Cameron Gleeson of Betashares talks about S&P/ASX 200 (INDEXASX: XJO), the Nasdaq-100 (INDEXNASDAQ: NDX), and the S&P 500 (INDEXSP: .INX) and their performances over the last couple of years. Are these share prices still a buy today?

A wrap up of the charts catching our eye over the past month.

As sentiment remains wary around equity market growth we take a look at how the underlying fundamentals stack up for some of the best performing equity markets globally.

Domestically, we consider what drives returns for the S&P/ASX 200 and the risk this poses.

Finally, putting gold’s recent rally under the microscope we look for reasons why it may still go higher.

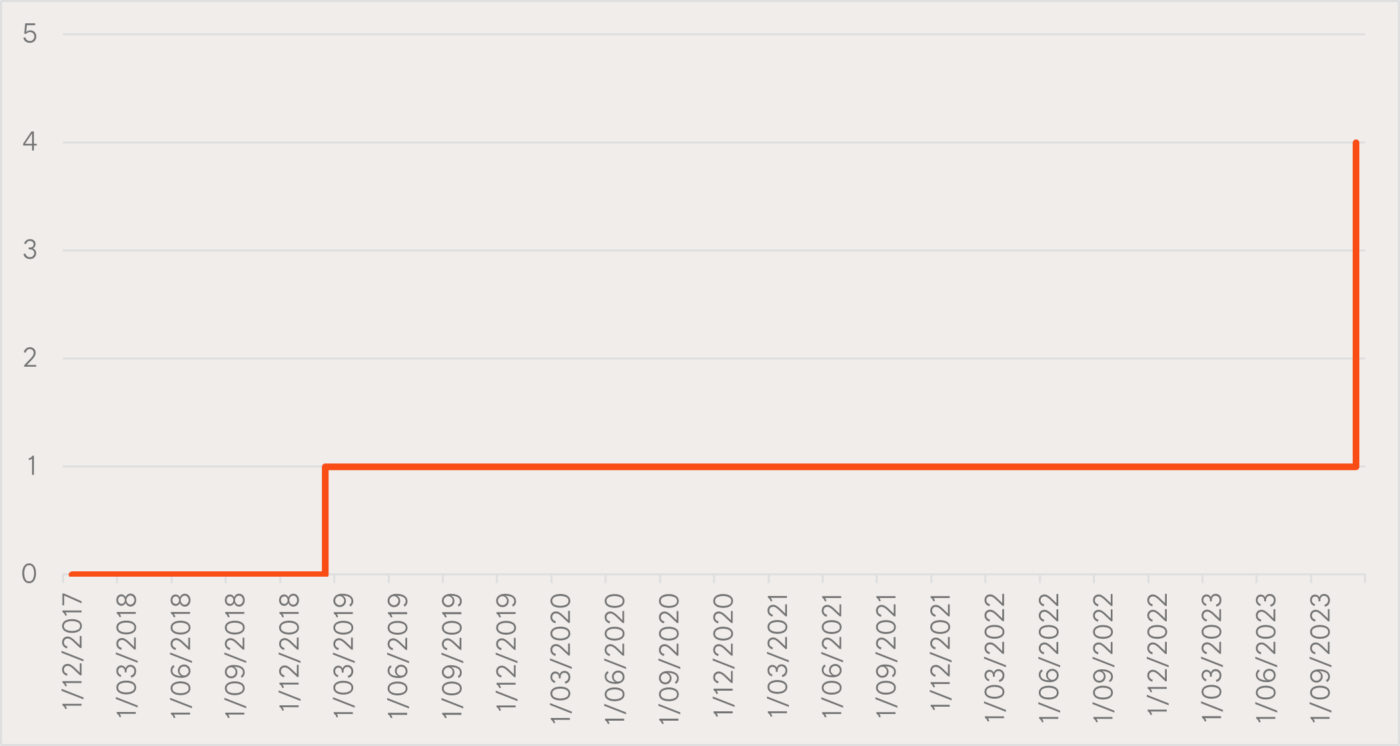

Will strong fundamental growth continue to drive the Nasdaq’s outperformance?

