Considering shares in artificial intelligence company Appen Ltd (ASX: APX) reached over $40 at its peak last year, now might be a great time to pick up a quality company at a near 55% discount.

Appen certainly has aspects of a high-quality company in my eyes, but I try not to anchor my decision using past information too much regardless of what it was trading at before.

APX share price

Why has Appen struggled recently?

In addition to currency headwinds, management has indicated COVID-19 reduced many of Appen’s major customers’ expenditure as they adjust to the pandemic accordingly.

Something I find interesting here is management has also said COVID-19 has accelerated the adoption of AI and e-commerce.

It makes a lot of sense that businesses would’ve scrapped more discretionary expenditure around the onset of COVID-19, but Appen’s trading update in December indicated these changes in priorities in spending was still an ongoing issue in its fourth quarter.

I wouldn’t have expected Appen to struggle as much as it did. In fact, I would’ve thought it may have ended up being a beneficiary given the rapid technology adoption.

What now?

Appen’s FY20 results didn’t look too bad at face value, but management reiterated the continued adverse impact of deferral and reprioritisation of projects on the business.

The important question to ask here is whether COVID-19 is a temporary headwind, or if there are some potential structural issues.

While not every company is comparable, I’ve observed many companies experiencing challenges from COVID-19 have had multiple profit downgrades. A2 Milk Company Ltd (ASX: A2M) and Integrated Research Limited (ASX: IRI) are just a couple that come to mind.

I think a safe option would be to wait for the next trading update to assess whether trading conditions are back to where they were pre-COVID. This would provide a clearer picture of whether structural issues may be the cause of the recent slowdown. Even if the share price jumps 10% in that time, you will have more information to judge the long-term future of the business.

Valuation

In hindsight, valuing Appen’s shares at $40 was a bit of a stretch considering the challenges it was up against.

Not only that though, but I also don’t think Appen is currently worthy of the eye-watering valuation multiples that many other tech companies like Afterpay Ltd (ASX: APT) or Xero Limited (ASX: XRO) trade on.

Despite being compared to many of these tech companies, Appen’s business model and cost structure are far different from a typical tech company that may have a Software-as-a-Service (SaaS) business model as an example. Appen is more comparable to that of a services business or a labour-hire company in some ways.

Appen has a contractor base of over 1 million people worldwide that act as the “picks and shovels” of the industry. Ultimately, it’s human labour that performs labelling services on things like images, text, speech and video, which improves a machine learning algorithm.

Part of the reason why Appen has traded on a “tech-like” valuation for years is because of the long-term potential of the data labelling process.

The blue-sky scenario for Appen would be that after humans label the first 10,000 of 1 million images, for example, its own machine learning process would be able to handle the rest, which would drastically reduce project times and associated labour costs.

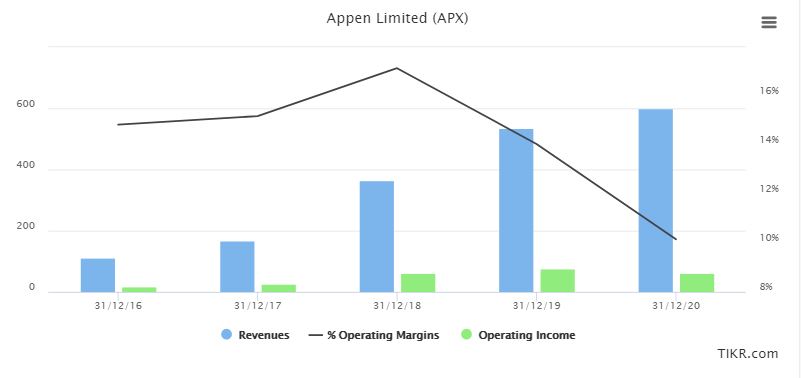

The company was saying this years ago, but as you can see from the image below, earnings before interest, tax, depreciation and amortisation (EBITDA) margins haven’t increased in-line with revenue growth, implying it hasn’t been able to achieve these scale benefits as of yet which would need to justify the tech valuation in my opinion.

Even though Appen’s shares have fallen 55% since last year, they’re still on a trailing Price/Earnings (P/E) of close to 45. Given the uncertainty of COVID-19 and its customer concentration, potential currency headwinds and the additional threat of rising bond yields, I’m not chasing Appen’s shares at these levels.

Summary

This is just one way I look at analysing a company like Appen that highlights a potential bear case.

The market opportunity still appears to be large and growing. Appen is estimating around $110 billion in AI spending by 2024, representing a 24% compound annual growth rate (CAGR).

Ideally, Appen will be able to unlock some of these previously mentioned scale benefits and transition to more machine learning data labelling, which will remove much of the grunt work out of the current process.

Until management can provide some more clarity into the COVID-19 situation, Appen shares are a hold for me at these levels.

If you want more ASX share ideas, click here to read: I think these are the best large-cap ASX shares at the moment: XRO, ALU & CSL.