Global markets

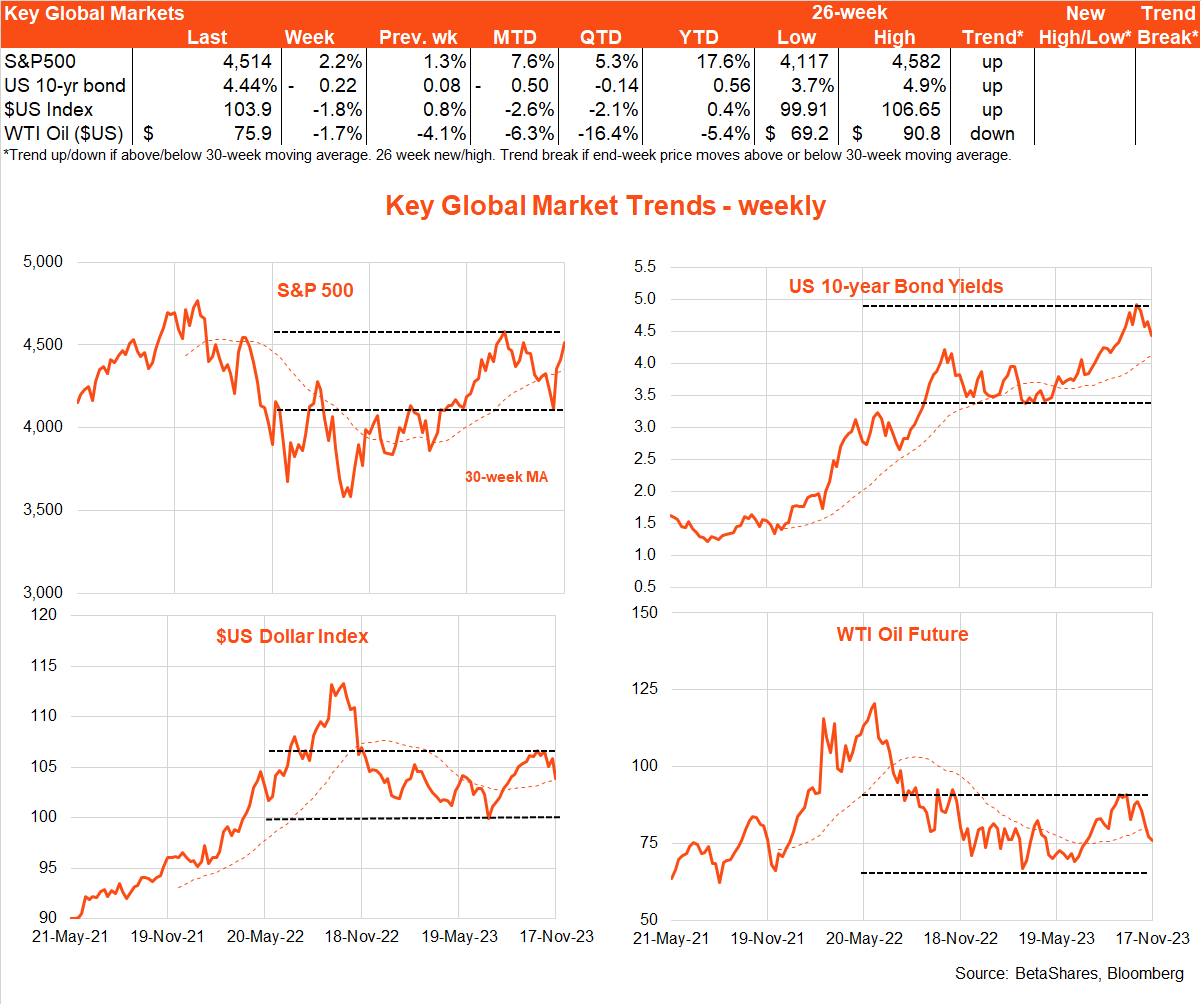

Global equities rose for the third week in a row as a slightly lower-than-expected US CPI result led to a chunky decline in bond yields and increased hopes that the Fed has finished raising interest rates.

A further easing in oil prices contributed to what was, simply, a stone-cold stunning week for both global bond and equity markets.

The global highlight last week was the October US consumer price index report.

Although both the headline and core monthly prices gains were only 0.1% lower than market expectations, US 10-year bond yields dropped an impressive 0.19% on the day, to end the week down 0.22% at 4.44%.

Contributing to the market’s enthusiasm was a nice easing back in core services inflation excluding housing (the ‘super core’), which rose only 0.2% after an uncomfortable 0.6% gain in September. Annual super core inflation is now down to 3.7%.

Adding to market optimism, October producer prices were also lower than expected, with both the CPI and PPI benefitting from a decline in oil prices over the month. US retail sales, meanwhile, remained reasonably firm, declining only 0.1% in October after a solid 0.9% gain in September.

Fed rhetoric, however, remained mixed, with many officials stressing it was too early to declare victory in beating inflation and talk about cutting rates – even though privately they may be fist pumping the air as a once considered unlikely soft landing appears increasingly achievable.