Focusing on the US market, the strong fundamental growth of the region’s technology companies listed on the Nasdaq-100 have driven equity market growth.

After a period of catchup by the S&P 500’s sales growth following Covid lockdowns, consensus estimates once again have the Nasdaq’s companies outpacing the rest.

Chart 1: Historical and consensus estimates of sales growth for the Nasdaq 100 and S&P 500. Past ten years and estimates of next two.

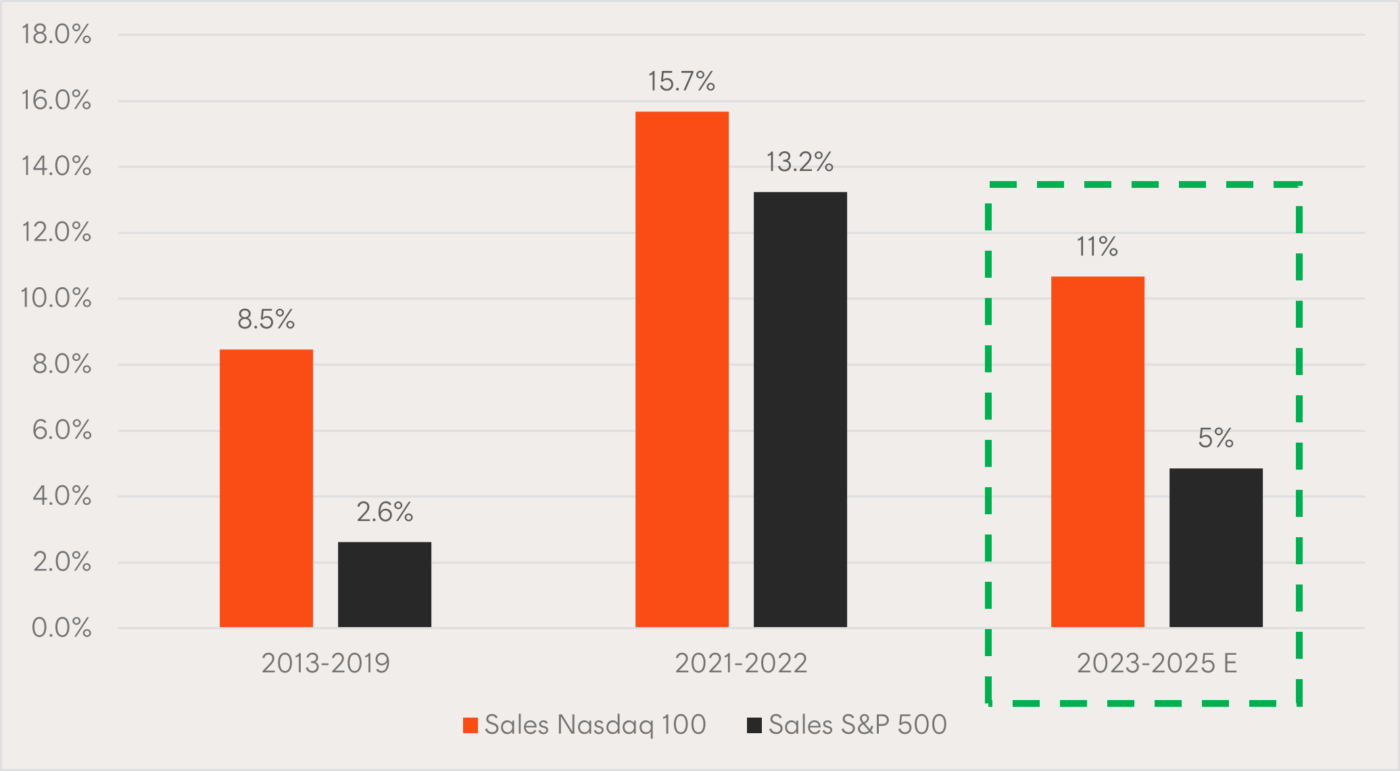

Japanese equities have been a standout for earnings growth over the past decade

Many investors closely associate Japanese equities with the term ‘the lost decades’.

However, structural corporate reforms, accommodative macroeconomic policies, and geopolitical tailwinds are starting to take hold as underlying company fundamentals improve.

