Marcus Today does Technical Scans every day, and on 15 September 2023, they turned up four big stocks (five if you include Resmed CDI (ASX: RMD), seven including resources) that are interestingly oversold on weekly charts.

Resmed CDI (ASX: RMD)

Weekly charts smooth out a lot of the volatility, so to be oversold on a weekly chart is reasonably significant, especially for a big stock that tends to be less volatile.

So, let’s have a look at a few of the numbers on those.

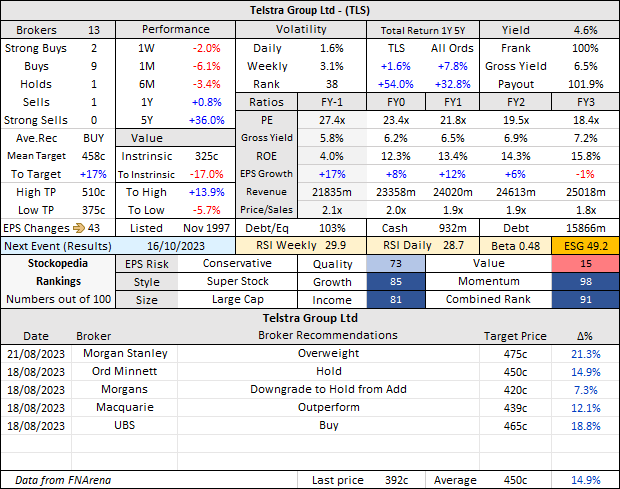

Telstra Group Ltd (ASX: TLS)

Don’t buy until it turns – buy for income when it does. This is not a growth stock, and if it gets down to the bottom of the trading range, it will offer an almost 7% yield. 6.3% at the moment.

It is one of the least volatile stocks in the market – it ranks 38th out of 500 for the least volatile stocks in the All Ordinaries (INDEXASX: XAO) index. It is just beginning to develop a bit of an earnings growth trend again after the NBN era comes to an end.

The average broker target price is 14% above the current share price.

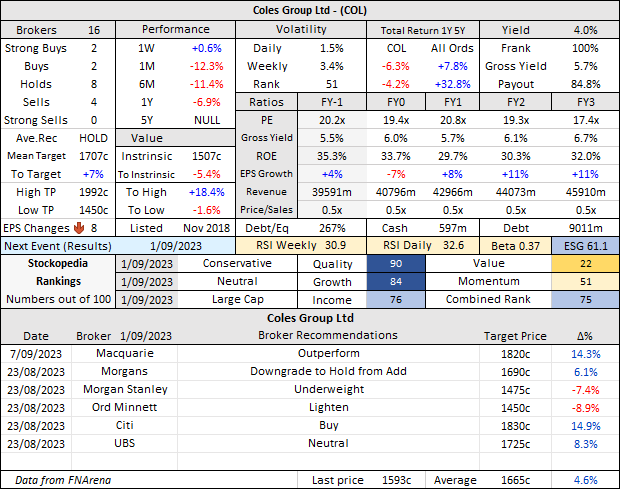

Coles Group Ltd (ASX: COL)

A quality stock (but a boring stock) that has got itself oversold after recent results disappointed, on the back of a surprising boom in shrinkage (theft).

What do you expect when you remove staff from checkouts (some of the shrinkage comes from staff, funnily enough)?

When the cost of living shoots up, essential goods become more expensive, and shrinkage booms. And then they remove staff at the same time. The perfect storm.

The other retailers – Wesfarmers Ltd (ASX: WES), Woolworths Group Ltd (ASX: WOW) – also had results and didn’t have the same experience, so it is fixable. The issue has left the company in a sentiment hole compared to the other consumer staple stocks. An opportunity. Showing signs of bottoming, and also close to the bottom of a quite well-established trading range.

But don’t get too excited. The range, if timed perfectly, is only 10-20%. It ranks 51st out of 500 for the least volatile stocks in the All Ordinaries index.

The average broker target price is 5% above the current share price.

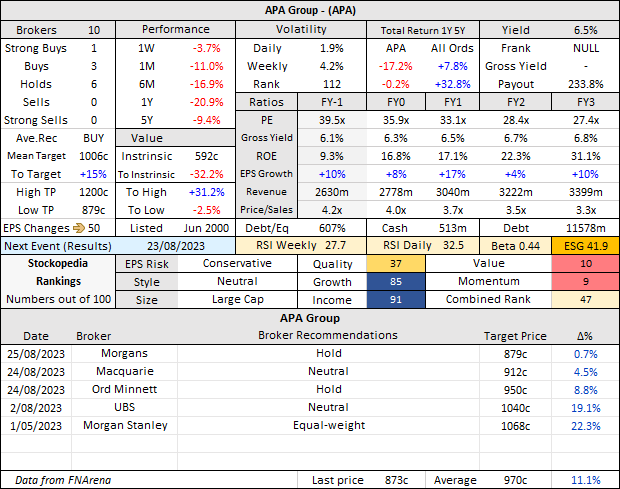

APA Group (ASX: APA)

A boring utility stock that naturally struggles (like most utilities and infrastructure stocks) from a rise in interest rates (they have huge debts behind their assets).

