Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.17% to 7,040.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The intra-day trend (chart below) shows the impact of low volumes, and as one trader said today, it’s great to see the ASX also celebrates Thanksgiving! Strength early, weakness late but a positive session to cap off a fairly flat week for stocks.

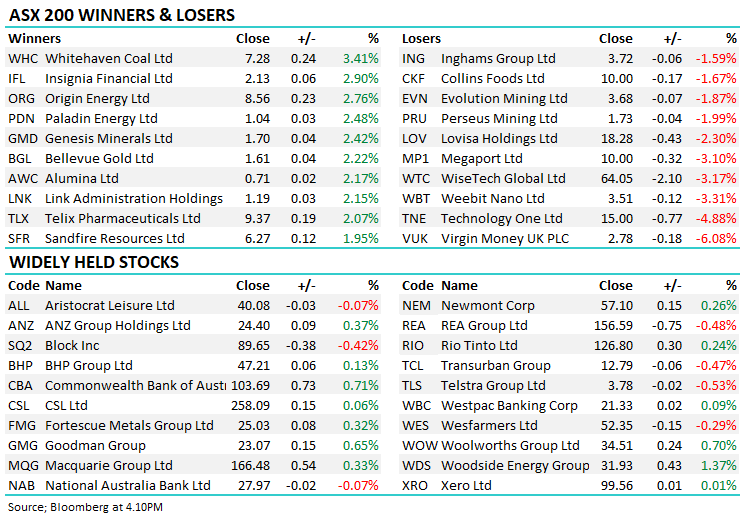

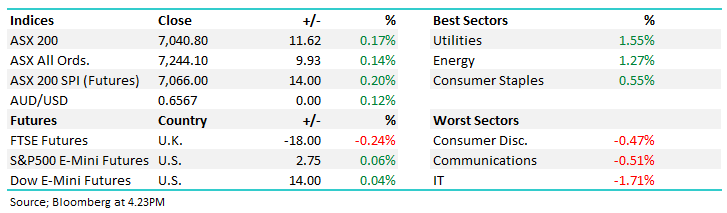

- The ASX 200 finished up +11pts/ +0.17% to 7040

- The Utilities (+1.55%), Energy (+1.27%) and Staples (+0.55%) were best on ground.

- IT (-1.71%), Communications (-0.51%) and Consumer Discretionary (-0.47%) were weak.

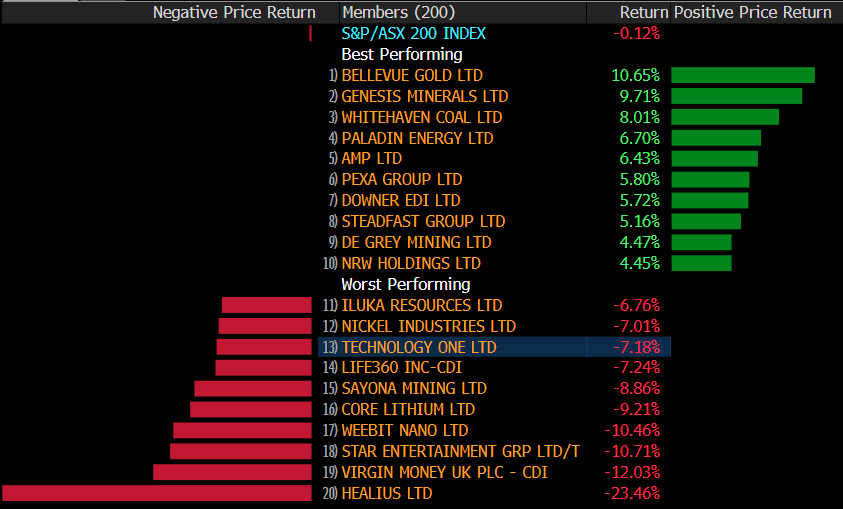

- Origin Energy Ltd (ASX: ORG) +2.76% moved higher as there remains a chance the takeover in some capacity will still eventuate.

- WiseTech Global Ltd (ASX: WTC) -3.17% lost ground despite reaffirming earnings guidance, with Chair Andrew Harrison stepping down.

- Virgin Money UK CDI (ASX: VUK) -6.08% fell after the UK-based lender missed expectations at their FY23 result, higher costs and provisions to blame.

- Select Harvests Ltd (ASX: SHV) -10.53% a tough session for the almond grower on the back of a poor FY23, posting a loss of $114m.

- Conditions in the almond market have been tough, facing wet weather and varroa mite problems weighing on output while prices remain subdued.

- The market is now rightly concerned with the company’s $190m of debt on the balance sheet.

- Whitehaven Coal Ltd (ASX: WHC) +3.41% is finding some support and looks good here.

- We flagged APA Group (ASX: APA) +0.6% this morning as a quality infrastructure stock that is at attractive levels.

- TechnologyOne Ltd (ASX: TNE) -4.88% down again on this weeks result that flagged higher costs.

- Iron Ore was down smalls during our time zone today, sitting $US131/mt

- Gold was up +$2 trading at US$1994/oz at our close.

- Asian stocks were mixed, Hong Kong -1.38%, Japan +0.63% and China -0.52%.

- US Futures are flat.

- Half day in the US tonight

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Healius Ltd (ASX: HLS) Raised to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$1.30

- Nick Scali Limited (ASX: NCK) Cut to Neutral at Citigroup Inc (NYSE: C); PT A$11.57

- Boss Energy Ltd (ASX: BOE) Raised to Speculative Buy at Bell Potter; PT A$5.53

- AMP Ltd (ASX: AMP) Raised to Neutral at Barrenjoey; PT 96 Australian cents

- City Chic Collective Ltd (ASX: CCX) Raised to Buy at Citi; PT 62 Australian cents

- Vulcan Steel Ltd (ASX: VSL) Rated New Add at Morgans Financial Limited; PT A$9

Major Movers Today