The share price of Southeast Asian buy-now-pay-later (BNPL) company, IOUpay Ltd (ASX: IOU) took a 12% hit yesterday, despite no obvious news or announcements made.

After reaching highs of around 85 cents, IOU’s share price has now lost around 57% of its value since the rally last month.

Could now be a good time to buy in?

IOU share price

About IOUpay

IOUpay (formerly known as iSentric) provides fintech and digital commerce software solutions to its clients around Southeast Asia. The company has caught the eyes of investors recently through the recent addition of its BNPL platform that plans to capture a part of the largely untapped Malaysian market.

For more reading on IOU, click here to read: My take on the IOUpay share price: Buy/Hold/Sell?

What’s happening with the IOU share price?

Keep in mind that IOU’s shares rallied hard last month and gained over 400% within the space of weeks. It’s quite normal for some investors to hit the sell button and take some profits after such an increase, which puts some downward pressure on the valuation.

However, BNPL valuations more broadly have also been declining in light of increasing bond yields and a rotation out of high growth stocks into value.

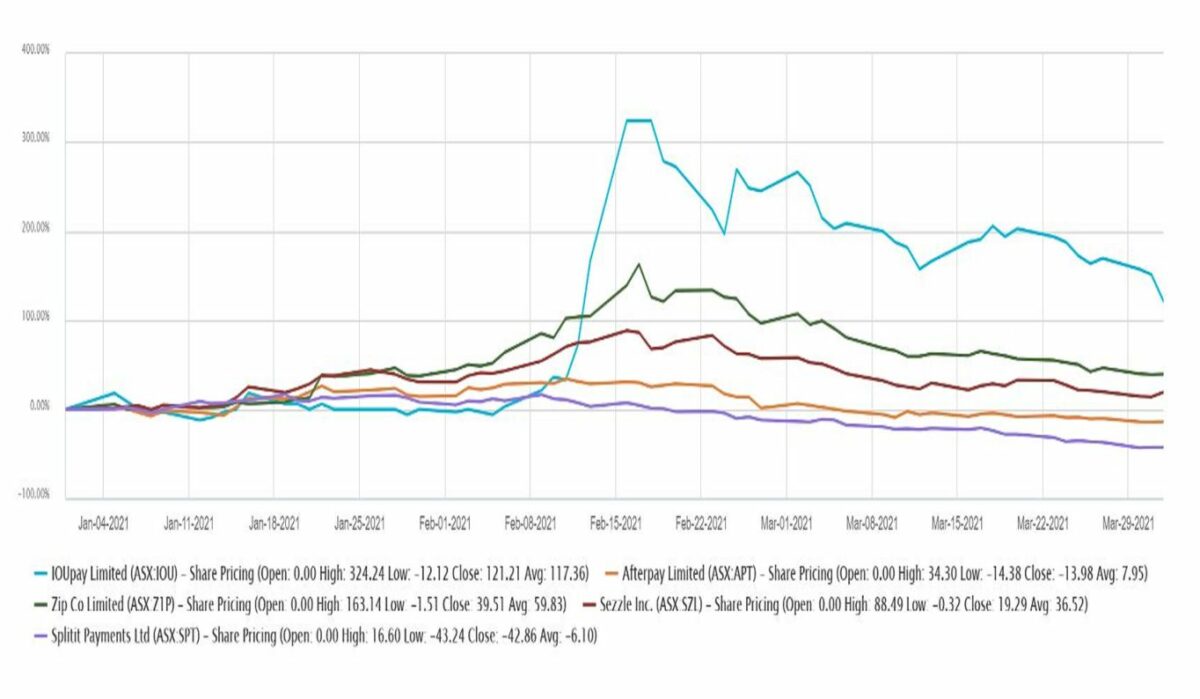

As you can see from the chart below, other ASX-listed BNPLs including Afterpay Ltd (ASX: APT), Zip Co Ltd (ASX: Z1P), Sezzle Inc (ASX: SZL), and Splitit Ltd (ASX: SPT) have experienced a similar trajectory as the sentiment around BNPL has subdued.

With IOU’s market capitalisation at just under $200 million, it’s definitely one of the smallest ASX-listed BNPLs.

In downturns, quite often what happens is the larger players can hold their momentum a little bit better, while the smaller competitors are often the first to be sold off as they’re often considered as more speculative.

Time to buy IOU’s shares?

The South-East Asian market definitely seems like a large growth opportunity, and it’s pleasing to see that the company has won some partnerships, and has been granted a Malaysian money lending licence to kickstart its BNPL service offering.

For me to be a buyer of IOU’s shares, I’d first be wanting to see some evidence of how these partnerships are translating into significant sales numbers.

I’d rather invest in businesses that have a bit more of a proven track record. For some share ideas that I think fit this category, click here to read: 2 high quality ASX retail shares to watch in April.