The dividend yield of more than 7% fully franked for Naos Emerging Opportunities Company Ltd (ASX: NCC) shares is no doubt very appealing to many LIC investors. I suspect it is a strong reason why the shares still trade relatively close to the net tangible asset value (NTA). This is despite a very poor 2018 performance.

Normally such underperformance versus their benchmark and a declining NTA for the year would be expected to hit sentiment hard. If the yield, in this case, is minimising the falls in the share price then we better examine how sustainable the dividend may be.

LICs Ability to Pay a Steady Dividend Stream

Even though 2018 was a challenging year for NAOS, it highlighted one of the appeals of the LIC structure. This LIC still has a good record of performance since inception in 2013, thanks largely to a fantastic first few years. This has assisted them in setting aside some profit reserves and franking credits that can be drawn upon in the future. In part, it has helped NCC pay about 7 cents a share of fully franked dividends each year for the past four years (click here to learn what franking credits mean).

NCC’s management certainly recognise that this income stream appeals to their investor base and aim to grow this further. This may not be as easy as they have found it over the last few reporting periods though. The 15% decline they suffered in their portfolio in 2018 could place them under pressure to generate growing fully franked dividends going forward.

NCC is a LIC investing in a concentrated selection of micro-caps. That can make it more difficult to take profits in stocks and generate franked dividends for shareholders. Liquidity in the underlying positions can be challenging and sometimes NAOS owns significant shareholdings in its companies.

Adding to the uncertainty about future consistency in dividends is what the future may look like in terms of the treatment of franking credits. Will some LICs look at changing to a Listed Investment Trust (LIT) structure?

***

This episode of The Australian Investors Podcast interviews NAOS’ lead portfolio manager, Sebastian Evans:

Buying LICs After Short-Term Underperformance

Normally I would find this type of performance history as potentially being a catalyst for a turnaround. That is, I find the market can be too fickle and punish a LIC’s share price harshly for a poor few years of investing performance. The concentrated strategy NAOS runs needs to be judged over a much longer period. They can still point to their performance numbers since inception to say they have delivered for shareholders.

Where I find good turnaround opportunities like this though is where the market pushes the price to a discount to NTA of approximately 20%. Clearly, this is not happening with NCC (yet), so I am not too interested at these levels. I put this down to the high historical dividend yield and also NAOS making a strong effort in the marketing and communication with investors.

How About The Underlying Investments?

With the monthly NTA reporting, NCC keeps its cards close to its chest. It does not reveal its top five or ten holdings as you may see with other ASX LICs. This is understandable given their concentrated portfolio may only hold about 10 holdings in total. They also have a very low portfolio turnover.

I wrote in a previous article about Thorney Opportunities Ltd (ASX TOP), another LIC that takes concentrated positions in ASX shares. I made the point that being too upfront with disclosing the portfolio breakdown may even encourage some shareholders to replicate the LIC’s themselves.

As for NAOS’ NCCC, we do learn some of their investments in their regular investor presentations and when they discuss historical performance attribution. Also, with some ASX shares they have become a substantial shareholder. Under the ASX disclosure rules, they must disclose this to the ASX, which is then made publicly available. The NCC annual report also shows the list of their stock holdings at the time but not the portfolio weights of each.

Ultimately, NAOS’ micro-cap holdings may appeal to investors with a contrarian nature.

