Ron Shamgar of TAMIM Asset Management talks about how retail discretionary stocks outperformed during inflation. Will the cost-of-living crisis persist, placing overwhelming strain on stretched households, or can consumer resilience endure?

The Australian consumer has navigated a complex landscape over the past 12-18 months.

Grappling with the repercussions of a post-pandemic surge in inflation, the Reserve Bank of Australia has raised interest rates 13 times since May 2022 with the current cash rate target at 4.35%.

Price hikes have placed considerable strain on households, triggering a cost-of-living crisis.

As investors anticipated the worst, a large sell-off and re-rating of ASX consumer discretionary businesses during 2023.

Remarkably, despite these significant headwinds, consumer spending over the past six months has demonstrated notable resilience.

For astute investors employing a second-level thinking approach, high-quality brands and companies have defied initial concerns, revealing results that were less dire than initially feared.

In our October analysis, we discussed whether it was time to go shopping for ASX retail stocks and touched on the first- and second-level approach.

As a refresher, while first-level thinking reacts swiftly to immediate problems, second-level thinking goes a step further by considering broader implications and consequences.

This strategic shift involves zooming out, analysing the situation, and pondering potential long-term opportunities, especially in this case when sentiment improves amid widespread retail stock doom and gloom.

Currently, investors face two prevailing narratives:

- Will the cost-of-living crisis persist, placing overwhelming strain on stretched households,

- or can consumer resilience endure?

Retail performance

Over the last 12 months you could have been forgiven for expecting ASX retail businesses to capitulate.

Market sensitive announcements with trading updates from retailers across the country were being released, downgrading earnings expectations and setting the scene for lacklustre results.

Negative sales growth expectations from Baby Bunting Group Ltd (ASX: BBN) saw the share price sold off heavily. Harvey Norman Holdings Limited (ASX: HVN) had seen aggregated sales turnover decline by close to 10% in the first quarter, highlighting the pressure on consumers.

Contrary to these grim expectations, some retailers surprised on the upside, outperforming initial projections in the first six months of the financial year. We wrote about three retailers with impressive results who did just that.

It’s not just retail spending that is remaining resilient, travel is too.

Helloworld Travel Ltd (ASX: HLO) has seen impressive growth with total revenue increasing 53.4% to $112.3 million and profit after tax of $16.0 million an increase of 902.9%. Chief Executive Officer and Managing Director of Helloworld Travel Limited Andrew Burnes commented:

“These half year results are a demonstration of the strong demand for leisure travel that is continuing in Australia and New Zealand. The need for professional travel services continues to expand and is more important than ever.”

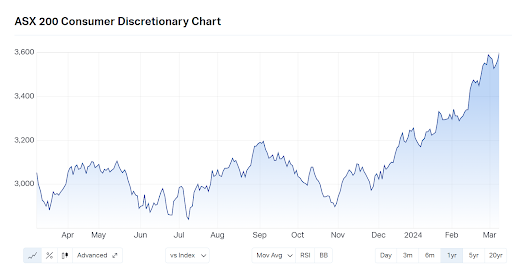

As signs of inflation being to ease and stability in interest rates emerge, consumer resilience may persist. If so, the potential for sales recovery increases, offering these beaten-down retail discretionary stocks a high likelihood of outperforming.

The below chart would suggest investors are beginning to factor this in.

Why has the consumer been so resilient?

The January CommBank Household Spending Intentions Index (HSI) reviews the spending data of around 7 million Commonwealth Bank of Australia (ASX: CBA) customers which showed a 3.1 percent increase in consumer spending.

Notably, recreation spending surged by 13.5%, rebounding from a 5.8% dip in December.

This category includes expenditures on travel agencies, online bookings, airlines, cruise lines, and fitness clubs/gyms. The increase in fitness club spending aligns with a recent trading update from TAMIM holding Viva Leisure Ltd (ASX: VVA) where CEO Harry Konstantinou noted the strong operational performance in the first two months of H2 FY2024.

Perhaps a few new years resolutions are underway?

Data from the Australian Bureau of Statistics highlighted the continued impact of inflation on most goods and services, with the consumer price index rising 0.6% in the December quarter and 4.1% over the past 12 months.

This was the smallest quarterly rise since March quarter 2021. Supporting consumer resilience was the increase in wage growth.

The wage price index rose 0.9 per cent during the quarter and 4.2 per cent over the year — the highest annual growth since the March quarter of 2009.

The TAMIM Takeaway

Investors find themselves at a crossroads, contemplating whether consumers will persist in resisting external pressures and maintain spending or succumb to mounting challenges.

Analysing available information and strategically navigating the market’s trajectory presents a significant opportunity for investors.

While adhering to conventional thinking may pose challenges in outperformance, the contrarian take also entails risks.

Investors must carefully weigh the likelihood of each opportunity, considering both potential risks and rewards.