As a result of strong equity markets and rising net inflows, Pinnacle Investment Management Group Ltd (ASX: PNI) has announced a stellar FY21 result with profits up 108%.

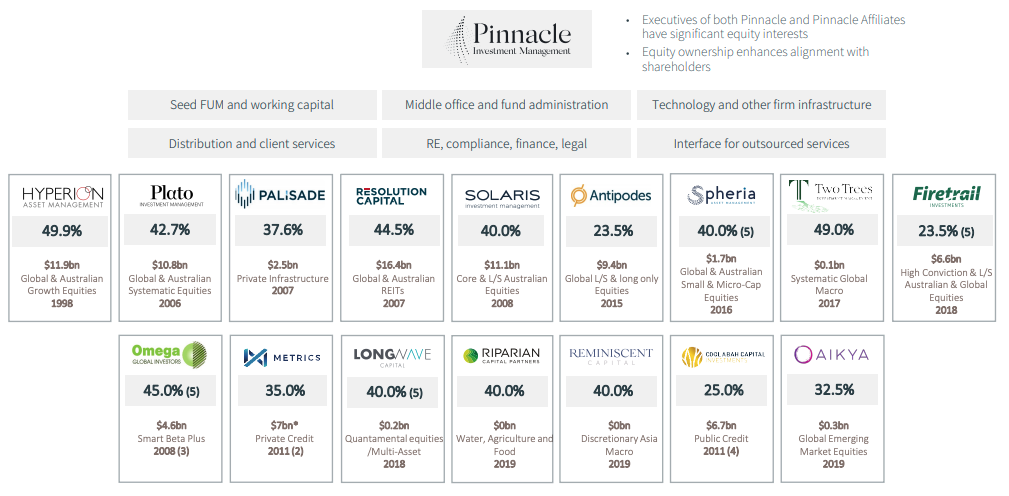

Pinnacle is a multi-affiliate investment manager with 16 brands in its stable including Hyperion, Plato and Firetrail.

The company takes ownership stakes and develops new and existing funds. In return, it receives management and performance fees.

Pinnacle also assists with backend distribution and support services, allowing managers to do what they do best – manage money.

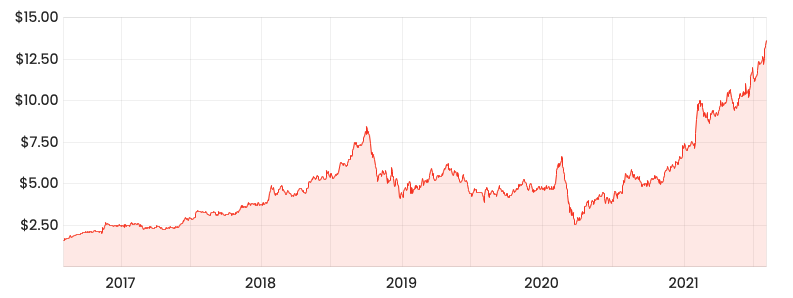

PNI share price

Profits soar

Pinnacle’s share of net profit after tax (NPAT) from its equity interests in affiliates was $66.4 million, up 75% from FY20.

$19.5 million of affiliate NPAT was attributed to performance fees compared to $6.6 million last year. The remainder of affiliate NPAT resulted from management fees.

Performance fees are more variable due to it being typically contingent on trailing 12-month performance. Conversely, management fees are recurring in nature.

Fund administration and support activities reported a $0.6 million NPAT, a positive turnaround from the $5.6 million loss in the prior year.

This resulted in a record $67.0 million total NPAT for the year, up 108% from FY20.

Earnings per share for the year equalled 38.2 cents or an increase of 103% from the prior year.

With a closing market price on Tuesday of $13.63, this infers a price-to-earnings ratio of 35.

The company will pay a 17 cent fully franked dividend, bringing FY21 distributions to 28.7 cents.

Operational highlights

Total funds under management (FUM) across the 16 affiliates increased 52% for the full year to $89.4 billion.

Of this, $16.7 billion was a direct result of net inflows and $14.0 billion was due to market performance.

Breaking down net inflows further, $4.5 billion was a direct result of retail investors and $12.2 billion for institutional investors.

Management noted institutional interest remains strong heading into FY22.

Seven affiliates achieved a performance fee for the year compared to five last year.

Impressively, 80% of affiliate strategies have outperformed their respective benchmarks over the 5 years to 30 June 2021.

My take

Its been a brilliant year for Pinnacle shareholders, with the share price increasing 147% in the past 12 months.

Across publicly listed fund management companies, Pinnacle ranks second for fund inflows in FY21, beating the likes of Magellan Financial Group Ltd (ASX: MFG) and Australian Ethical Investment Limited (ASX: AEF).

On traditional metrics such as price-to-earnings, the company look expensive.

However, I think there is a long runway of growth ahead with no affiliate with more than $17 billion in FUM.

In fact, only four affiliates have FUM greater than $10 billion.

Management noted on the investor call this morning the company is actively scaling its international distribution to increase FUM and expects to be a “high-growth” company moving forward.

For more on Pinnacle, check out what makes Pinnacle so interesting and why its share price may keep heading north.