The anticipation was beyond high going into NVIDIA’s 2Q 2023 earnings result last week. Artificial Intelligence, or AI, has been the phrase on everyone’s lips in the investment community since the launch of ChatGPT late last year, and stocks set to benefit from the AI boom have seen significant returns this year.

NVIDIA Corp (NASDAQ: NVDA)

NVIDIA Corp (NASDAQ: NVDA) is the poster child for this AI fascination, and its previous earnings announcement generated incredible hype.

Management’s guidance that revenue for the second quarter would be 50% higher than consensus estimates helped propel the stock to more than three times its level at the start of the year, and eclipse the well-publicised trillion-dollar market capitalisation.

What does NVIDIA actually do?

As a quick introduction, NVIDIA produces semiconductors and associated products for the gaming, professional visualisation, data centre and automotive markets.

These products benefit users with high computing demand, such as gamers, designers and scientists. One simple example would be how NVIDIA’s GPUs, or Graphics Processing Units, have replaced CPUs, or Central Processing Units, for high-powered computer simulations, such as those used in flood forecasting.

These GPUs process the simulations in much less time, allowing engineers to run a wider range of scenarios and having information in a more timely manner (which can greatly assist the emergency services).

The main event – summary of the results

With expectations so high going into the results, it’s almost hard to imagine such a blockbuster result – but that’s precisely what happened.

Revenue for the second quarter came in at US$13.5 billion, nearly US$2 billion above the analyst consensus estimate (which un-coincidentally was almost exactly in-line with the guidance of US$11 billion provided last quarter) and a staggering 101.5% above the prior year’s results.

This revenue result included gaming revenue 22% higher year-over-year (YoY) to approximately US$2.5 billion, a 23% decrease in professional visualisation to US$379 million, and an increase in automotive revenue by 15% to US$253 million.

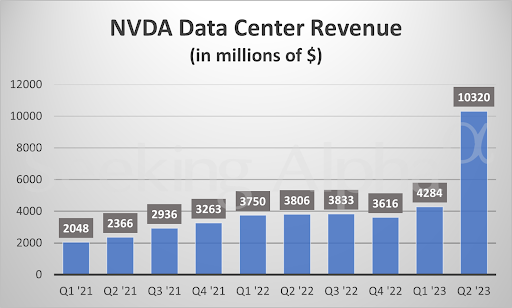

All of these segments were overshadowed, however, by the monster performance of data centre revenue, which rocketed 171% YoY to US$10.3 billion.

Source: SeekingAlpha

Moving further down the income statement, gross margins (adjusted) were 71.2% (above the 70.1% estimate and materially higher than NVIDIA’s numbers over the past decade) and operating leverage saw net income launch 422% to US$6.74 billion (or $2.70 per share).

There really wasn’t anything remotely negative to see in this quarter’s financials.

Guidance for the October (third) quarter was also exceptional. NVIDIA is forecasting revenue of $16 billion, well above the $12.6 billion analyst consensus – which has no doubt risen throughout the year as expectations have risen.

Wedbush Securities analyst Dan Ives called it “guidance heard around the world” and cited “jaw dropping demand.”

No doubt analysts at the major investment banks have been deep in the thesaurus looking for superlatives to describe the incredible result.

What now? and history as a prologue

Investors who have held NVIDIA shares for almost any length of time will be celebrating this result and guidance – and for a good reason.

This was an unquestionably impressive earnings report for a company that has delivered for shareholders for more than a decade and managed to eclipse some truly high expectations.

There’s no doubt that NVIDIA looks well-placed to benefit from a secular trend towards AI and has a highly profitable business model and pristine balance sheet.

Yet it’s often said,

“good companies don’t always make good stocks.”

Despite how impressive a company’s market position, growth and the like, the price an investor pays can have a material impact on the return they eventually receive. The “multiple expansion” that investors benefit from as optimism rises can be an incredible contributor to returns – just ask Shelby Davis, the best known for maximising this benefit through the “Davis Double Play.” (multiple expansion refers to the increase in the price-to-earnings multiple that investors typically use as a benchmark for share market valuations). George Soros is also a notorious beneficiary of riding investor momentum, always preferring to buy into any bubble he recognises.

However, as much as this can benefit investors on the way up, multiple compression can be a cruel mistress as this optimism eventually fades. One of the best examples for this mantra was the so-called “Nifty Fifty.” These were a group of 50 companies that rose to extraordinary heights on the New York Stock Exchange in the early 1970s. They included the likes of Coca-Cola Co (NYSE: KO), Procter & Gamble Co (NYSE: PG), Johnson & Johnson (NYSE: JNJ), Walt Disney Co (NYSE: DIS) and American Express Company (NYSE: AXP). Investors at the time believed that there was no price too high to pay for this group of incredible businesses, such was their respective market strangleholds and growth opportunities.

While amazingly the share prices of several of these businesses continued to perform well over the decades to come, the majority suffered a dramatic fall during the bear market of the 1970s and suffered long-term underperformance versus the market averages.

Always Do the Math

Let’s do some simple math.

Over the long term, we expect NVIDIA to eventually trade at an average P/E multiple as its business becomes more mature and the law-of-large-numbers comes into play.

The long-term average of the share market is approximately 16x (admittedly NVIDIA is a better-than-average company, but eventually growth will slow to the point where it grows at the rate of other large and mature businesses).

Let’s assume that this happens 10 years from now.

Based on NVIDIA’s current market capitalisation of approximately $1.16 trillion, it would need to generate a net profit after tax of approximately $72.5 billion (P/E can be rewritten as market capitalisation divided by net profit after tax) – more than 850% higher than FY23’s $8.4 billion (adjusted) net income and representing a compound annual growth rate of approximately 24%.

This is certainly not an impossible task and the recent quarter’s results show truly impressive progress, but it’s certainly challenging in a capitalist society (it greatly exceeds the “base rate”, the boffins would say).

And remember, this is for the current share price to produce an average P/E multiple in FY33 – that means, an investor today would receive a 0% return. To generate an average market return for investors (let’s assume this would be 10% per year), NVIDIA would need to generate EPS growth of 34% per year for 10 years – a tall order indeed.

What’s an investor to do?

It’s easy to get caught up in the hype of the stock market. Such is the temptation that the great and rational intellect Isaac Newton succumbed to the South Sea Bubble

, even after knowing that it was a mania!

It’s even more difficult when the secular change is real, and the company’s business model is a truly profitable one.

At this stage, it appears too early to tell whether NVIDIA is one of the Nifty Fifty that went on to beat the market over subsequent decades, or one that will fall precipitously over the next few years. It is obvious, however, that there is a huge amount of optimism priced into the shares – even by Wall St standards.

Of the 50 investment analysts covering the stock, 90% rate NVIDIA as a buy (up from 64% at the beginning of 2023) and the only analyst who had previously rated it with a sell or underweight, upgraded to a hold. Consensus indeed!

As Warren Buffett, CEO and Chairman of Berkshire Hathaway Inc Class A (NYSE: BRK.A) once stated,

“be fearful when others are greedy, and greedy when others are fearful.”

This could be such a time for new investors to be fearful. Instead, prospective investors may consider other stocks to benefit from the secular trend in AI, such as Taiwan Semiconductor Manufacturng Co Ltd (TPE: 2330), a recent investment made by Berkshire Hathaway, or Texas Instruments Inc (NASDAQ: TXN), a favourite of Peter Lynch and long-standing survivor of the NIFTY 50 (INDEXNSE: NIFTY_50).