The Challenger Ltd (ASX: CGF) share price fell 15% upon the announcement of its half-year (HY21) results on Tuesday. So is this now a great ASX opportunity?

In short, the market reacted negatively to Challenger’s results but I think there are a few positives to focus on…

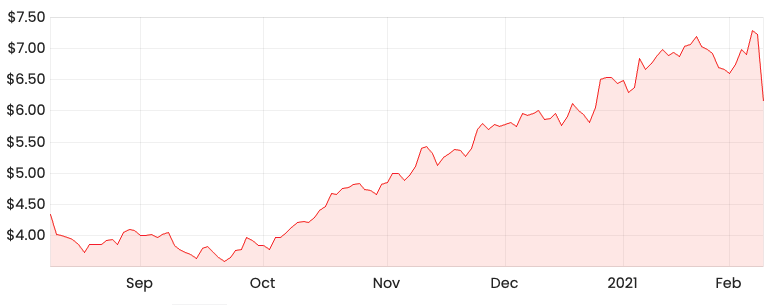

CGF share price

Before diving into the financial results, let’s understand Challenger’s business model.

Business model

The Challenger business model is comprised of two operating segments: Life, and Funds Management.

The Challenger Life segment focuses on providing annuities and guaranteed retirement income products. Life is the market leader in Australian retirement incomes, with a 75% annuity market share.

An annuity is a financial product which allows you to provide a lump sum of money upfront in return for a guaranteed stream of payments for a fixed-term or until your death. Challenger doesn’t charge a fee for these products. So…what’s the catch?

Challenger makes money by investing the funds you give them. It invests the money into a mix of defensive and growth assets; predominantly fixed-income securities and commercial property. Challenger also allocates a small portion of investments in infrastructure and share investments.

If Challenger achieves returns on these investments that are higher than what is promised to annuity/retirement product holders, it keeps the excess amount. If not, Challenger covers the shortfall through its own money.

Essentially, Challenger’s bottom line is largely dictated by the performance of its investment portfolio.

FY20 performance

If you look at Challenger’s results for HY21 in isolation, it paints a bleak picture. However, let’s rewind to FY19 and FY20 to get some context.

In FY19, Challenger recorded its best-ever investment revenue performance but it then suffered its biggest drop in FY20 as result of COVID-19.

Challenger’s total revenue dropped by more than 50% from $2.37 billion in FY19 to $1.13 billion in FY20. Fixed income securities were the biggest detractor, with revenue falling from a $714 million gain to a $90 million loss due to record low-interest rates.

FY21 turnaround?

It seems like Challenger is steering its investment portfolio in the right direction as investment revenue rebounded to pre COVID-19 levels, and it’s only for the half-year.

The most prominent turnaround is revenue from fixed income securities, recording $667 million of revenue for HY21.

This contributed to Challenger boosting its total revenue from $1.22 billion in the prior corresponding period (HY19) to $1.28 billion for HY21. The fact that Challenger pushed its total revenue for the half-year to the same amount generated for the full-year in 2020 is quite promising in my eyes.

In addition, Challenger’s Life segment continues to provide consistent revenue, as it grew 4.7% in HY21. Whilst growing revenue from annuities is a positive, investors should be wary of the corresponding rise in payments required to be made due to the maturity of annuities and withdrawal rights. The return that Challenger is required to pay the annuity/guaranteed retirement product holders is fixed.

So, it’s important for investors to monitor the level of investment revenue against the level of Life contract claims and expenses. There has been an upward trend of Life contract claim and expenses, which has pushed Challenger’s margins down.

Basically, Challenger will need to keep improving its investment performance to maintain and grow its margins.

Final thoughts

Despite not meeting analyst expectations, I think Challenger managed to show a positive turnaround in its investment revenue performance, which is the key driver.

However, in light of the low-interest-rate environment, I’m not sure there will be potential for significant investment outperformance with respect to fixed-income securities.

As for commercial property, it appears the market is still experiencing the ill-effects of COVID-19 with Australia’s office vacancy rates hitting its highest level in more than 20 years, increasing over the past six months to 11.7%.

I am not overly optimistic about the future performance of these asset classes.

Instead of Challenger, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.