What sort of quality characteristics do you think the market would react to most positively in response to a half-year report? Seems fairly straightforward – things such as rising revenues, gross margins and profit growth, right? Maybe. But in this case, you’d be dead wrong.

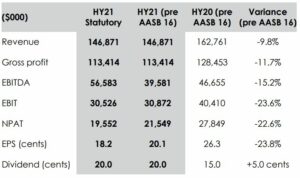

How about this instead: Decreases in revenue, gross profit and EBITDA

by 9.8%, 11.7% and 15.2%, respectively, and a 23.8% drop in earnings per share (EPS) on the prior corresponding period, H1 FY20 (pcp).

Doesn’t sound too great? These were the actual first-half FY21 results released by fashion retailer Lovisa Holdings Ltd

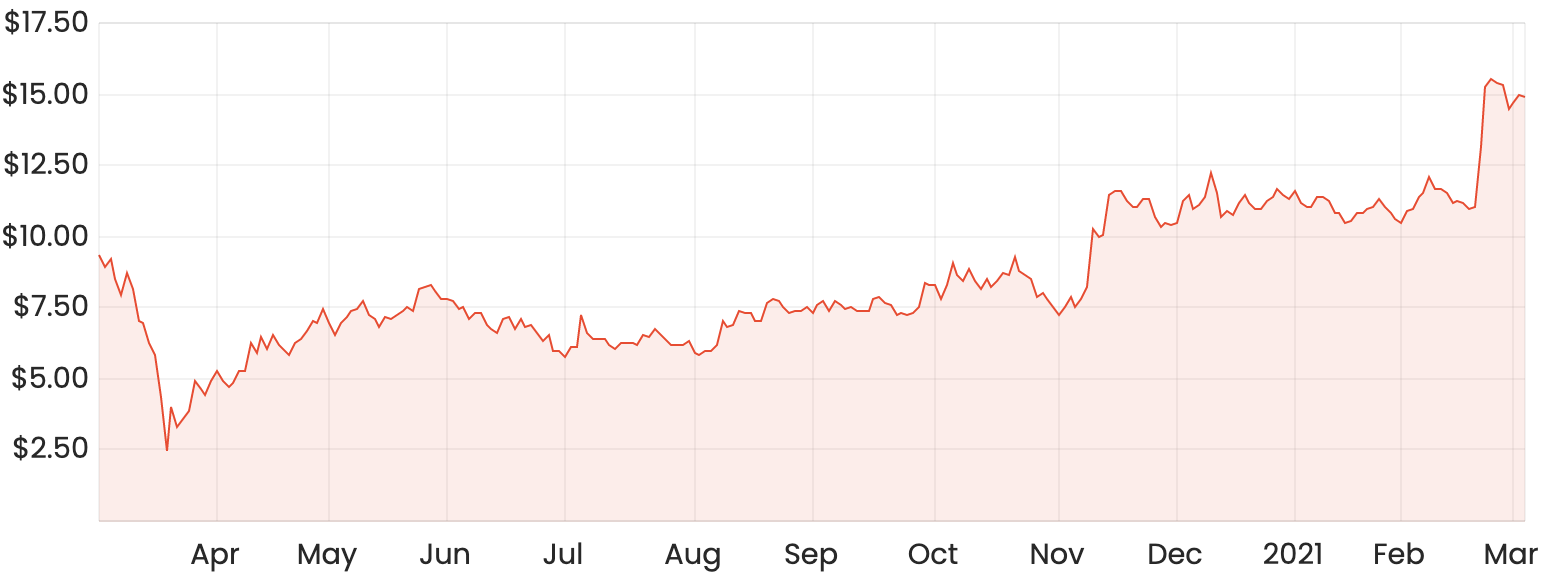

(ASX: LOV) last week, which have since sent the Lovisa share price up roughly 35%.

LOV share price chart

It appears the market has overlooked these results at face value and appreciated its value elsewhere. And I have as well.

Valuation aside, there’s a fairly compelling investment case here that has only been reinforced by these results.

Opportunistic management decisions

While COVID-19 threatened to bring retailing across the globe to a standstill, management’s counter-cyclical decision making during this time appears to make a lot of sense.

