Is it just me or do Australia’s best investors have something in common?

It’s not their Buffett-spired ‘value investing’ approach. Though value principles are important…

And it’s not their flashy suits or their big bonuses…

I’ve found that the best investors are investing with ‘the wind at their back’.

Indeed, there are a select group of investment professionals who have thrived in the past decade as growth at a reasonable price — known as ‘GARP investing’ — took the reigns from traditional value investing approaches.

At risk of oversimplifying it, value investing is the art of buying ‘cheap stocks’. You’ve probably heard someone say, “I try to buy $1 for 50 cents”. In essence, that’s what value investing is.

To put it another way, you would prefer to buy a $100 pair of Nike’s on sale at $50 than for the standard price of $100, right?

Below, I explain the simple principles behind this philosophy, what you need to look for and I even outline three of my favourite global megatrends for the coming decade.

***

As you may know, I interviewed my friend Joe Mayger from Lakehouse Capital for The Australian Investors Podcast earlier this year. During the podcast, he told me that he too likes to buy $1 shares for less than they’re worth, just as any investor would.

However, instead of targeting the ‘bargain buys’ at 52-week lows, which have become harder to come by in recent years, investors like Joe add a unique twist to the value investing approach.

These investors try to buy $1 that will go on to be worth $1.20, $2 or more in years from today.

It’s like buying a pair of Nike’s that increase in value after you buy them.

For example, if the same $100 pair of Nike’s were going to be worth $200 in a year from now you would happily pay $90, $100 or maybe even $110 to get a pair, right? I know I would.

It’s the exact same strategy used by investors who follow the ‘GARP’ philosophy.

Indeed, if you can identify shares in companies that might go on to be worth multiples more than they are worth today, you need to be prepared to pay a higher price.

For the record, I’m not talking about buying shares like Pro Medicus Limited (ASX: PME) — a company we recommended for Rask Invest members in late 2018 for less than $8. To me, the current Pro Medicus share price of around $26 is not ‘reasonable’.

The catch is, you need to pay a decent price for these growth stories. The way you do that is by identifying these opportunities early and more often than not, these companies must have very strong long-term tailwinds at their back.

My ‘Boring’ Principles Apply

Before I get to the three trends, my standard investing rules apply to these GARP opportunities:

- Their operations must be understandable;

- They must be competitively advantaged companies, capable of reinvesting their profit and cash flow at attractive rates for many years on end; and

- They must be run by talented and aligned management teams (founders and family-run businesses are preferred)

***

Without further ado, here are three industries that I believe every Australian investor needs to be actively investigating in 2019 and beyond.

To be clear, these are the exact industries we’ve targeted for our Rask Invest share ideas…

1. Virtual Reality (VR)

According to Research And Markets, the global virtual reality marketplace is expected to grow from $US7.9 billion in 2018 and $US44.7 billion by 2024 — or 33% per year.

