Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.56% to 7,670.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The market was hit particularly hard early on today, down ~120 points at the 11.30am low before buyers of the dip came roaring in, cutting those losses by 2/3rds with a very strong afternoon session into an index re-weight at the close.

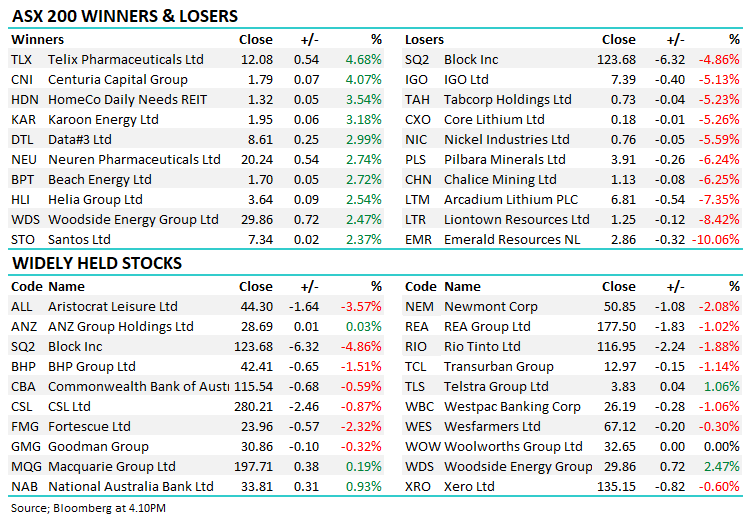

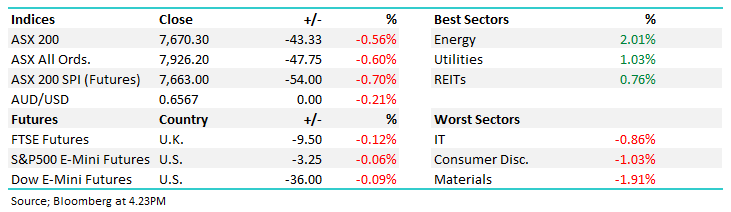

- The ASX 200 fell -43pts/ -0.56% to 7670, although it felt like a decent session by the end.

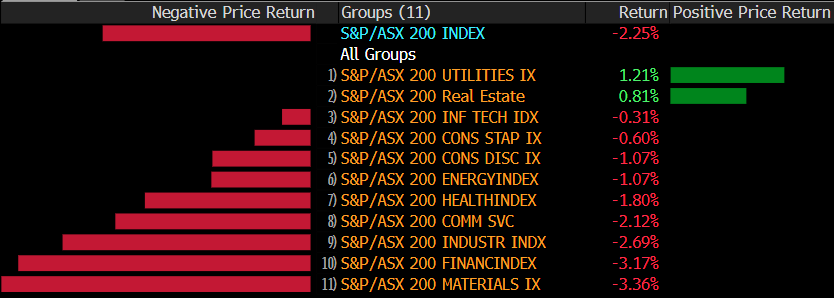

- Energy (+2.01%) was the standout, Utilities (+1.03%) and Property (+0.76%) also did well.

- Materials (-1.91%) were still on the nose, Consumer Discretionary (-1.03%) and IT (-0.85%) weighed.

- A softer week overall for the ASX down 2.25% with only 2 sectors closing higher i.e. fairly broad-based selling.

- Tabcorp Holdings Ltd (ASX: TAH) -5.23% fell as the CEO resigned following inappropriate and offensive language in the workplace.

- EML Payments Ltd (ASX: EML) +11.5% rallied on news they sold their struggling Sentenial business for ~$54m, a good result for a company that is meant to lose $2m in EBITDA in FY24. This follows the line in the sand drawn on the PCSIL business that has regulatory issues, we like the moves.

- Iress Ltd (ASX: IRE) +1.42% sold their UK Mortgage business for $164m into Private Equity. Iress has been offloading non-core assets, this being the biggest so far.

- NRW Holdings Limited (ASX: NWH) +1.67% mining & services contractor announced several contract wins, mostly extensions/variations, but all in worth ~$270m.

- Strong buying in Centuria Industrial Reit (ASX: CIP) +2.29% and Centuria Capital Group (ASX: CNI) +4.09% today, even Centuria Office REIT (ASX: COF) +2.03% was bought.

- Gold was up $US2 in Asia, trading at $US2164/oz at our close, Gold stocks pulled back.

- Iron Ore was off -0.75% at $US107.60

- Stocks in Asia were down, Hong Kong -2%, Chinese equities dipped -0.18%, while Japan was off -0.50%

- US Futures are down a touch.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Southern Cross Gold Ltd (ASX: SXG) Rated New Speculative Hold at Bell Potter

- Hartshead Resources NL (ASX: HHR) Cut to Speculative Hold at Bell Potter

Movers & Losers