Turning to the week ahead, there’s little in the way of major data this week with Tuesday’s Fed minutes the likely global highlight. Markets will no doubt be hoping for more signs of a dovish Fed pivot, though I suspect the minutes will try hard to avoid that impression – lest markets get too far ahead of themselves.

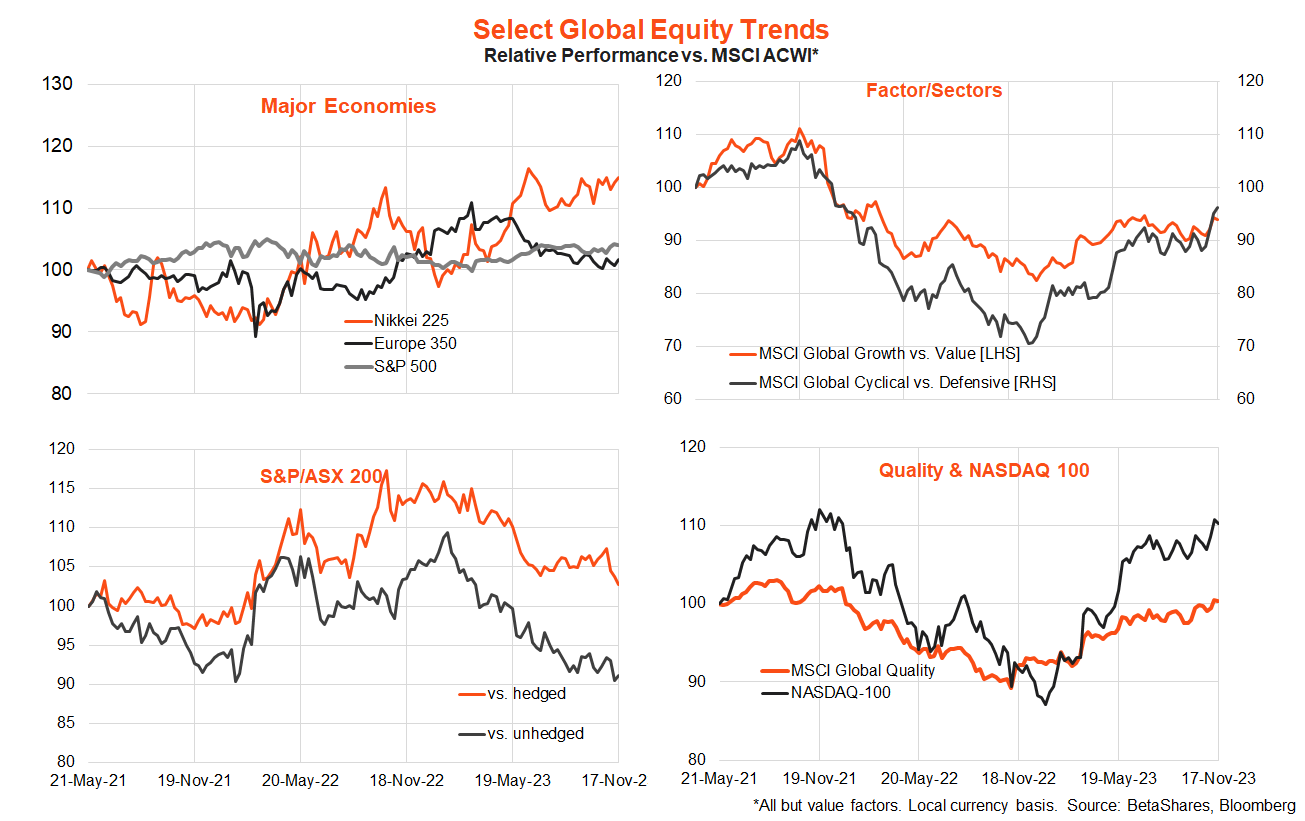

In terms of global equity trends, global quality and the tech-heavy NASDAQ-100 (INDEXNASDAQ: NDX) have displayed an outperforming bias in recent weeks (consistent with the decline in bond yields), while Australia’s value-heavy market remains in a relative performance downtrend.

Japan continues to do relatively well, helped by a still-weak Yen, with the BANK OF JAPAN (TYO: 8301) resisting global pressures to raise interest rates.

That said, overall global growth has not broken out relative to value, though cyclicals have recently started to outperform defensives.

