The Altium Limited

(ASX: ALU) share price has sunk in morning trade despite announcing a return to profit growth in its first-half report.

Keep up to date with the February 2022 reporting season calendar.

Altium is the leading provider of design software for printed circuit boards (PCB) in technology such as cars, mobile phones and appliances.

Altium share price unimpressed by a return to growth

Currently, the Altium share price is down 8.50% to $31.55.

Key financial results for the half ending 31 December include:

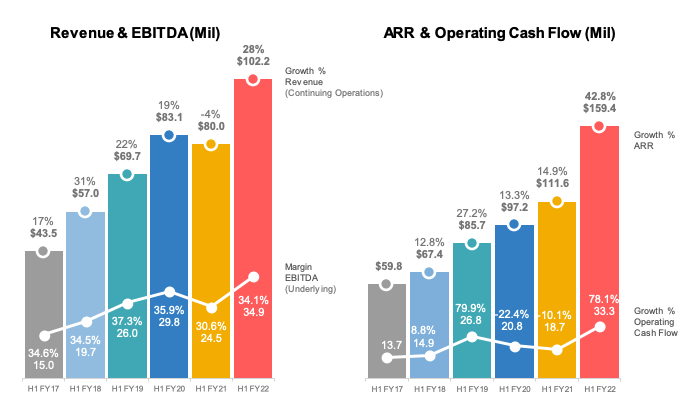

- Revenue of US$102 million, up 28% year-on-year (YoY)

- EBITDA of US$34.8 million, up 29% YoY

- Earnings per share (EPS explained) of $0.24 per share

- Interim dividend per share of $0.21 per share

After a difficult two years, Altium has returned to double-digit growth as it aims to reach US$500 million in revenue by 2025.

The core printed circuit board (PCB) business grew by 16% as demand returned following a temporary downturn in 2021.

More users are shifting to recurring subscriptions, rather than one-off license subscriptions.

Subsequently, recurring revenue has improved from 60% to 74% over the past two years.

Altium 365 product, which aims to link the entire PCB design and manufacturing process, increased monthly users by 54% to 19,743.

All regions achieved growth, with EMEA and Americas the standout growing 25% and 14% respectively.

Slower growth in China of 6% was impacted by COVID-19 lockdowns.

From a divisional perspective, Octopart had a record half doubling sales to $22.1 million.

Chip shortages in the semiconductor space, which has impacted the likes of Audinate Group Ltd (ASX: AD8) have led to strong demand for Octopart’s component and search function.

What’s next for the Altium share price?

The Altium share price will be supported by an increase in guidance. Altium now expects:

- Revenue between US$213 million to US$217 million (18-20% growth)

- Underlying EBITDA margin of 34-36%

- Annual recurring revenue (ARR) growth of 23-27%

FY22 results will likely be at the low end of this range as the business scales up its leadership recruitment for new cloud and enterprise sales teams.

Over time, EBITDA margins are expected to reach 40%.

Altium will also need to find a permanent CEO after Martin Ive departs the company.

Former CFO Richard Leon will resume the role on an interim basis while a replacement is sourced.

“We are picking up pace toward market dominance and accelerating our transformative vision to digitally connect electronic design and manufacturing to the broader engineering ecosystem”