Luke Laretive of Seneca Financial Solutions reviews their 2023 top dividend stock picks, namely, GQG Partners Inc (ASX: GQG), AUB Group Ltd (ASX: AUB) and Macquarie Group Ltd (ASX: MQG). How did their top 3 dividend shares perform in 2023?

At the start of 2023, we offered a free report to the Rask Media community, detailing our ‘3 high dividend shares we recommend to almost all our clients.

At Seneca Financial Solutions, we emphasise the importance of transparency when evaluating client outcomes, including benchmarking returns.

As a result, we take this opportunity to analyse the returns generated by our top picks in the 2023 calendar year.

How did we perform?

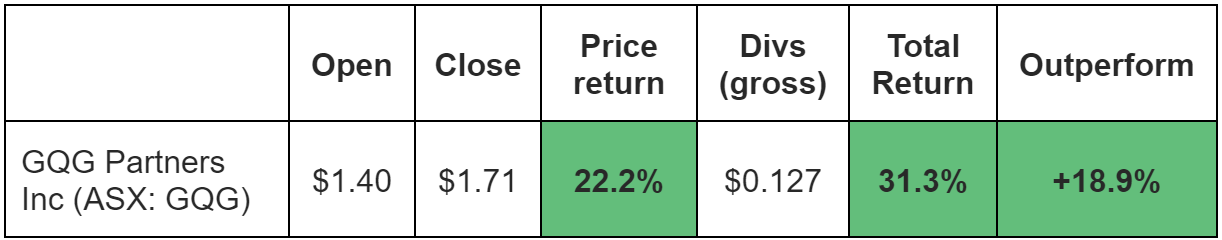

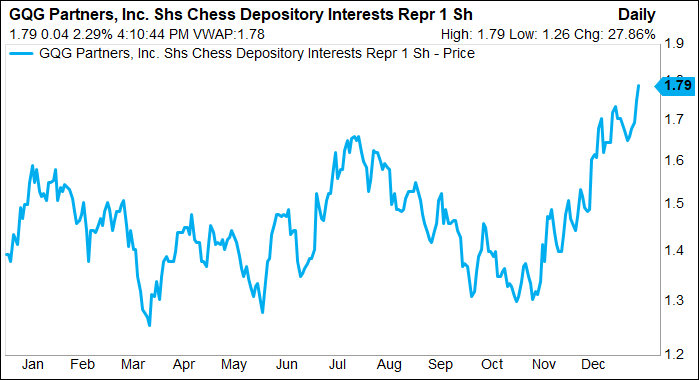

GQG Partners (GQG)

GQG Partners Inc was the top performing recommendation in the 2023 report, generating a 31.3% return (including dividends) for investors, beating the wider market by +18.9%.

GQG increased its dividends per share from USD7.48 cents per share in 2022 to USD8.89 cents per share in 2023 (AUD12.7cps), an increase of 19% year-over-year. Based on the 2 January 2023 opening price, that equates to a 9.1% dividend yield, showcasing the benefits of looking beyond ASX50 shares to achieve dividend income while growing earnings.

Throughout the year, GQG grew funds under management across its 4 global equity strategies from US$88.0 billion to US$120.6 billion. Investors rewarded the growth outlook with a P/E multiple re-rate from 9.2x to 14.3x on a trailing earnings basis, with expectations for further earnings growth in 2024.

GQG featured in the news during the latter stages of 2023 as it announced a non-binding indicative offer (NBIO) to acquire Pacific Current Group Ltd (ASX: PAC) for $11.00 per share (vs stated NAV of $11.92). PAC is a multi-boutique asset manager and was formally known as Treasury Group. GQG is a major shareholder and was competing for PAC with River Capital Pty Ltd (another major shareholder).

The rationale for the transaction as that PAC’s most valuable asset was a long-held 4% stake in GQG, which GQG could have used to do a small buyback as well as buy some bolt-on stakes in a range of boutique fund managers at discount prices. However, PAC did not recommend either bid to its shareholders and has now concluded discussions with both parties. The market did not seem to see this as a negative, with GQG shares performing strongly to finish the year.