The NAOS Brand

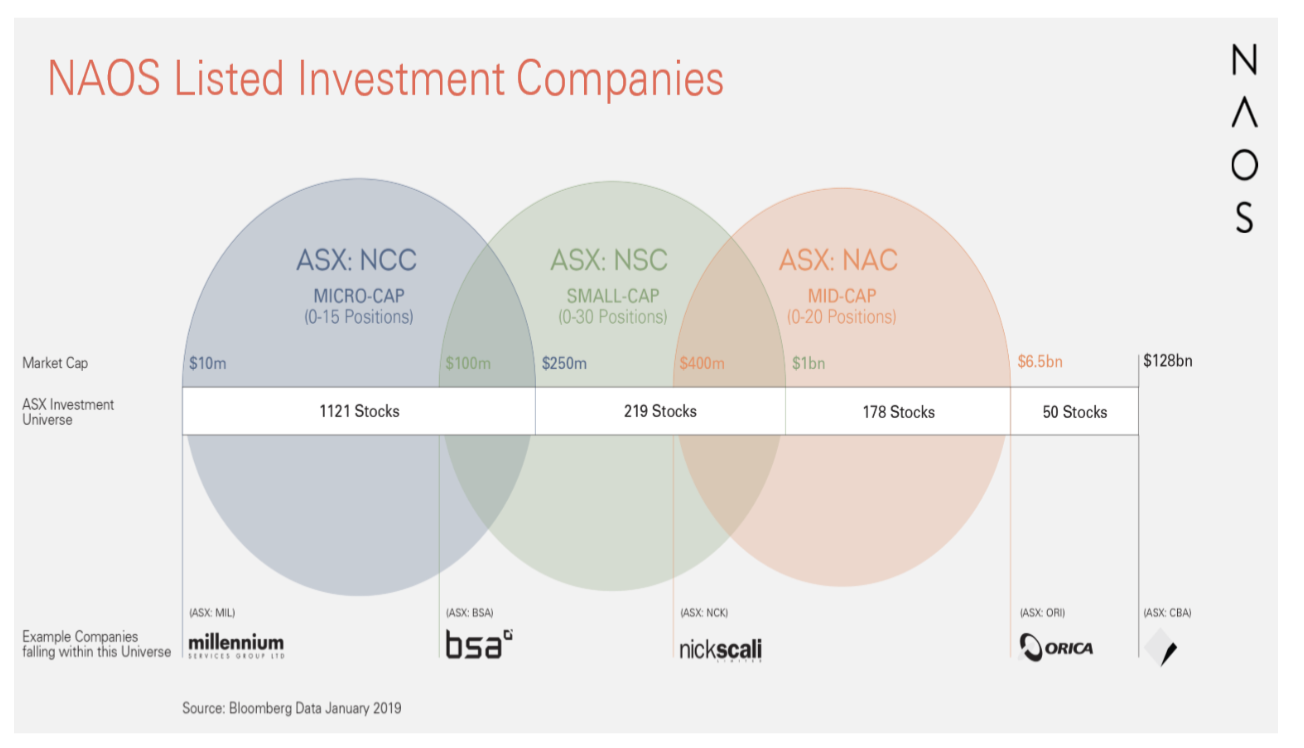

The LIC universe has become very large now, expanding to well over 100 on the ASX. It has become noticeable how many fund managers have struggled to get a LIC off-the-ground, even with good results. NAOS now has three separate LICs having taken over the reins from Contango Asset Management in late 2017. Below is a snapshot from one of their presentations to illustrate how NAOS’ LICs differ.

Source: NAOS Investor Presentation 5/2/19

Source: NAOS Investor Presentation 5/2/19

When NAOS Small Cap Opportunities Company Ltd (ASX: NSC) commenced in late 2017, unfortunately, the NAOS portfolios saw their performance suffer. I assume this was a coincidence but it is interesting that the market judges the three LICs quite differently. Whilst Wilson Asset Management has successfully kept numerous different LICs going in the market, it is not always easy.

For example, we saw another asset manager in Watermark Funds Management experience how difficult it can be. This year Watermark announced plans to move two of their three LICs to an unlisted open-end trust structure.

Conclusion

I am not looking to buy the various NAOS LICs at this point in time. And I find it strange how NSC trades at such a large discount compared with NCC. The worry for me is that the poor sentiment of the former may begin to affect the latter.

I completely understand it is related to the long term performance histories, and how NSC was born out of a LIC run by Contango Asset Management. Even still I think it is strange that both LICs have the same people picking smaller company stocks yet trade at different relative valuations.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, Steve Green does not own shares in NAOS Emerging Opportunities Companies Limited or NAOS Small Cap Opportunities Company Ltd.