The Pinnacle Investment Management Group Ltd (ASX: PNI) share price will be on watch this morning after the business acquired Perth-based Winston Capital Partners.

PNI share price

Who is Winston Capital?

Winston Capital is an administration and distribution firm specialising in raising capital for new boutique funds.

The business also supports retail distribution and managing regulatory and communications.

In a lot of ways, Pinnacle and Winston are similar business’s, with both taking the administrative burden off fund managers to allow them to focus on investment returns.

What are the terms of the acquisition?

Pinnacle will acquire 100% of the Winston business for an undisclosed amount. Subsequently, four sales executives from Winston will join the Pinnacle retail distribution team.

Winston’s founding partners Stephen Robertson and Andrew Fairweather will also join Pinnacle.

Head of Retail at Pinnacle Ramsin Jajoo said:

“This is an important investment in the continued expansion of Pinnacle’s retail distribution capabilities that will deliver our multi-affiliate network additional resourcing across Australia and help in bolstering our entire Group’s ability to scale and grow”.

Why did Pinnacle acquire Winston?

The acquisition provides Pinnacle with on-the-ground access to Western Australia for the first time.

Pinnacle will also be able to leverage the relationships of Winston to bring its 16 boutique affiliates to new retail markets.

Any other news that could affect the Pinnacle share price?

Pinnacle also reaffirmed its announcement to acquire an additional 10% stake in one of its affiliates, Coolabah Capital Investments.

This brings Pinnacle’s total ownership to 35%.

What next for the Pinnacle share price?

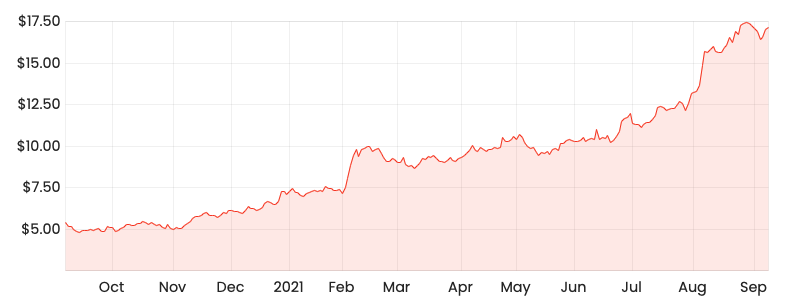

Its been a cracking year for Pinnacle shareholders, with the share price up 136% in 2021.

The company recently announced a 108% jump in profits led by a big spike in performance fees from seven of its affiliates.

Pinnacle flagged further growth going forward, which has the market valuing shares on an eye-watering 49x price-to-earnings ratio.

My take

The Pinnacle share price is largely unmoved today on the news, which isn’t too much of a surprise.

It’s a bolt-on acquisition that didn’t even mention the purchase price. Nor was it classed as market sensitive.

Pinnacles share have run very hard in 2021, so I wouldn’t be jumping in straight away. When valuing fund managers, I prefer to model just the management fees, which are recurring in nature leaving the performance fees as a bonus.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.