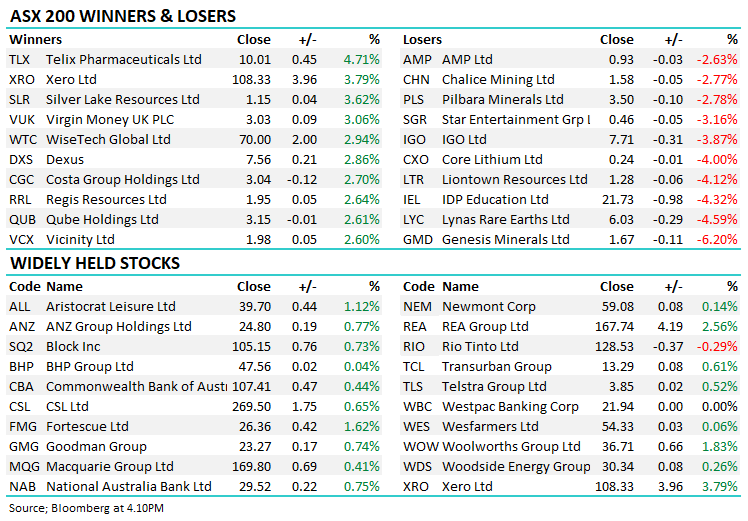

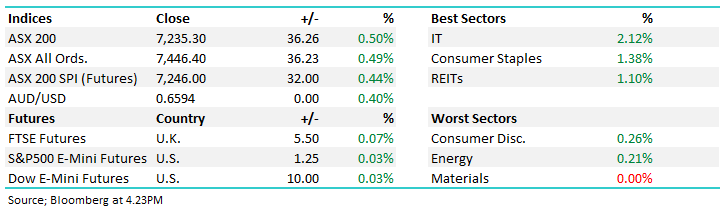

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.50% to 7,235.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Another session where a lack of selling was obvious across the market as 10/11 sectors made gains headlined by technology stocks as they sprang back to life led by heavyweight Xero Limited (ASX: XRO) +3.79%, a classic illiquid stock squeezing up into Christmas. Not a lot to cover this afternoon, so a short & sharp missive for a Tuesday….

- The ASX 200 finished up +36pts/ +0.50% to 7235

- The Tech Sector (+2.12%) was the best on ground today, followed by strong moves in Staples (+1.38%) and Real Estate (+1.10%).

- The Materials sector finished flat on the day, still taking out the wooden spoon.

- The ABS released their overseas arrivals and departures data for October which showed some robust trends, Total arrivals: 1,742,840 – an annual increase of 529,990, total departures: 1,479,380 – an annual increase of 464,550 – this is a solid trend for travel stocks.

- Healius Ltd (ASX: HLS) -1.01% interesting to see that only 60% of retail investors took up their rights at $1.20 when the stock closed today at a 23 premium, a rare win for the underwriters.

- Incitec Pivot Ltd (ASX: IPL) +1.05% appointed a new CEO to start on the 22nd January, Mauro Neves de Moraes previously ran the BHP Mitsubishi Alliance (BMA) that was recently bought by Whitehaven Coal Ltd (ASX: WHC).

- Whitehaven Coal (WHC) +1.80% looks set to pop here, it’s been grinding marginally higher for the past 3 months and just needs a decent coal price tailwind which is starting to happen.

- Gold stocks did well relative to a weak gold price overnight, now back under $US2000/oz – while we already own Evolution Mining Ltd (ASX: EVN), we think it’s a buy ~$3.60 after the cap raise.

- Rea Group Ltd (ASX: REA) +2.56% broke out of its recent range and is now only ~7% below al time highs.

- Perpetual Ltd (ASX: PPT) -2.03% has pulled back post Washington H Sl Pttnsn nd Cmpny Ltd (ASX: SOL) bid @ $27. PPT has rejected it yet the stock remains ~$2 below their initial salvo, “the game is afoot”, if they’re prepared to pay $27, they must believe it’s worth well over $30, perhaps an improved offer is in the works.

- If PPT is worth $30, Magellan Financial Group Ltd (ASX: MFG) +1.04% if worth over $11, currently at $8.78 it still looks cheap to us.

- Banks had a solid day, it is worth remembering that National Australia Bank Ltd‘s (ASX: NAB) dividend will hit shareholders’ accounts on Friday, followed by Macquarie Group Ltd (ASX: MQG) & Westpac Banking Corp (ASX: WBC) on the 19th and ANZ Group Holdings Ltd (ASX: ANZ) on the 22nd, a wave of cash is about to wash through investors’ accounts.

- Iron ore was up another 1% in Asia, trading ~$US136/mt

- Asian stocks were up by varying degrees, Hong Kong +0.85%, Japan was up +0.12% while China added +0.06%.

- US Futures are all mildly higher, Nasdaq the best of them +0.12%

- American inflation data out tonight, with expectations for CPI of 3.1% YoY, before the Feds decision on interest rates out Wednesday.

- While no change is widely tipped, the economic forecasts (dot plot) and press conference could set the tone for equities into year-end.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Cochlear Limited (ASX: COH) Raised to Overweight at Wilsons; PT A$318.46

- Eureka Group Holdings Ltd (ASX: EGH) Cut to Dropped Coverage at Canaccord Genuity Group Inc (TSE: CF)

- Genesis Minerals Ltd (ASX: GMD) Rated New Hold at Ord Minnett; PT A$1.70

- Costa Group Holdings Ltd (ASX: CGC) Cut to Neutral at Macquarie; PT A$3.20

- WiseTech Global Ltd (ASX: WTC) Rated New Hold at Morgans Financial Limited; PT A$73.20

- Smartgroup Corporation Ltd (ASX: SIQ) Cut to Hold at Morgans Financial Limited; PT A$9.70

Major Movers Today