The stock is not well covered by analysts, despite its size, as GQG is a highly cash generative business that does not need to raise capital. The couple of analysts that do cover it upgraded their price targets from a consensus of $1.93 to $2.13 during the year on an improving outlook.

GQG closed the year at 12-month highs.

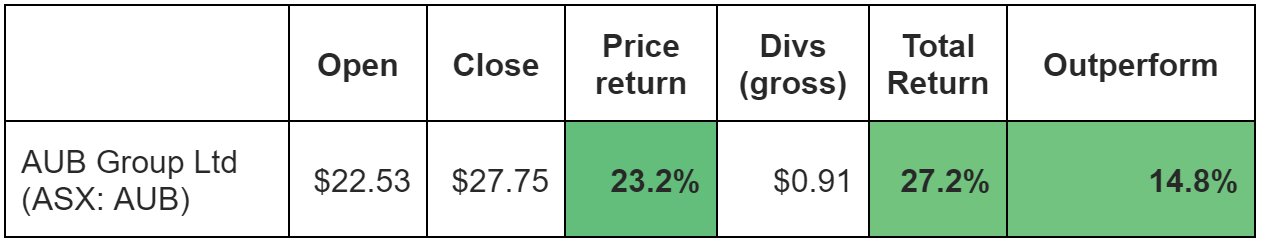

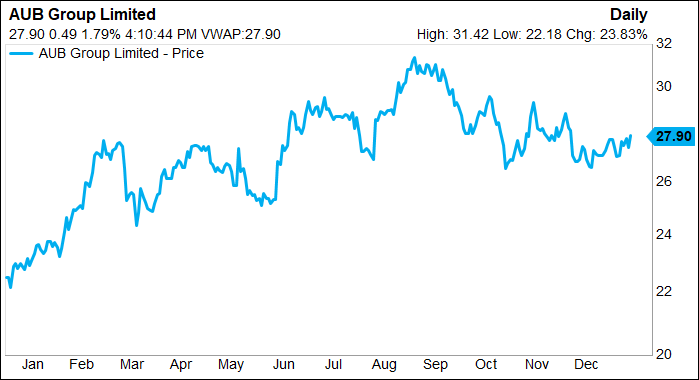

AUB Group (AUB)

Insurance broker AUB Group Ltd, along with the broader sector, benefitted from the tailwind of rising interest rates and rising insurance premiums.

Throughout 2023, the RBA cash rate increased 115bps from 3.10% to 4.35%. Higher investment income and inflation-linked premiums supported an earnings tailwind for AUB shares which returned 27.2% for investors, including dividends.

AUB started the year off with a bang, beating 1H23 underling NPAT guidance by 8.5% at the midpoint and upgrading full year guidance in February 2023 to between $112.9-121.4 million from a previously guided range of $107.5-115.0 million range.

In May 2023, AUB again upgraded FY23 underlying NPAT guidance to between $120-124 million from a previously guided range of $112.9-121.4 million range.

Concurrently, AUB decided not to proceed with the Tysers joint venture with PSC Insurance Group Ltd (ASX: PSI) and raised $150 million to cover the shortfall from the would-be proceeds. The equity raising consisted of a placement and share purchase plan (SPP) done at a discounted share price of $24.00, in what proved to be a profitable deal for investors. All AUB directors participated in the SPP.

AUB ended up reporting an FY23 underlying NPAT of $129.1 million, beating the twice upgraded guidance by 5.8% at the midpoint, and representing 74.5% year-over-year growth. This includes 9 months of Tysers profit contribution, an acquisition made in late 2022, which performed above expectations, but there was still an impressive level of organic growth.

Earnings per share of $0.80 of dividend of $0.64 per share, fully franked. While the yield based on a starting share price of $22.53 doesn’t jump off the page at 2.84% (or 4.06% grossed up), the year-over-year dividend growth of 16.4% was impressive.

AUB hit its all-time high of $31.42 in September 2023, before cooling inflation yield drove bond yield expectations lower and the share price pulled back to ~$28 to close out the year.

We trimmed AUB in our flagship Seneca Australian Shares SMA in May 2023 and August 2023 from a large overweight position. Investors receive monthly performance and position updates here.

