The buy now, pay later (BNPL) sector has been one of the hottest spaces on ASX in recent weeks.

Shares in IOUpay Ltd (ASX: IOU) were the sixth most traded on the CommSec platform last week, just behind Zip Co Ltd (ASX: Z1P) and Afterpay Ltd (ASX: APT), taking out first and second place, respectively.

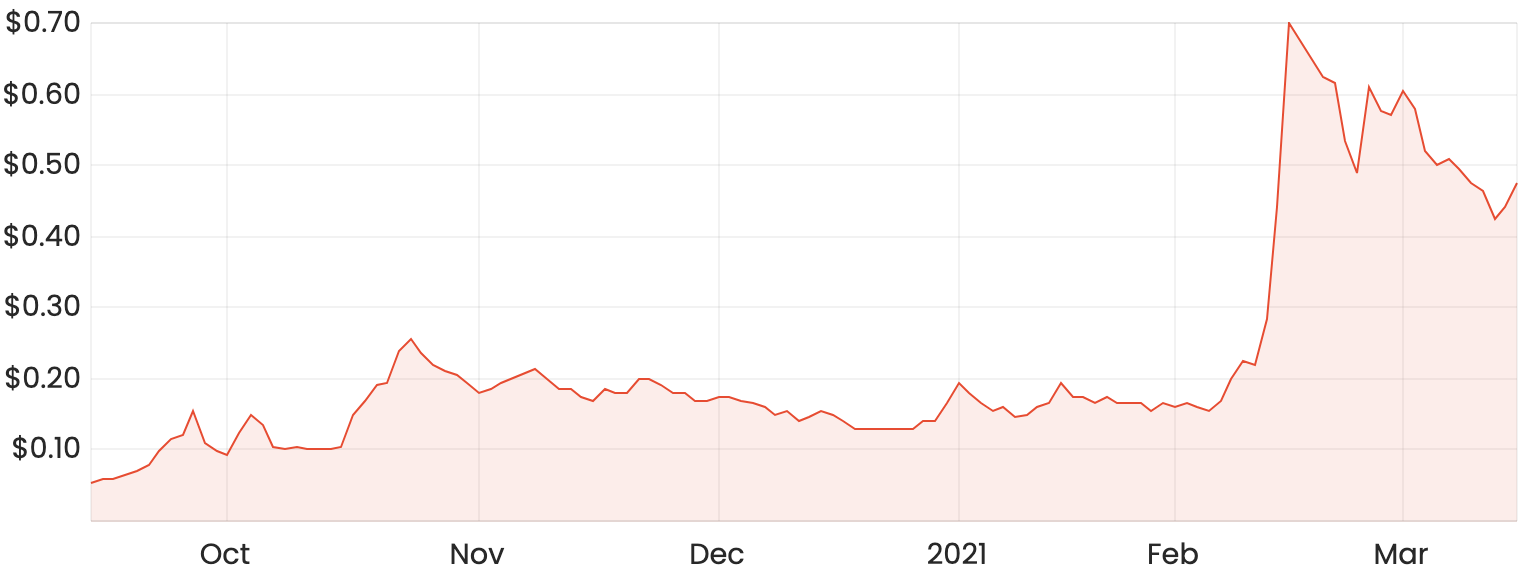

After hitting highs of 85 cents in intra-day trading last month, the IOUpay share price has calmed down slightly, now trading at around 48 cents per share.

IOU share price chart

IOUpay hasn’t been covered too much on Rask Media, so here’s a rundown on the company and some of my thoughts.

IOUpay background

IOUpay was formerly known as Isentric, which operated as a fintech and digital commerce software company with customers predominantly in South East Asia. Its platform offered mobile banking, authentication services and other payments processing services to the top 20 banks in Malaysia and other leading corporate telecommunication companies in Indonesia.

The company rebranded to IOUpay in September last year and operates through many of the same previously mentioned business functions. However, management has indicated that an acceleration towards e-commerce and other digital trends presents a large potential opportunity given its established position as a market leader in the region.

IOUpay already processes over 18 million transactions per month in Malaysia and Indonesia. The company’s current objective is to leverage its large customer base and expand from transaction processing into higher-value services such as bill payments as well as a BNPL offering.

Recent IOUpay share price movements

The IOUpay share price has rallied hard over the last six months, partly fuelled by the broader hype surrounding the BNPL space, along with some additional catalysts in the form of company announcements and partnerships.

Management was quick to take advantage of the rapid spike in the share price and subsequently issued 100 million new shares through a $50 million placement at 50 cents per share last month.

Earlier this year, IOU announced it had acquired a Malaysian money lending licence, which is required to offer a BNPL service to merchants and consumers. It additionally announced a partnership with EasyStore, which has over 7,000 merchants across the Southeast Asian region.

Under the agreement, customers who shop through the EasyStore platform will be able to use IOUpay’s BNPL platform and choose to pay in instalments. EasyStore generated revenue of $435 million in 2020 across 20 million transactions.

Are IOUpay shares still good value?

I’m sure many of us can remember back a few years ago when shares of Afterpay were trading at around the $5 mark. Even at that level, a common criticism from many was the company’s perceived lack of value given its revenue-generating ability at the time.

Given how wrong some of us have been on companies like Afterpay, I think it’s worth at least paying attention to emerging companies like IOUpay that have large potential growth opportunities.

In saying this, IOU’s financials leave much to be desired in my opinion. It’s well capitalised from its recent share placement but has been a consistent loss-making company for years under the Isentric brand name. The company will continue to perform the same transaction services it’s previously done, with the addition of some new services including its BNPL offering.

Management has been shuffled around quite a bit recently it seems. And while it’s ideal to have the right person for the right job, it does make it harder to see a clear, demonstrable track record of management’s actions.

Competition builds

It’s worth noting that IOUpay isn’t the only player trying to tap into the growing Southeast Asian BNPL market.

Singaporean-based ride-hailing company Grab allows its customers to buy goods and services through its PayLater offering, which gives the customer an option to either pay across four equal instalments or at the end of the month. Grab is currently present in Malaysia, Indonesia and six other countries throughout Southeast Asia.

Afterpay may also pose a threat after it announced its expansion into Asia with the acquisition of an Indonesian-based BNPL EmpatKali in August last year. While it doesn’t have any exposure to the Malaysian market, it indicates that a land grab for new customers is very much still underway, and more competitors emerging seems likely.

IOUpay: buy/hold/sell?

IOUpay’s shares are a hold for me at these levels. BNPL has been one of the hottest areas over the last 12 months, so I’d rather wait to see if the sector cools off more than it already has in recent months.

So far, the IOUpay share price rally has been sentiment-driven, with the main catalysts being announcements and partnerships, rather than things like sales or profit growth, which is what I’d typically look for.

Additionally, if we see bond yields rise further from here, I would expect speculative growth companies like IOUpay to be some of the most exposed, so you might be able to pick up shares slightly cheaper than these levels.

For a few share ideas that I think are closer to a buy right now, click here to read: 3 more “buy the dip” shares to buy in a market crash.