Japan has been the second-best performing major equity market in 2023 to date, as highlighted by the metrics shown in the chart below.

Chart 2: Trailing 10-years earnings per share (EPS) Compound annual growth rate (CAGR), in local currency, for selected equity markets

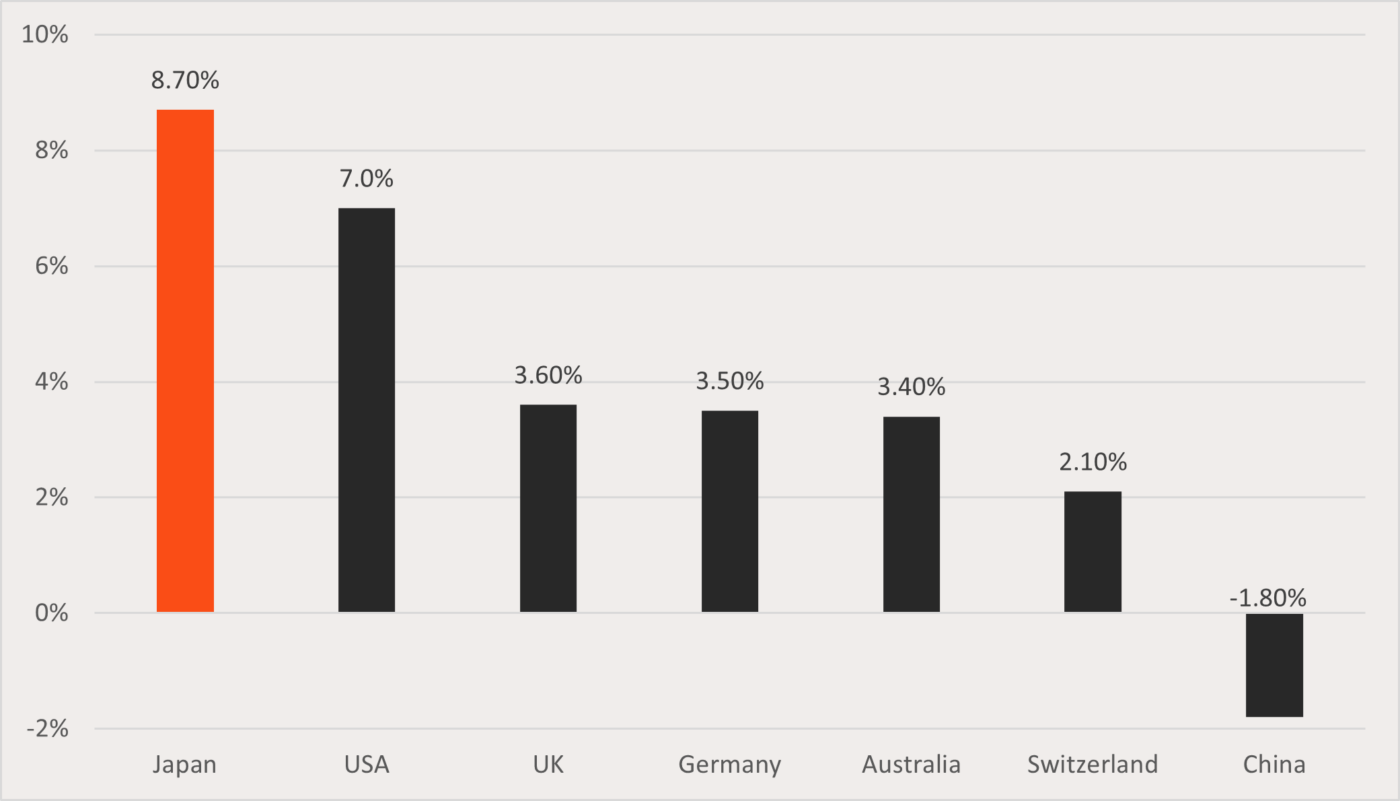

The ASX remains reliant on dividends for returns, and the dividends remain heavily reliant on ten contributors

On 1 November 2007, the S&P/ASX200 Index reached 6,828 points; on the 1 November this year it was just 10 index points higher.