They are a stock that you might look at when interest rates peak. They have been in a downgrade cycle and have recently had a new capital raising, which has dumped the share price. Their business is high quality but gas transmission, gas storage, gas distribution, renewable energy, and ‘other infrastructure’ (water and waste systems) are hardly electrifying.

This company will be around in 50 years. It yields 6.3%. It has a reasonably high return on equity for an infrastructure company (17%). It’s not going to change your life, but at the right price could offer a recovery trade and a reasonable yield. I have seen a few fund managers getting more bullish on it after the recent price fall.

One for long-term investors. It ranks 112th out of 500 for the least volatile stocks in the All Ordinaries index.

The average broker target price is 11% above the current share price.

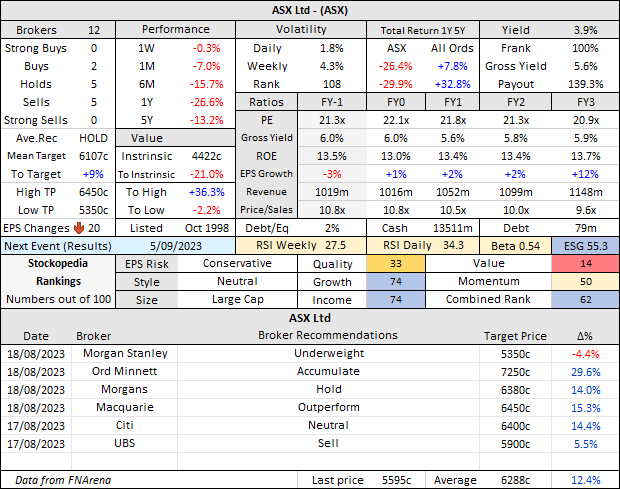

ASX Ltd (ASX: ASX)

I hold the ASX Ltd (ASX: ASX) in our Long Term Portfolio, and it has been disastrous. I have misjudged the impact of Chi-X competition, but I am also aware it is a long time broker, that it is a stock that thrives on stock market activity, and we are in a (temporary) lull for everything to do with the stock market, including M&A deals, IPOs, and turnover on which they earn a clip. It is a long-term quality stock, and it is not going anywhere.

If I didn’t already hold it, I would be looking to buy it. So I’m holding it. I would happily buy it as a long-term investor, I think there is money to be made out of a recovery in stock market activity.

It is your perfect ‘Stock Market Stock’.

The only problem is that the stock market is going nowhere at the moment. It’s a bit like Macquarie Group Ltd (ASX: MQG) on Valium. No rush to buy, but looking to be reasonable buying when the market picks up.

Unbelievably, it’s almost an income stock now. It ranks 108th out of 500 for the least volatile stocks in the All Ordinaries index.

The average broker target price is 12% above the current share price.

Another big oversold stock without a 6% yield

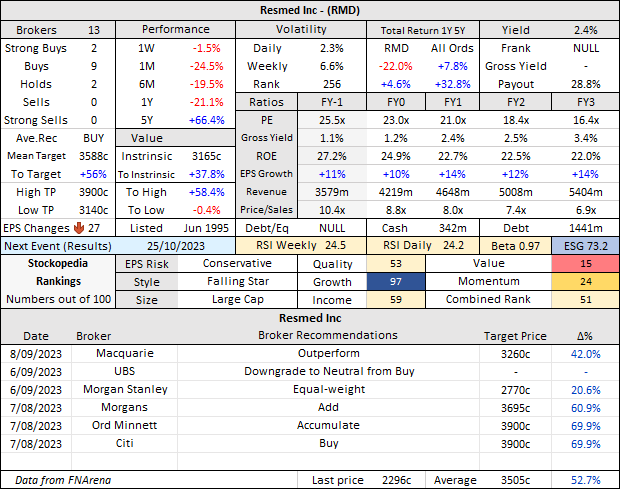

ResMed CDI (ASX: RMD) – Fed up of the RMD drop – surely it’ll have a sharp relief rally at some point.

It is struggling under the prospect of obesity drugs becoming commonplace in the US (let alone the world), although a lot of brokers have already done some significant downgrading, and target prices are still well above the current share price.

It appears to be oversold.

The problem I have is that the PE is still not making it look cheap. The fundamentals aren’t compelling. There is no reason to buy for income. The only attractive part about it is that it is in a sentiment hole, and is technically oversold and due a relief rally (beware of mean regression).

I wouldn’t be buying it until that started. We have already buried ourselves in the Ideas Portfolio, so will hold it for now. It ranks 256th out of 500 for the least volatile stocks in the All Ordinaries index. The average broker target price is 52% above the current share price.

Can so many brokers be so wrong (of course they can)?

A couple of other oversold stocks

Other large stocks oversold on a weekly chart include Alumina Limited (ASX: AWC) and (almost) South32 Ltd (ASX: S32) – both are highly correlated to the aluminium price. You need more than an iron ore price rally to lift stocks like AWC and S32. One day. They are both quality stocks, but are both long-duration trading stocks as well, not buy and hold stocks.

Wait for the bottom.

If the Chinese economy ever took off, or ‘Global Growth’, they would recover. It’s not happening for them at the moment.