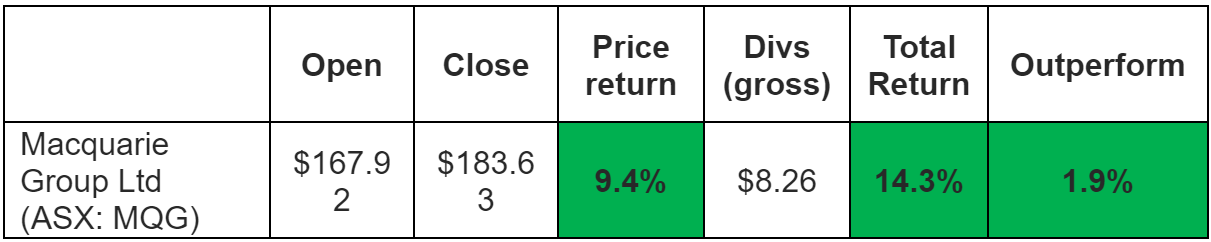

Macquarie Group (MQG)

Macquarie Group Ltd paid out $7.05 in dividends per share in 2023, or $8.26 including franking (Macquarie dividends are typically 40% franked due to the global nature of operations). This was a dividend growth rate of 8.5% year-over-year and represented a yield of 4.2% for those that bought shares at the start of the year.

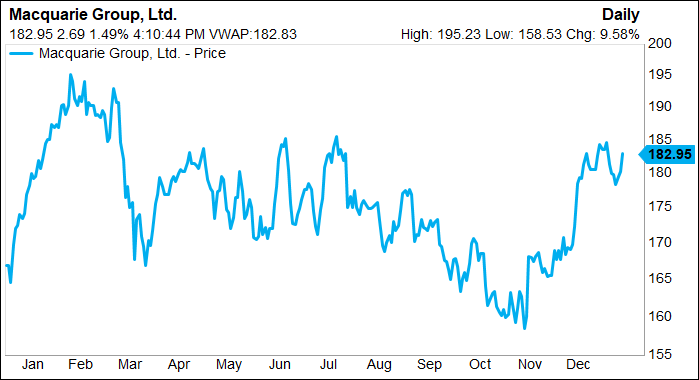

Macquarie reports its full year results on a 31 March year end, with net profit +10% to $5.18 billion. Commodities & Global markets was the standout division, growing +51% on the back of clients hedging gas and power prices which ballooned in 2022. MacCap, the group’s investment banking division, produced operating level profits down -47% due to a lack of dealflow (M&A and IPO activity).

Conditions deteriorated through the middle of the year, driven by commodities reverting lower, and the share price followed suit. Shares traded weaker prior to the release of 1H24 results in early November 2023, where normalised NPAT of $1.42 billion missed consensus estimates by -16%. Analysts cut forecasts, with the average price target dropping from $202.40 in June 2023 to close the year out at $185.00.

However, green shoots emerged in November with the US CPI inflation print below expectations, with dovish commentary from the Federal reserve leading investors to believe that we may have seen the last rate hike, with long dated bond yields falling and equities rallying strongly to close out the year.

Macquarie’s leverage to rising markets propelled shares, in addition to a well-received on-market share buyback of up to $2 billion, and shares rallied strongly to finish the year at $183.63, just 6% below its 12-month high.

Summary

100% strike rate for the Seneca Investment Team in 2023 with all 3 companies recommended generating double-digit positive returns, outperformed the S&P/ASX 200 (INDEXASX: XJO) and impressively, were all able to deliver material dividend growth year-on-year.

Some takeaways

- Dividends are a critical component of total returns on the ASX.

- Being able to identify companies that have sustainable, high dividend growth can drive outperformance.

- Identifying companies with historically high Dividend Yield does not typically result in strong total investment returns – many of these investments are ‘yield traps’.

- Franking credits can materially increase the after-tax value of dividends to investors, however investors should not chase credits, rather chase strong after-tax total returns (i.e. Macquarie only offers 40% franking, GQG offers 0%)

- While we shared these 3 companies with the RASK community, our in-house, proprietary processes identified another 24 ASX companies at the start of 2023 (some of which performed ever better than GQG, MQG and AUB