Australian markets

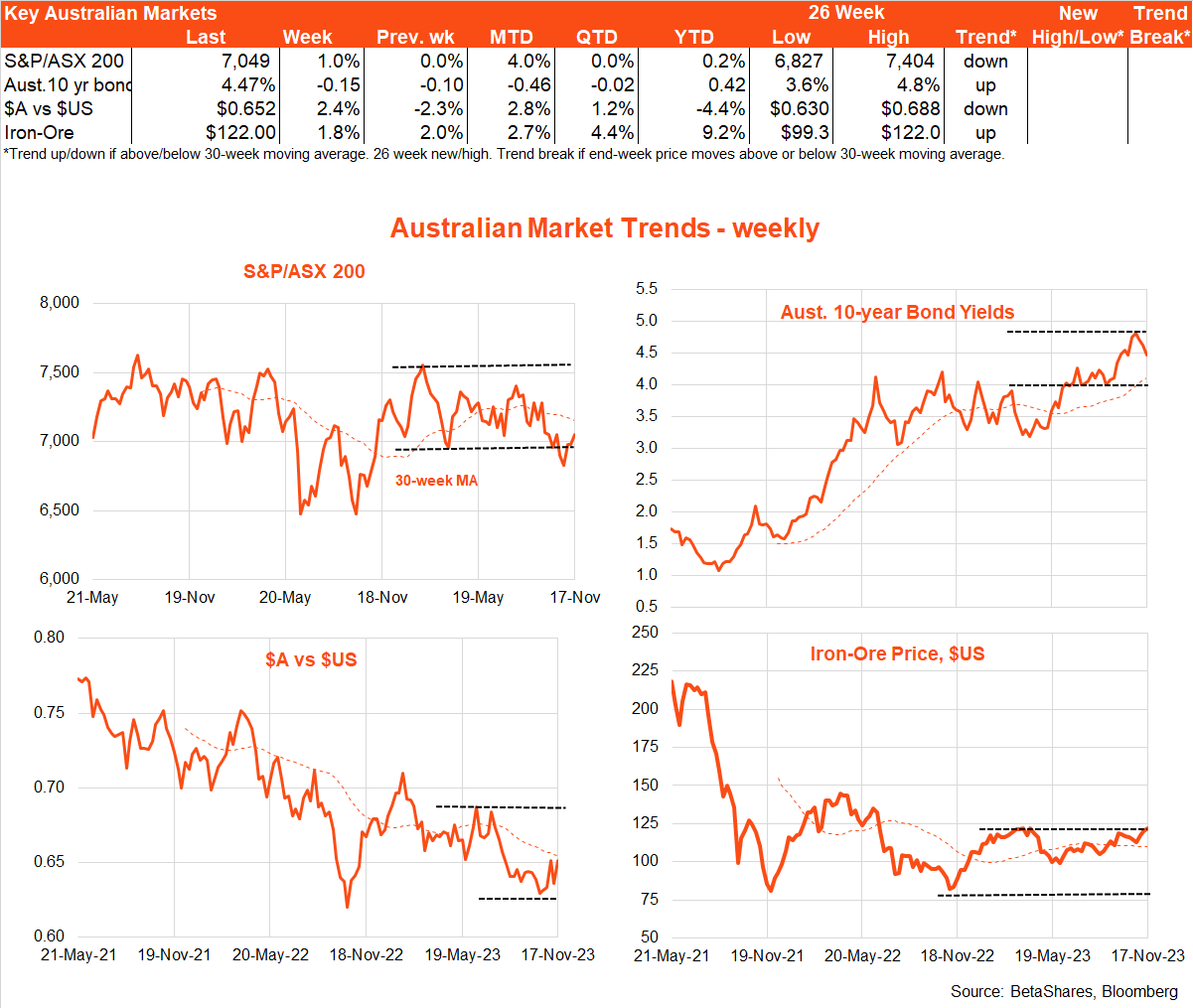

Local stocks and bonds participated in last week’s global rally, with mixed economic data on the home front. A softening US dollar has seen the $A stage a recovery, helped by still firm iron-ore prices.

In terms of economic data, the divergence in business and consumer sentiment remained evident last week with the National Australia Bank Ltd (ASX: NAB) measure of business conditions holding up even as the Westpac Banking Corp (ASX: WBC)/Melbourne Institute index of consumer sentiment retreated following the RBA’s recent rate hike.

Despite solid employment growth, local households remain under pressure from rising rates and weak real wages, while business is enjoying overall firmer conditions thanks to the rebound in tourism and immigration and strength in public and private capital spending.

Although relatively high, the 1.3% gain in the Q3 wage price index was largely as expected and reflected the boost to minimum and award wages over the quarter.

According to the RBA, underlying wage pressures appear to have peaked – though there remains a risk of lingering high wage demands if inflation remains stubbornly firm.

The last key piece of data last week was the October labour force report, which revealed a bumper 55k gain in employment.

That said, there are growing signs that labour demand is starting to soften and the economy can no longer absorb sharply rising number of new workers as easily as it once could. The share of part-time employment is rising, average hours worked are being cut back and the cyclically sensitive youth unemployment rate has jumped up to 9.2% (from 7.1% in mid-2022).

The nation-wide unemployment rate edged back up to 3.7%, compared to around 3.4-3.5% in late 2022.

All this is consistent with the RBA remaining comfortably on hold in December, though there remains a risk of a rate hike in February if pricing pressure in the late-January Q3 CPI remains firm.

As in the US, there is little major local economic data this week, with tomorrow’s minutes to the RBA November policy meeting (at which it hiked rates) the highlight. Of interest will be any hints over how finely balanced the decision to raise rates turned out to be – though I suspect the minutes will suggest the RBA did not agonise all that much.

Have a great week!