If it wasn’t for dividends, the total market return over that 16-year period would have been close to zero.

The top 10 contributors currently make up 60% of the index’s dividend yield, posing a potential threat to our domestic market’s returns if these dividend yields were to fall.

Chart 3: Cumulative contribution of each stock to the trailing 12-month S&P/ASX200 Index yield (highlighting the top 10 contributors)

Gold’s disconnect from its historical drivers could help bullish sentiment

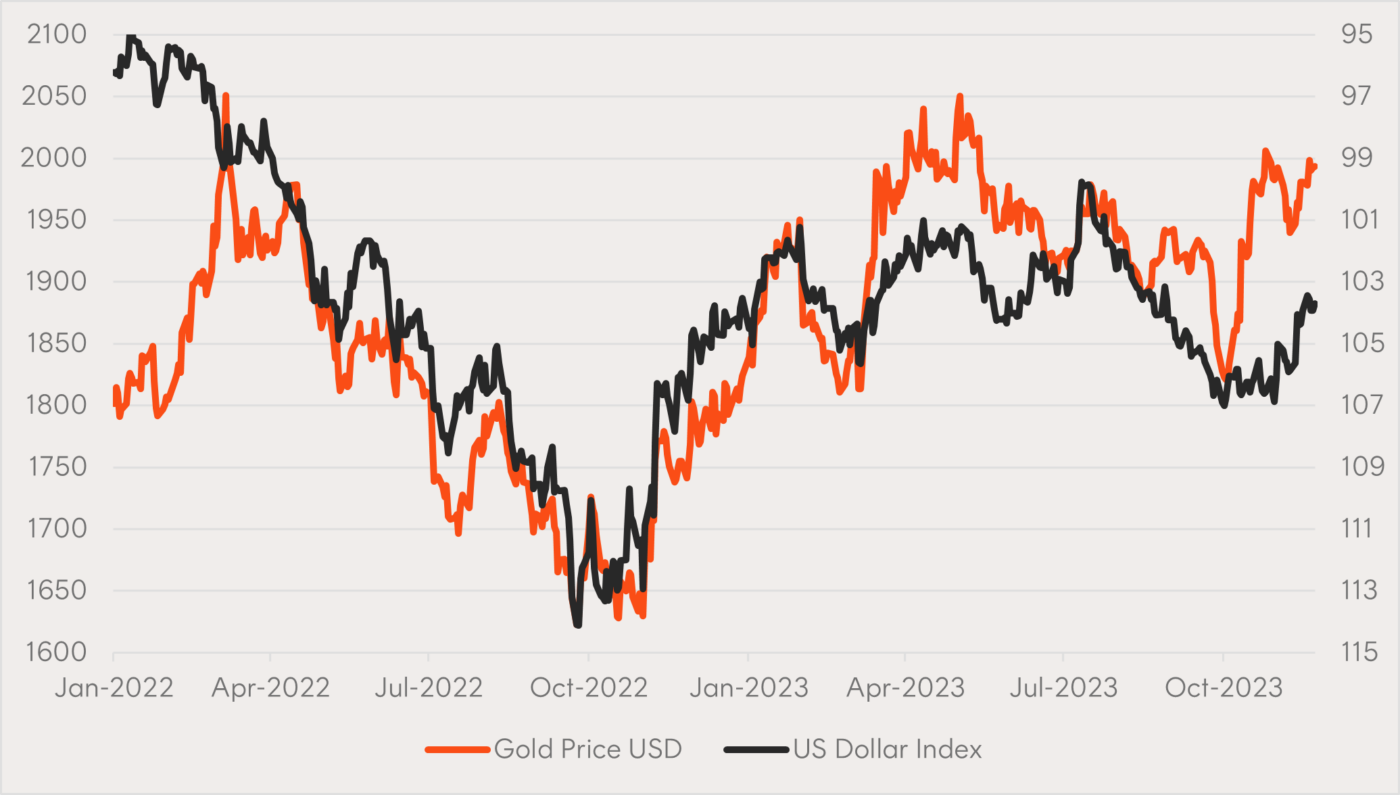

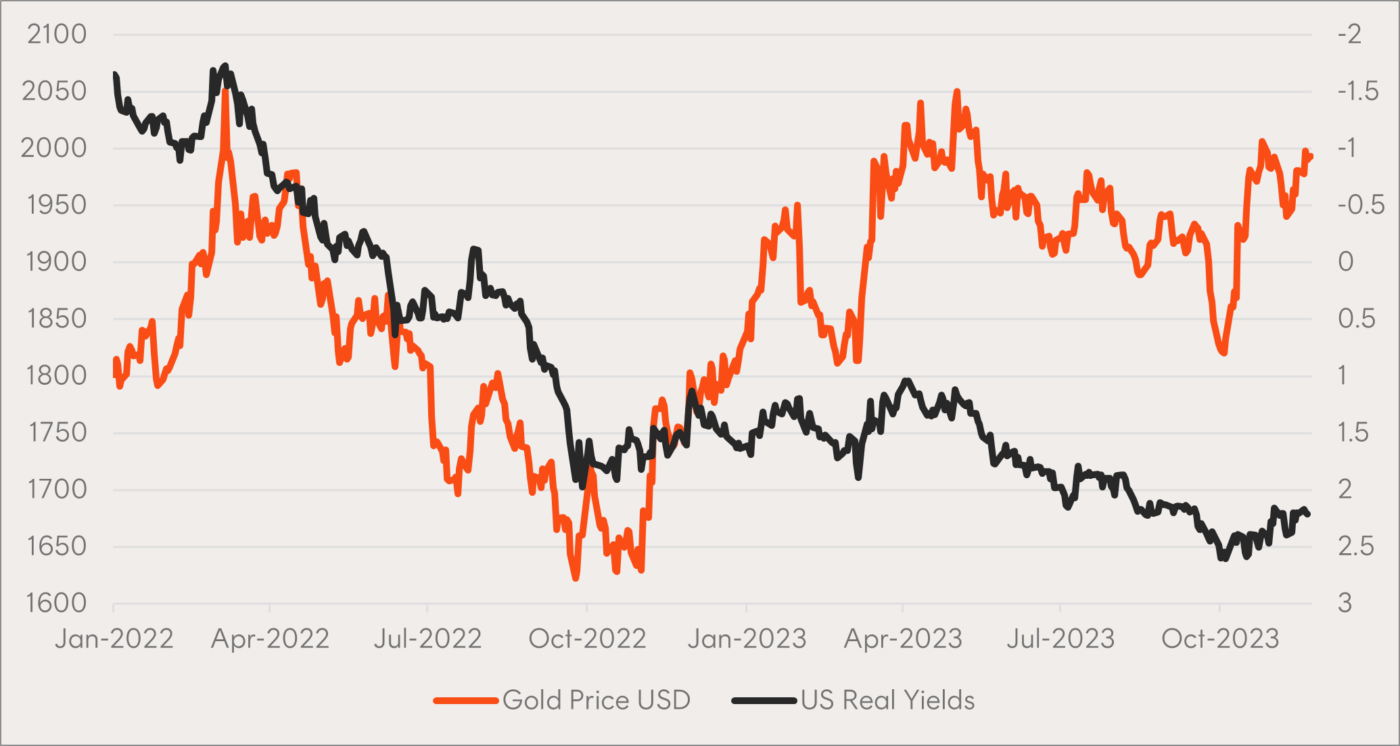

Historically, the US dollar and US real yields have tended to be two key drivers of the gold price (in US dollars).

More recently, these inverse relationships have broken down as the gold price has risen (Charts 4 and 5) while we experience US dollar strength (inversed, Chart 4) and higher real yields (inversed, Chart 5).

Many suspect this is on the back of gold’s safe haven utility and central banks buying gold in place of US dollars.

A reversal of US dollar strength or falling US real yields could potentially be a catalyst for the gold price to take another leg higher.

Chart 4: USD gold price (orange, LHS) and US dollar index (black, RHS inverted).

Chart 5: USD gold price (orange, LHS) and US real yields (black, RHS inverted).

