One ASX retailer that has more or less gone under the radar this year is Beacon Lighting Group Ltd (ASX: BLX).

The Beacon Lighting share price finished more than 12% higher yesterday after the company released a better than expected trading update, revealing significant growth in revenue and profit.

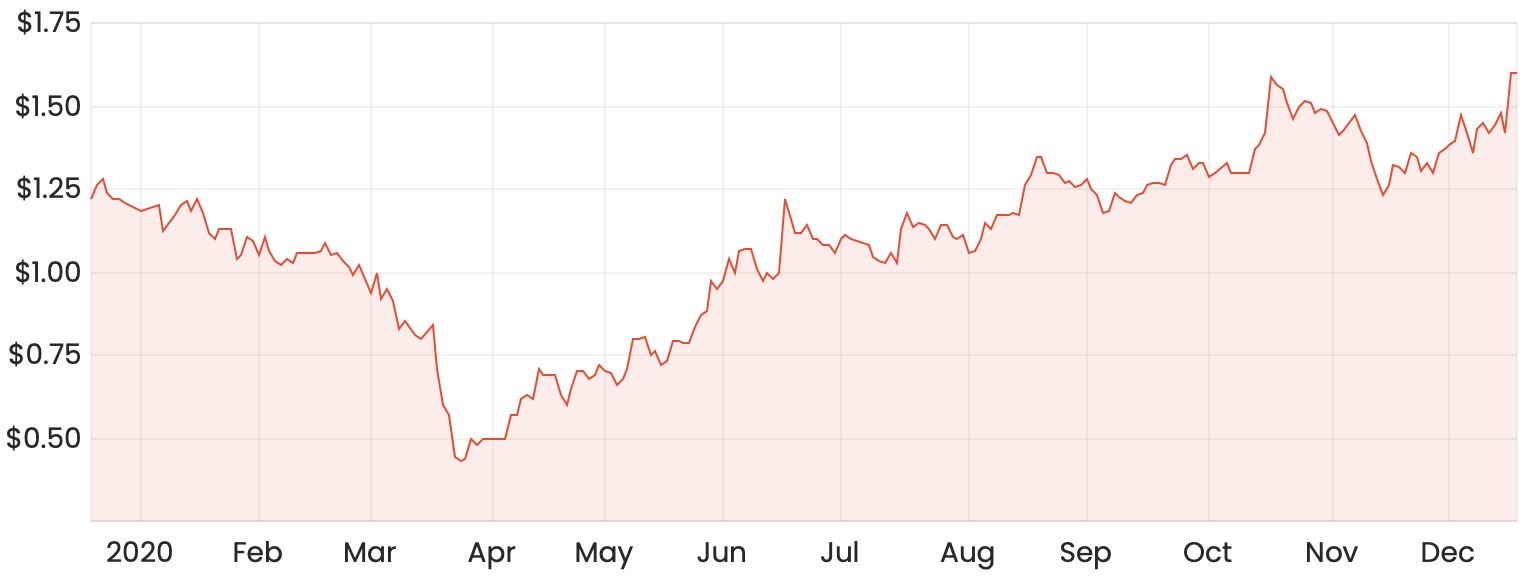

BLX share price chart

Beacon Lighting shares currently trade at around $1.60 per share – up over 200% since March. Despite the good run, are shares a buy today?

Beacon Lighting’s operations

Beacon is an Australian retailer that specialises in lights, fans and other items. The group owns 109 stores across Australia, with an additional four run as a franchise.

I compare Beacon to other ASX retailers such as Nick Scali Limited (ASX: NCK) and Temple & Webster Group (ASX: TPW) in that COVID-19 provided the perfect storm to benefit from the situation.

Due to people being stuck indoors during lockdowns, many turned to improving the interior of their homes by buying new furniture and other items, much to the benefit of these retailers.

What did Beacon Lighting report?

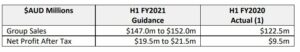

Beacon reported guidance for the 26 weeks ending 27 December 2020. As you can see from the table below, it’s easy to see why the BLX share price jumped.

The anticipated revenue growth is significant, but what’s more impressive is the jump in net profit as a result of expanding margins from a boost in online sales.

Are Beacon Lighting shares a buy today?

While I try not to anchor my investment decisions too much on past events, I think it’s worth taking a look back in time into Beacon’s past performance. Over the last five years or so, revenue growth has been sluggish and earnings have struggled to grow on a per-share basis.

While this company has clearly been a COVID-19 beneficiary, it’s important to ask yourself if you think it’s likely that these conditions are sustainable, or if these results might be more of a once-off occasion.

My intuition would tell me that for products such as lights and fans, these might not be the sort of things that would be replaced too often, but rather every now and then.

Therefore, I wouldn’t be too certain these exceptional results are sustainable and I personally wouldn’t buy shares based on this announcement alone.

Summary

If you are looking to add some ASX retailers to your portfolio, I think some companies will perform better than others out of COVID-19.

Accent Group Ltd (ASX: AX1) is one retailer that I think could fit this category. If you’d like to learn more about Accent Group, check out this article: This ASX retail share could be one of the best on the market.