Since presenting at an investor day, which paved the way for a transformational restructure, Appen Ltd (ASX: APX) shares have made a slight recovery, up nearly 15%.

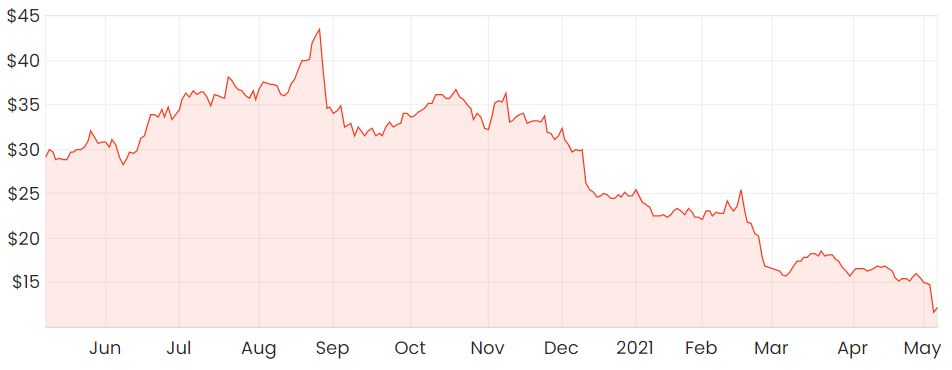

The long-term picture is still fairly bleak, with Appen’s market valuation still down 75% from its high last year.

APX share price

What’s been happening with Appen recently?

Appen held its annual general meeting (AGM) last week, which outlined its plan to pivot towards a customer-centric company with a product-led focus as opposed to its old project-based model.

While Appen has previously had a highly concentrated exposure to many of the largest US tech companies such as Google, Facebook (NASDAQ: FB) and Microsoft Corporation (NASDAQ: MSFT), it’s now looking to support a wider variety of customers that demand training data.

Visibility around future earnings might be somewhat clearer under the new strategy shift. Appen is targeting a higher proportion of committed revenue compared to project revenue, of which the latter has proven to be quite cyclical in nature resulting in some lumpy earnings on a yearly basis.

Appen saw a large increase in committed revenue during 2H20 thanks to an enterprise-wide platform agreement with an existing customer that included an $80 million commitment.

Appen will also start reporting its earnings in USD$ to remove some of the uncertainty around foreign exchange (FX) movements between the Australian dollar.

Future outlook

Management seems to think the outlook remains positive with growth in both existing and new markets.

Chinese revenue has been growing rapidly, albeit off a small base, with major customers in industries such as autonomous vehicles, health and education.

New markets are expected to experience growth of around 25% per year, in line with the broader artificial intelligence (AI) market.

Time to buy Appen’s shares?

Appen’s recent announcements certainly do paint a slightly more optimistic view of what the future may hold, but I’ll remain on the sidelines for now.

Appen’s valuation is a major consideration. While It’s always easy to say in hindsight, I don’t think Appen is worthy of trading on a highly elevated multiple that most tech companies trade on.

This comes down to its business model, which you can read about here: The potential bear case for Appen (ASX: APX) shares – Are they dirt cheap?

I’d also recommend signing up for a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.