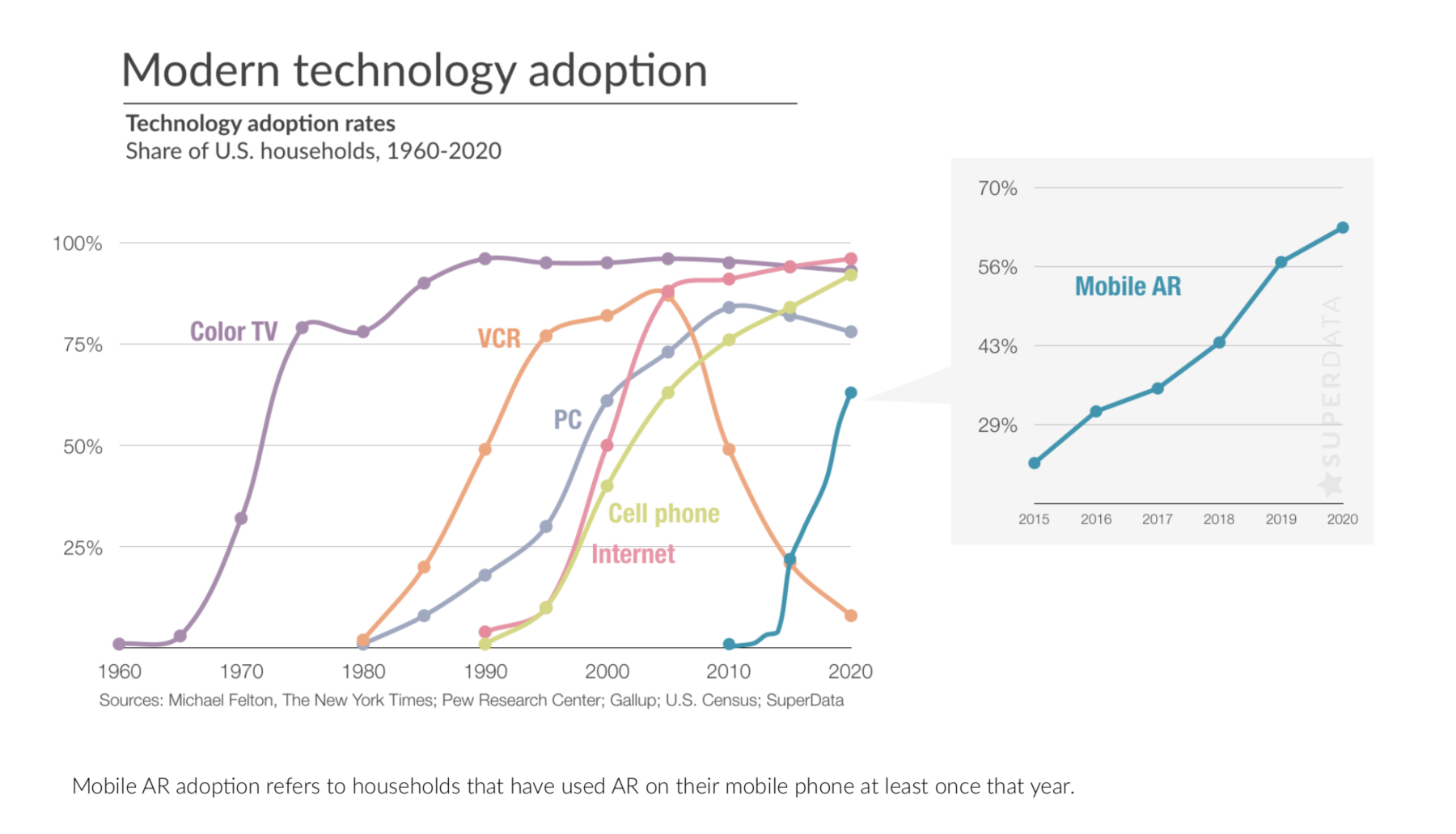

However, if you take a look at the following chart from the video game market research provider, Superdata, you might think that estimate is conservative.

I believe the VR market will be a much bigger market, especially if we consider the broader or indirect opportunities VR will create to consumers and businesses. Think of retailers selling products, movie studios and streaming services producing interactive films and series, video game publishers, smartphone makers, dating businesses and social media portals… the list goes on.

At Rask Invest, we are extremely excited by the intersection of gaming and VR. It’s hard to pick a winner, sure, but we think there are a select handful of businesses which can be expected to cash in on this megatrend for many years yet.

As part of our Rask Invest website, we recently released a special update for our members identifying three technology companies which stand to benefit.

2. Driverless Cars

Driverless cars or ‘autonomous vehicles’ are expected to hit the roads in a big way within the next 2-3 years. Alphabet’s Waymo is already offering people in the city of Phoenix (Arizona, USA) a free taxi service called “Waymo One”.

Waymo drives — by itself — for more than 16,000 kilometres each day on public roads and does another 16 million in simulation as it performs its ‘deep learning’. Unlike some (most?) humans, the more Waymo drives on our roads the faster it’ll learn to drive safer and more efficiently.

Some analysts believe autonomous cars will be a $US65 billion per year industry by 2027. Some analysts believe Waymo — by itself — is now worth more than $200 billion!

How?

If Waymo can do what analysts expect it can, and it stays miles ahead of the competition (pun intended), it’ll snatch an enormous share of the vehicle industry’s value.

Think about it, most people won’t need more than one car!

For example, in five years from today, you may be able to send the kids to school by themselves, then the car might automatically lease itself out to other families for a few hours. As a result of this disruption, inner-city carparks will begin to empty and traffic congestion will ease considerably.

If I asked you to consider shares in a ‘cheap’ old style automotive company or Waymo, which would you consider first?

I know what I’d do.

3. Digital Advertisement

The way consumers interact with advertising is constantly changing. More consumers go directly to online stores like Amazon or Facebook Marketplace and to video services like Instagram and YouTube to make their purchasing decisions. One to one video has proven to be an exceptional way to engage with consumers.

What do I mean by ‘one to one’?

TV advertising has always been a ‘one to many’ approach to advertising (i.e. one broadcaster, thousands of viewers).

Unfortunately, TV advertising is fast becoming too blunt and low returning for modern businesses to use to grow their services efficiently.

Fortunately, with major online platform companies able to serve ads on a ‘one to one’ basis — given their knowledge of your preferences, location and habits — advertising dollars are rapidly changing pockets towards digital advertisers.

It’s estimated around $US600 billion in worldwide revenue will be generated by media organisations in 2019. Digital advertising should continue to grow at double-digit rates in the next year.

How about TV advertising?

MagnaGlobal says it will shrink 2% to $175 billion — or less than 30% of total spending. Looking forward a few years I suspect TV advertising will keep shrinking as viewer numbers dwindle in place of things like Netflix and YouTube, and costs rise.

For Rask Invest, we own shares of two technology companies that are direct beneficiaries from this megatrend. To be frank, I’d say they are the companies which stand to benefit most from this trend.

Risks

As always, there are considerable risks to buying shares in ‘the next hot’ thing. To mitigate some of them, my first questions are always ‘are the companies already free cash flow positive?’ In other words, are they making money?

Second, I’d ask, ‘does the company I want to own have a competitive advantage?’ More often than not, the answer is no.

However, if the company is already cash flow positive and it’s able to reinvest excess cash at very high rates of return, then you may be onto something big.

Unfortunately for most part-time investors, if you don’t spend hours, weeks or months investigating these trends and doing your homework on the businesses, you could be overlooking some serious risks or miss out on the biggest gains. Proceed with caution and do your homework.

Cheers to our financial futures!

[ls_content_block id=”14947″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen owns shares in Pro Medicus (ASX: PME).