cuts any time soon.

This is likely a signal that he no longer thinks three rate cuts this year – as included in the latest dot plot forecasts – is appropriate.

As is stands, the market is now expecting only one to two rate cuts later this year.

The week ahead

We’ll learn more on the US inflation front with the all-important consumption deflator on Friday.

The market anticipates that both the headline and core measures rose 0.3% in March, which would see annual core inflation edge down from 2.8% to 2.6% but headline annual inflation edge higher from 2.5% to 2.6%.

A higher number could see the market fully price out US rate cuts this year and potentially deepen the US equity market correction.

Also this week, four of the Magnificent 7 companies [Tesla Inc (NASDAQ: TSLA), Meta Platforms Inc (NASDAQ: META), Alphabet Inc Class A (NASDAQ: GOOGL) and Microsoft Corp (NASDAQ: MSFT)] report Q1 earnings.

Given jittery market sentiment and high tech valuations, any earnings disappointments are likely to be severely punished.

Global equity trends

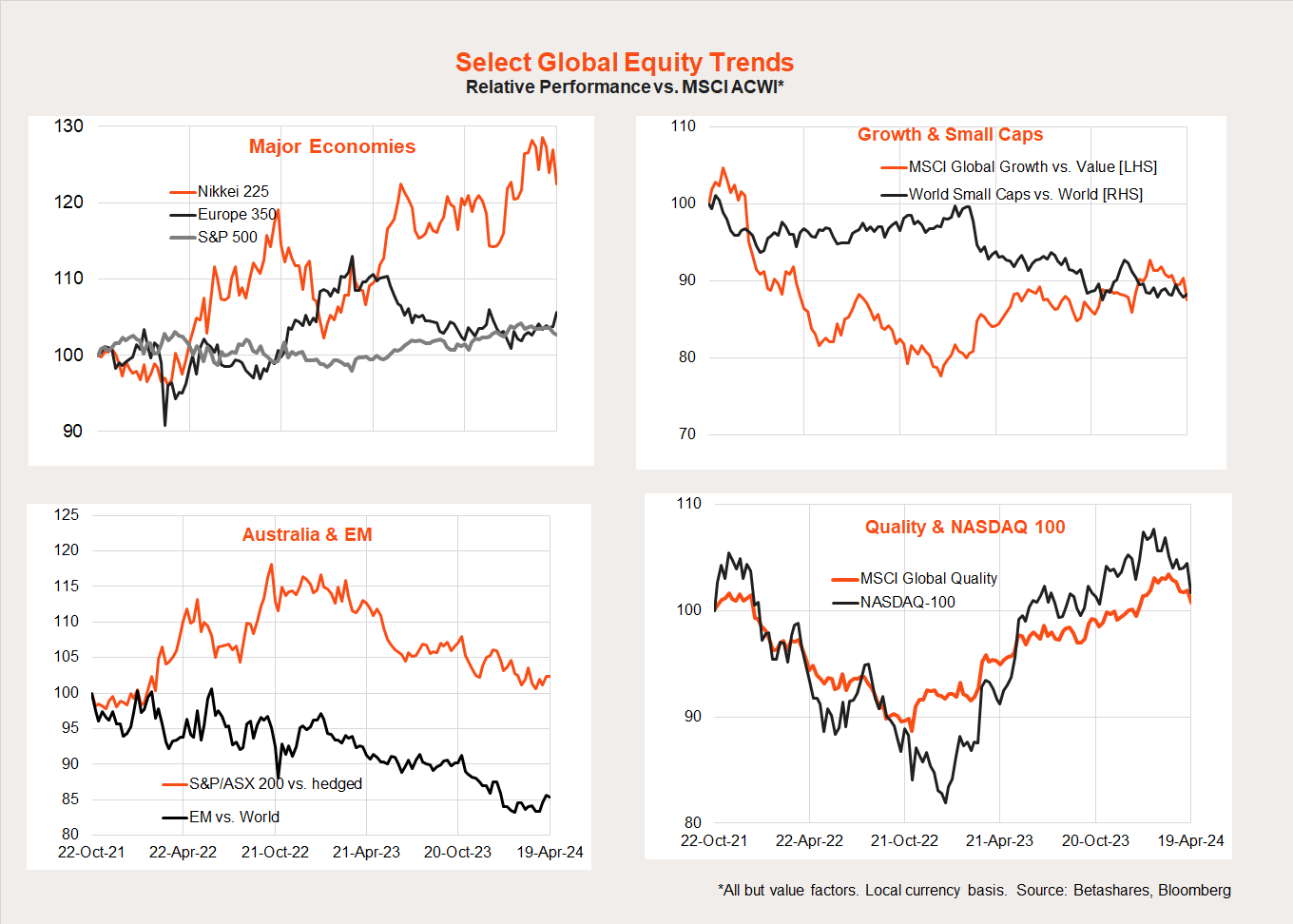

Looking at global equity trends, the rebound in bond yields is helping drag back the relative performance of growth over value, as evident in the pullback in Nasdaq-100 (INDEXNASDAQ: NDX) relative performance. Japan has also pulled back, with Europe faring better.

