Chris Steptoe of DMX Asset Management tells why Findi Ltd (ASX: FND) could be a buy today. Is Findi share price undervalued?

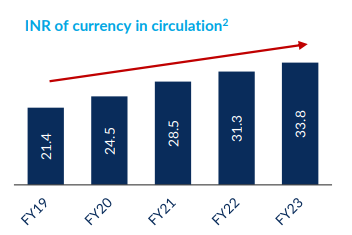

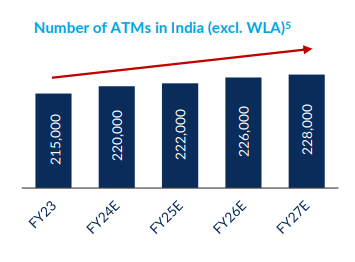

While most economies are turning their backs on cash, India is increasing the number of ATMs, and cash usage is on the rise.

Cash is deeply embedded in their culture due to unique factors, such as the number of unbanked individuals.

Even with the growth of e-commerce, more than 50% of e-commerce transactions are paid by cash on delivery. At the same time, banks are outsourcing their ATM operations, providing opportunities for operators such as Findi Ltd.

Findi is an ASX-listed company that owns approximately 80% of Transaction Solutions International (TSI), an ATM and digital payment business based in India.

Ninety percent of revenue comes from managing 20,000 ATMs on behalf of large banks, with the remaining 10% coming from a retail digital payments business.

DMX entered the register in December 2021 via a capital raise that facilitated the buyout of the TSI JV partner.

While excellent financial progress has been made, it has been a sleeper for nearly two years; however, a flurry of news in the last couple of months has significantly advanced the investment case.

Management

Simultaneously with the acquisition of the TSI JV partner, the Indian management received a 10% shareholding, with the possibility of increasing it to 20% upon achieving financial targets.

Our recent meeting with the Indian management left us impressed with their presentation of the opportunity and execution strategy.

With the recent financial performance, it appears that management are well-aligned.

State Bank of India Deal

TSI has secured a 10-year ATM contract with the State Bank of India (NSE: SBIN). This extended deal is expected to generate $250-280 million over 10 years at an IRR of 35%.

This deal was significant as they were an existing customer, and the current deal had expired. Along with the previously announced deal with the Central Bank of India Ltd (NSE: CENTRALBK), it provides earnings certainty for the medium term.

Half-year results

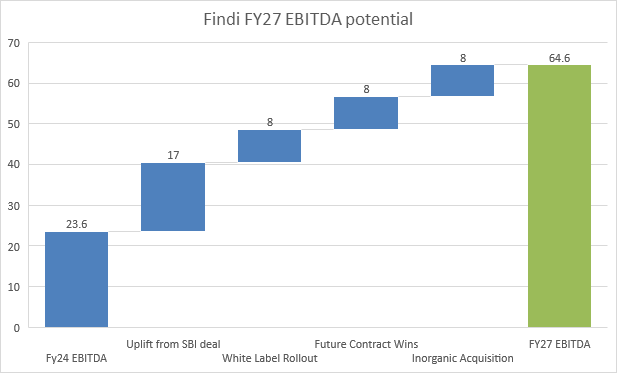

At the end of November, Findi released an impressive half-year result with EBITDA rising 84% to $12.4 million and tracking ahead of the FY24 forecast of $23.6 million.

Free cash generation was strong as the CBI deployment has completed.

This is a significant turnaround from the $6 million FY22 EBITDA.

Funding with equity conversion

TSI raised $37 million in a debenture with a 8% coupon rate that will compulsory convert to 16.7% equity at an intended IPO.

The debentures will be held by Piramal Structured Credit Opportunities Fund which is 75 per cent owned by one of Canada’s largest pensions funds, CDPQ .

The pricing of the equity conversion values Findi’s stake in TSI would be $129 million if an IPO takes place, well above the current market cap of Findi is just $39 million @$1.06 share price.

The funds raised will support the capital required for the rollout of the SBI contract and the following growth opportunities:

- White Label License – TSI is applying for a license to white label ATMs (subject to approval from the Reserve Bank of India). Here, TSI will be able to leverage the 10,000 old SBI ATMs, refurbish, and deploy in new locations. With higher margins, this should significantly improve the earnings profile.

- Flagged Acquisitions – Findi management has cited an imminent business acquisition. With the capital raise complete, they have the firepower to proceed.

- Further Outsourcing Deals – There is clearly an opportunity for further SBI-like contracts. A competitor, CMS Info Systems, has suggested that 100,000 ATMs will be outsourced over the coming years, with multiple large banks tendering their ATM outsourcing.

- Findi Pay – TSI’s digital payment business currently reaches 16,000 merchants and is growing at 2,000 per month.

IPO exit

The endgame for TSI is an IPO on the Bombay Stock Exchange.

If all goes well, this would be undertaken in three years with a target valuation of $500 million.

To reach that valuation, the growth opportunities identified above will need to be executed.

Their closest peer, Cms Info Systems Ltd (NSE: CMSINFO), currently trades at 9 times FY24 EBITDA. With the bulk of the debt converting to equity, debt levels should be modest at the IPO, given the cash generation in FY26 and FY27.

We would expect a vendor sell-down to be the main use of funds for the IPO.

Therefore, it would need FY27 EBITDA to be around $65 million to achieve a $500 million IPO. Assuming Findi sells down at this time, the value to Findi from its TSI holding could be $6 per share.

As shown below, we see this target as quite achievable, given the visibility of current earnings from SBI and modest assumptions on future growth initiatives.

Risks

Notwithstanding the recent strong progress, we are cognisant of some key risks:

- A quick reversal of the current ATM and cash growth in the Indian economy, possibly as a result of government regulation or cultural shifts.

- Missteps in the SBI rollout that reduce the profit contribution and leave the company with an unmanageable debt burden.

- Integration risks of the flagged future acquisition.

- Key management leaving the business.

Valuation

Putting aside the IPO scenario, we expect healthy cash returns going forward to justify our position.

By FY27, we expect the SBI contract and the white label rollout to be complete with TSI to generate $35 million or more in free cash. This excludes any value associated with accretive acquisitions (and there is a genuine consolidation opportunity to take advantage of), new contract wins, and any value for successfully growing their digital initiatives.

Our DCF, which includes a negative terminal rate to factor in risks associated with lower cash usage in the future, still suggests fair value near $3.

We think this valuation provides a more than adequate margin of safety.