The Altium Limited (ASX: ALU) share price is on the move after the company reiterated guidance at its annual general meeting (AGM).

In morning trade, the Altium share price is up 2.73% to $40.96.

We’re back

After a difficult FY21, the market has clearly warmed to management’s bullishness at today’s presentation.

Chief Executive Aram Mirkazemi said:

“Demand for our PCB design software has returned and is growing. All of this means that our confidence in our first half performance and our full year performance is very high”.

“I expect these growth trends to continue well beyond fiscal 2022, and indeed continue for the rest of this decade.”

Guidance confirmed, unlikely at the lower end

The business reiterated its FY22 financial forecasts including:

- Revenue of US$209 million to US$217 million, an increase of 16% to 20% on FY21

- Underlying EBITDA margin of 34% to 36%

- Annual recurring revenue (ARR) of 23% to 27%

Contrary to most other businesses, Altium has benefitted from the global chip shortage that is currently crunching supply chains around the world.

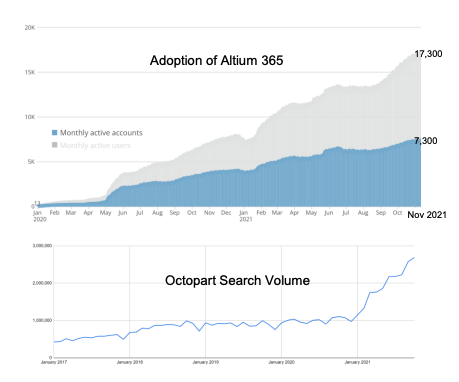

Due to part shortages, designers and engineers have been forced to revise electronic plans benefitting the flagship Atlium

365 design software.

Furthermore, its Octopart division – the electronic parts search business – has seen a big ramp-up in demand as customers source alternative equipment.

Notably, the business said its guidance won’t be at the lower end.

“Altium will review its market guidance in February, and based on business momentum, is confident that it is not likely to be at the low end of the guided range”.

Over the past twelve months, Altium has disappointed the market by barely reaching the bottom range of its estimates.

The company has suffered from the pandemic as customers delay purchases while the company divested its non-core Tasking division leading to a $20 million revenue hole.

My take

It was an interesting choice of words by Altium regarding guidance.

The company has disappointed the market in recent times but is showing that the downturn should be temporary.

Management and the board are also facing near term pressure to yield results after it turned down a $38.50 per share takeover offer by Autodesk Inc. (NASDAQ: ADSK).

With the Altium share price now above $40, it looks like that was the right decision for now.

If you enjoyed this Altium analysis, consider signing up for a free Rask account and accessing our full stock reports.