It’s been a busy week over at the Hub24 Ltd (ASX: HUB) HQ.

The business held its annual general meeting (AGM) on Tuesday before lodging its scheme offer for Class Ltd (ASX: CL1) on Thursday.

At its AGM, one shareholder posed a simple yet important question:

What are the benefits of the proposed transaction with Class Limited?

Let’s dive deeper into the rationale for the purchase.

Leading wealth management company

Hub describes the acquisition as aligning with its vision of becoming the best provider of integrated platforms, technology & data solutions for the wealth industry.

The presentation goes on to say both businesses benefit from increased scale, capabilities, product offering, distribution reach and technology resources.

“We’d like to lead the wealth industry as the best provider of integrated platforms, data and tech solutions”

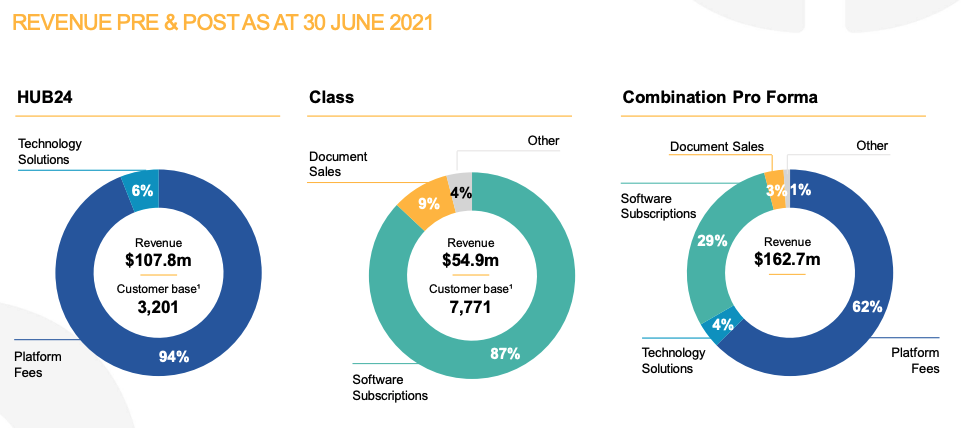

From a financial point of view, the deal will increase earnings by 8%.

A bear’s perspective

The purchase of Class doesn’t directly align with Hub’s existing products.

Hub is focused on wealth management, whereas Class does backend self-managed super fund (SMSF) administration.

Illustrating the lack of crossover, Class will remain a stand-alone business unit under the Hub24 umbrella.

Management noted synergies of just $2 million. But to achieve that Hub will have to spend $10 to $11 million over the next two years.

To fund the purchase, Hub will issue approximately 11 million shares. Put another way it will increase its share count by 16%.

Investors may not feel the dilution in their back pocket. But it’s not a small dilution and it will need to be accounted for going forward.

Wealth meets super

So if the acquisition is marginally earnings accretive, why would Hub purchase Class?

The scheme booklet lodged today offers an insight into what could be on the cards:

“HUB24 intends to conduct a review of Class’ operations in conjunction with the Class executive team and develop strategies to maximise opportunities across both businesses to work together to develop innovative product solutions”

At the AGM Hub Managing Director and CEO Andrew Alcock elaborated on this plan noting that younger people entering the superannuation system will be a big growth driver for SMSFs over the medium term:

“…if you imagine a world where HUB24 can work with Class to make a frictionless solution where an investment platform can be linked to a self-managed super fund, you can see the benefits of that in terms of making that easier for advisers and customers to get advice and secure or empower their financial futures”

In other words, Hub could partner with Class to create an administration tool that manages both the front-end (investing) and back-end (administration) for all SMSFs.

Now that’s interesting.

My take

Hub24’s acquisition of Class is a bet on management.

Can Hub24 work with Class to develop new products that combine wealth management and SMSF administration?

The outcome won’t be known likely for a number of years. I’d argue that a joint venture could have been a better arrangement, leading to much of the same benefits without the shareholder dilution.

Nevertheless, the combination of two leading tech companies potentially could lead to an amazing product for investors, advisors and ultimately shareholders.