In this article, I pull apart 2 top ASX lithium shares we would buy now. Here goes…

Reporting season has come and gone, and we’re sharing our key takeaways within the lithium sector.

Record profits from the likes of Pilbara Minerals Ltd (ASX: PLS) and IGO Ltd (ASX: IGO) led to mountains of cash sitting on balance sheets, and outsized dividends returned to shareholders.

However, with lithium prices moderating, we’re unlikely to see the whopping cash margins generated by these companies (over 85% in FY23) going forward.

Which shares we’d buy now

Allkem Ltd (ASX: AKE) had a stand-out result as their lithium brine project (“Olaroz”) began commissioning its Stage 2 development – driving production 30% higher year on year to 16.7 thousand tonnes (kt) of lithium carbonate.

Allkem Ltd (ASX: AKE) share price

The increase in Allkem’s production coincided with higher prices, and the asset was able to deliver a staggering 89% operating cash margin.

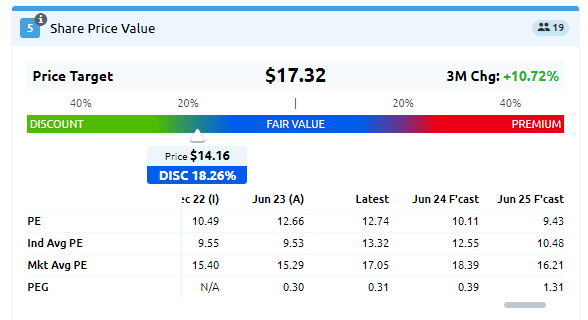

With multiple growth projects on the cards and a proposed merger with US peer Livent Corp (NYSE: LTHM), we believe AKE shares appear undervalued relative to its production growth profile, and re-rate potential, as the deal will generate operational synergies in Argentina and offer integrated chemical production capabilities.

Source: Consensus valuation of AKE as provided by Stock Doctor

Pilbara (ASX: PLS) share price

Pilbara Minerals has been rewarded for its operational excellence when compared to its peers. Spodumene mining and processing and has proven difficult this reporting season, with peers such as AKE announcing thin-grained mineralisation being lost in recovery at Mt Catlin and Core Lithium Ltd (ASX: CXO) struggling with its unpredictable orebody at Finniss.

Pilbara, on the other hand, has benefitted from greater investment in infrastructure at its world-class Pilgangoora mine which has been able to maintain ~68% lithia recoveries. Recovering the ore from crushing and milling rocks is crucial to a mining company’s profitability.

In essence, the costs incurred in mining, crushing, milling and shipping ore are consistent, so the more metal you can recover and extract, the greater operating leverage a project will experience.

That has been the secret sauce at Pilbara – generating higher recovery than its peers for the same processing costs.

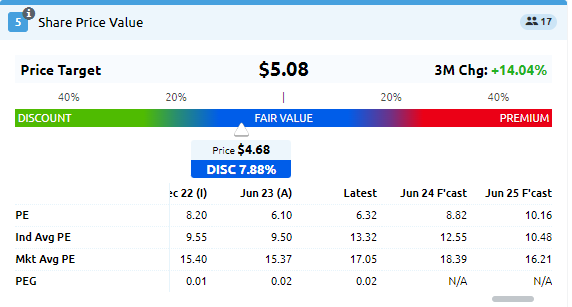

Record cash flows and an upgrade to its mineral resource highlight the quality of the asset – and we’d be happy to pay a slight premium for Pilbara shares for these reasons.

Source: Consensus valuation of AKE as provided by Stock Doctor

Lithium outlook for FY24

Analyst commentary has generally pointed towards lower profits amongst ASX-listed lithium miners in FY24 as the magnitude of price falls is greater than increases in production.

We are watching the lithium space closely, as supply growth continues to disappoint due to cost blowouts, operational issues and government interventions (particularly in Africa).

If electric vehicle (EV) penetration rates continue to rise at current rates, we are likely to see research houses revise their forecasts for EV sales upwards – which could lead to further orders made by automotive original equipment manufacturers (OEMs) and better-than-expected lithium prices.

One thing we can be certain of however is that volatility will continue given the relatively small size of the market.