Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -1.81% to 7,612.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The local market is now on a 4-day losing streak – its worst run since January (5 sessions) – with today being the worst of the batch.

As we said this morning, US stocks are leading the weakness, having fallen for six consecutive days; their worst losing streak since June.

Equities were on the back foot early following a soft session overnight, stemming from strong-than-expected retail sales numbers, which put pressure on rate cut expectations.

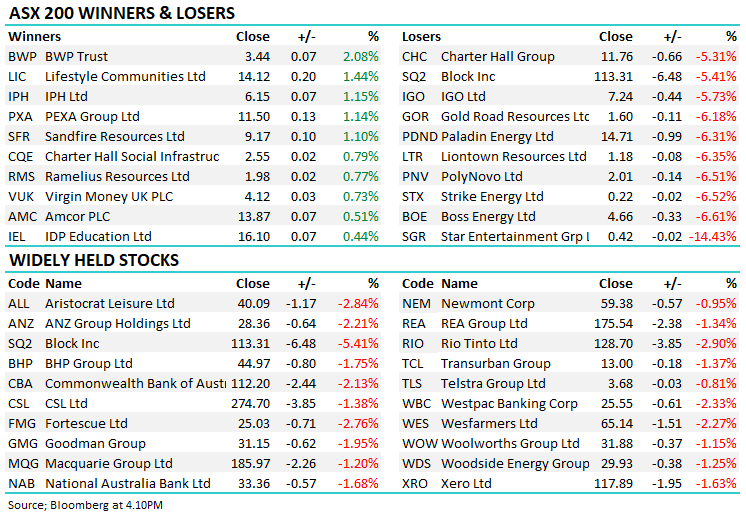

Early buyers were hurt today with the market not “feeling right all day”, come the close, 92% of the ASX 200 finished down, and not surprisingly, all sectors finished lower today, though there was some relief late in the session as the index closed 27pts / 0.35% off the lows.

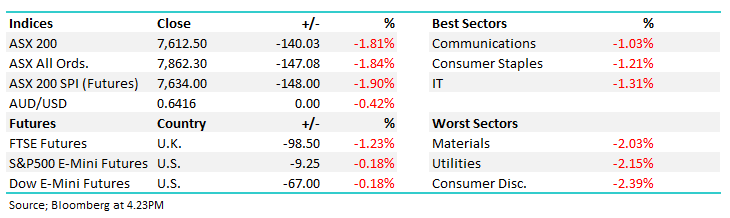

- The ASX 200 fell -140ts/ -1.81% to 7612

- Communications (-1.03%) was best on ground today, but hard to call that a positive.

- Consumer Discretionary (-2.39%) was the hardest hit, followed by Utilities (-2.15%), Materials (2.15%), Real Estate (-1.93%) and Financials (-1.92%)

- US Retail Sales numbers at +0.7% in March were far better than the 0.3% expected, while the prior month was revised higher as well. A strong consumer is working against a Fed that was keen on getting at least one cut before the election late this year.

- Interest rate markets are now only pricing in a 50% chance of a Fed cut in July, down from a near 100% chance just a week ago. Locally we have seen a 140% chance of a cut priced in by the December meeting now pegged back to a 99% chance.

- China data out today also weighed on our market. GDP was better than expected at 5.3% YoY for Q1, though Retail Sales and Industrial Production both came in below expectations. Ultimately, the market took a negative view of the news.

- Zip Co Ltd (ASX: ZIP) -10.9% tumbled despite a strong 3Q update today. We will cover this in the Morning Report tomorrow.

- Hub24 Ltd (ASX: HUB) -2.09% was soft despite record FUA in flows with the total number now hitting $100b thanks to flows and market performance. Like Netwealth Group Ltd (ASX: NWL) though, they flagged softening revenue margins given low cash balances and sliding fee schedules.

- Macmahon Holdings Ltd (ASX: MAH) -4.08% bid for Decmil Group Limited (ASX: DCG) at a huge 76.5% premium to yesterday’s close, all cash. This is a good read-through for the valuation of SRG Global Ltd (ASX: SRG) that we hold in the Emerging Companies Portfolio.

- Gold held last night’s gains today, trading around $US2,385/oz at our close.

- Iron Ore performed reasonably well, only dropping -0.12% in Asian trade.

- Stocks in Asia were also hard hit. The best seen in China, down -0.95%, while Hong Kong and Japan both fell ~1.9%.

- US Futures are all down around -0.15% – no major move here despite the weakness across our region.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- WiseTech Global Ltd (ASX: WTC) Raised to Positive at Evans & Partners Pty Ltd

- DroneShield Ltd (ASX: DRO) Cut to Hold at Bell Potter; PT A$1

- Star Entertainment Group Ltd (ASX: SGR) Cut to Underperform at Jefferies

Movers & Losers