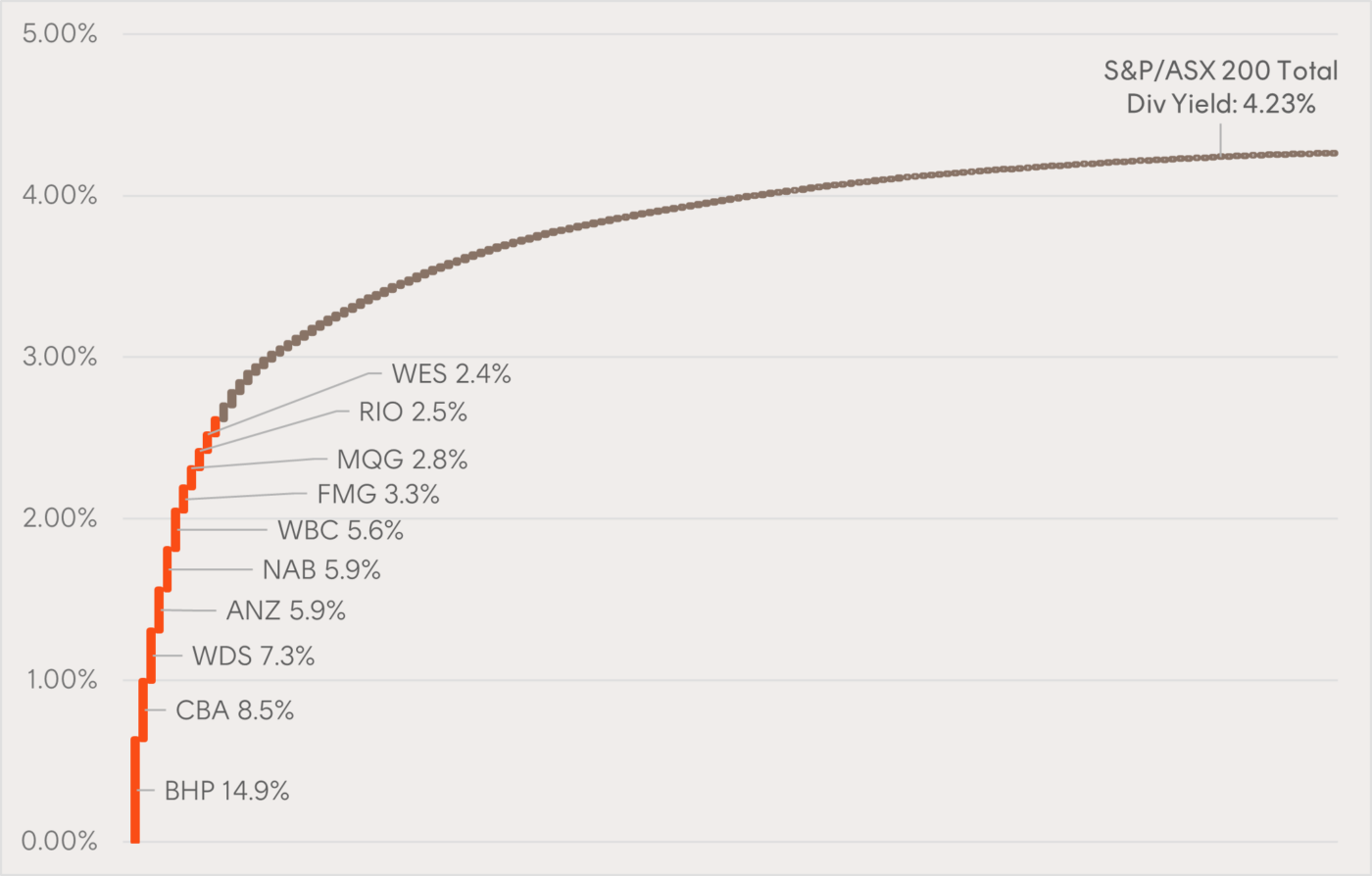

5 – OpenAI

On the lighter side of charts we have enjoyed over the past month, the fiasco at OpenAI has led to a 300% increase in the cumulative number of CEOs running the business in less than a week.

Chart 6: Cumulative number of CEOs at OpenAI