The extended period of Australia and emerging markets underperformance has bottomed out over this period.

Australian markets

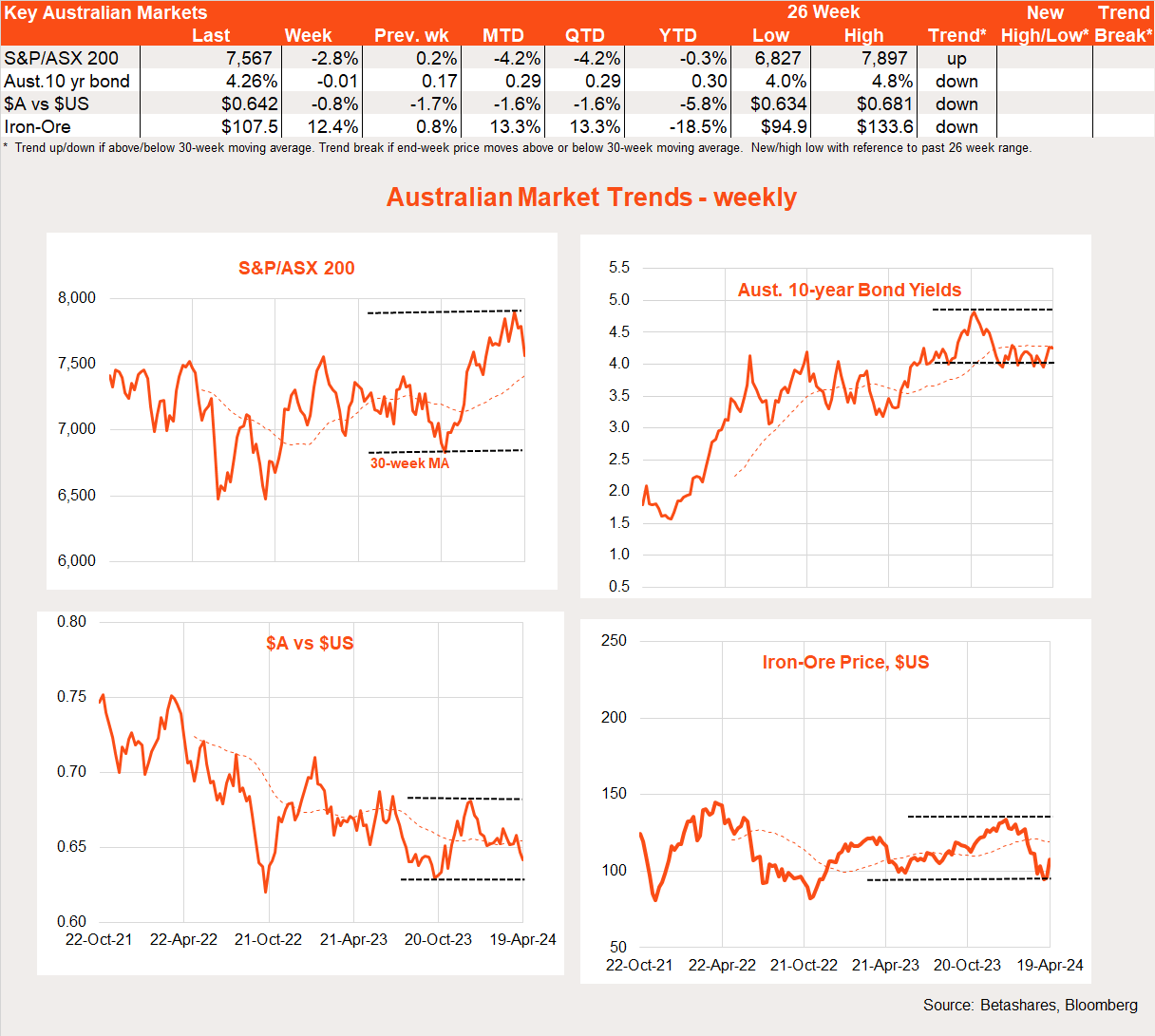

The S&P/ASX 200 (INDEXASX: XJO) caught up with the global pullback last week, with a loss of 2.8%.

Iron-ore prices bounced back after recent heavy losses, perhaps partly reflecting a stronger-than-expected Chinese Q1 GDP report.

The main local highlight last week was another fairly solid labour market report, with an employment loss of only 7k in March after a supercharged 100k surge in February.

The unemployment rate ticked up from 3.7% to a still low 3.8%.

The key local highlight this week will be Wednesday’s March quarter consumer price index report.

Of particular note, the trimmed mean measure of underlying inflation is expected to rise by 0.9% which – although a touch higher than the 0.8% in Q4 – would still be consistent with an easing in annual trimmed mean inflation from 4.2% to 3.9%.

That said, with annualised underlying inflation still expected at around 4%, such a result would not be a green light for the RBA to shift to a more convincing easing bias any time soon.

Have a great week!