Lovisa’s acquisition of German retail distributor Beeline in November last year is just one example of this.

This opportunity will allow Lovisa to expand its store network significantly, with over 90 new stores across six countries in Europe. Beeline’s stores will be rebranded as Lovisa as part of the deal, which all up, cost just €70. No, not €70 million. I actually mean just €70.

Lovisa additionally entered a put agreement which will allow Beeline France to sell its stores to Lovisa once certain conditions are met. This would add another 30 stores to its network.

Management indicated that the economic situation has allowed it to purchase new store locations at discounted prices. Across the half-year, 29 new stores were opened, with 14 of these in the US. Stores in Europe seem to be rolled out gradually, with four new stores in France.

A gradual rollout of new stores seems appropriate, with the closure of Lovisa’s operations in Spain clear evidence that it’s not always guaranteed success.

Its increased store network still wasn’t enough to offset the effects of restricted movement and less tourism, with group revenue down 9.6% on the pcp. Comparable store sales were down 4.5% in the most recent half.

Lovisa’s business economics

Lovisa is known to provide low-cost fast fashion, which is characterised by extremely high levels of inventory turnover – a measure of how quickly it converts its existing stock into sales.

This isn’t uncommon, but it’s usually seen in fairly low-margin retailers. This makes sense because high-volume selling (high turnover) typically offsets the effects of operating on such tight margins.

Lovisa is different from the crowd in that it has high levels of inventory turnover, but with extremely high gross margins as well. Even during this most recent half-year, gross margins only dropped by roughly 1%, down to 77.8% on a constant currency basis.

Its store network in Australia is fairly mature, with 156 stores as of December 2020. Importantly, this business model is proven to be efficient and highly cash-flow generative.

While the success of overseas expansion is not certain, management appears to be handling the rollout appropriately. And the Beeline acquisition strikes me as a potentially asymmetrical payoff, with large upside potential given the near-zero purchase price.

High return on equity makes for a compelling proposition

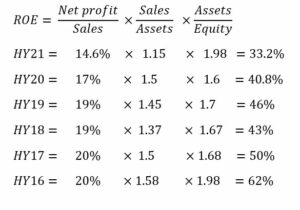

So what’s the result of a retailer that has both extremely high inventory turnover and gross margins? The answer is abnormally large returns on equity (ROE).

I’ve used a three-way DuPont analysis to further breakdown Lovisa’s ROE over the last six years.

The model measures ROE based on net profit margin (net profit/sales), asset turnover (sales/assets) and financial leverage (assets/equity).

This can be useful to look at because a high ROE can often be the result of the financial leverage component increasing over time, which isn’t something I’d personally find too attractive.

As you can see from the comparison below, Lovisa has boasted consistently high ROE levels over the last several years, but this has been trending downwards.

I don’t think this is much of a cause for concern, as prior to COVID-19, the reduction was mainly driven by decreasing levels of financial leverage (the third component of the equation), which I’d regard as a positive change.

Ignoring HY21 due to the effects of COVID-19, Lovisa has maintained high net profit margins and asset turnover leading up to this year.

Is the Lovisa share price a buy?

With COVID-19 still ongoing in nature, further drops in sales resulting from store closures and restriction of movement seem likely for the time being.

On a more positive note, it might create further opportunities for M&A and the continued rollout of new stores. Additionally, more resources can be put towards Lovisa’s digital capabilities, which have accelerated rapidly over the last six months.

I am fairly confident that Lovisa is more than capable of staying afloat during an economic downturn such as this. Even after accounting for capital expenditure used for 29 new stores in HY21, it still finished with a net increase in cash of $22 million and a net cash balance of $42.5 million.

Debt facilities of $50 million are there if needed but are currently undrawn.

It’s important to remember that the Lovisa share price has rallied over 500% since the recovery in March last year. I’d ideally like to buy shares slightly cheaper than where they are today, but valuation aside, Lovisa remains one of the highest quality retailers on the ASX, in my view.

If you are interested in other ASX growth ideas, I suggest getting a free Rask account and accessing our full stock reports. Click the link below to join for free and access our analyst reports.