Having high-quality datasets across all 2000 stocks on the ASX means that we can identify opportunities early on in a company’s life cycle by using the filtering tools on Stock Doctor.

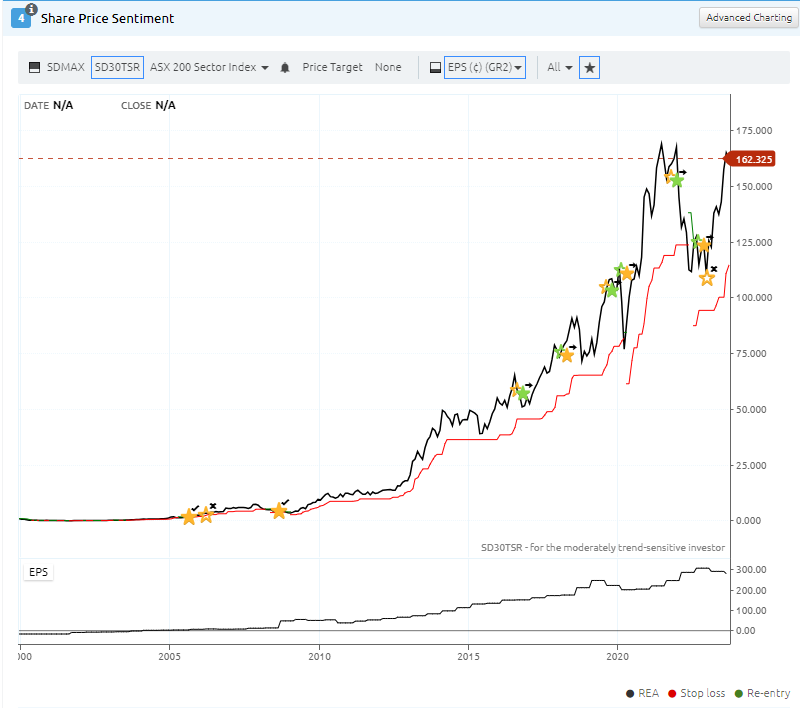

Take for example, Rea Group Ltd (ASX: REA), Stock Doctor first flagged Rea Group back in 2005 when it passed our quantitative filters at $2.27 per share.

Rea Group Ltd (ASX: REA)

Other success stories include CSL Limited (ASX: CSL) in 1996 (yes … Stock Doctor is really that old) and Pro Medicus Limited (ASX: PME) in 2006.

Source: History of REA Star Stock Status at Stock Doctor

There really isn’t a “secret sauce” behind these stories – it is purely a matter of scouring the market for companies displaying solid fundamentals (which we define as our “Golden Rules”), and then allowing these businesses to compound both earnings and cash flows over many, many years.

In fact, we owned and covered REA as a Star Growth stock consecutively from 2008 to 2022 as it continuously passed our quantitative criteria … the only mistake we made was deciding to sell the darn thing last year.

The “Emerging Star Opportunities”

As global economies experience slower growth due to rising interest rates, it can be difficult to find opportunities in the small-cap space – given that they are highly leveraged to the economic cycle.

This means that when growth contracts, small caps typically underperform, and stock selection becomes a greater focus for active investors in an attempt to avoid the laggards and uncover opportunities.

Below, we discuss an interesting emerging opportunity Stock Doctor has highlighted from the FY23 reporting season.

DUG Technology Ltd (ASX: DUG)

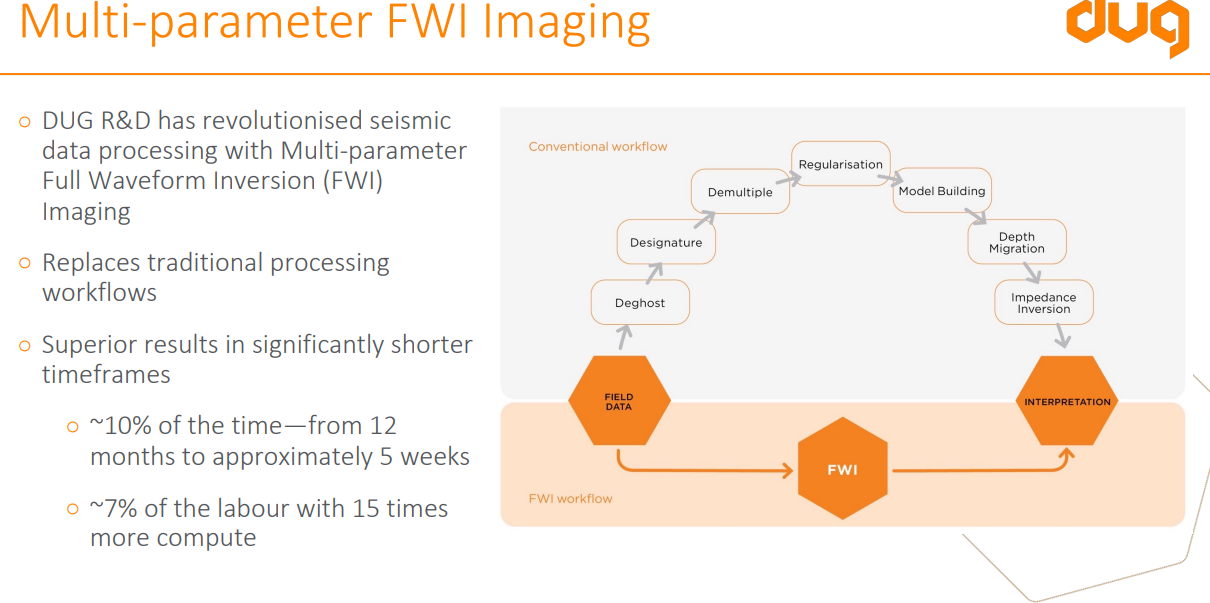

DUG Technology Ltd (ASX: DUG) (or Down Under Geosolutions) has humble beginnings in collating, processing and analyzing seismic data for the offshore oil and gas (O&G) industry.

It may be tricky to understand, but using quantitative estimates of physical parameters such as seismicity can help in identifying the areas to target for offshore O&G exploration.

The company can be highly cyclical and relies on exploration expenditure for hydrocarbons, which is why its share price was heavily impacted in 2022 as clients pulled budgets (and some even went bust) after lower commodity prices experienced during COVID.

The cycle has turned for now, and its recent report emphasized that. Highlights include the following:

- 51% revenue growth to US$50m

- 436% EBITDA growth to US$15m (highly scalable growth!)

- $13m in operating cash flows – which was used to pay down debt and reinvest in growing compute power (which will aid in servicing new contract growth).

Whilst the share price has recovered, we believe that further upside will come if management continues to grow the sales pipeline (currently at US$28m) and demonstrate continued commercial success in its multi-parameter full waveform inversion (MP-FWI) technology – which we won’t even attempt to explain as we’re not geophysicists!

The key point is that it could reduce workflow times by 90% and complete servicing contracts with ~7% of the labour.

Truly a game-changer.

Dug has been offering commercial trials at low cost to prove itself to large clients, which may lead to positive news flow within the next 6 months.