The GUD Holdings Limited (ASX: GUD) share price might be down today, but recent news of its divestment of Davey Water could be good news for shareholders, writes Stock Doctor’s Daniel Ortisi.

In December 2021, GUD Holdings Limited (ASX: GUD) completed the acquisition of AutoPacific Group (APG) for $775 million.

GUD Holdings Ltd share price

The business performance since then has been disrupted by supply chain issues causing a reduced supply of vehicles in the country, leading APG to miss initial expectations.

Furthermore, GUD has been in an awkward strategic position retaining ownership in a water pump business it has owned since the 1990s, which was clearly out of place amongst its suite of auto-part brands.

GUD’s sale of Davey Water

On the 7th of August, GUD announced the divestment of Davey Water for $64.9 million to Waterco Limited (ASX: WAT). The transaction should settle on the 1st of September, and the funds will be diverted to pay down debt – with management targeting <2x net debt-to-earnings ratio for FY23.

While the elimination of Davey will reduce GUD’s future revenues by ~$120 million (~10% of group revenue), the overall reduction to profit/earnings is minimal at only ~3%. Preliminary FY23 numbers have not been provided by management, but the mention of a targeted leverage ratio does allude to the fact like GUD’s earnings are likely to meet analyst expectations of ~$225m in earnings before interest, tax, depreciation and amortisation (EBITDA) at its upcoming result.

Reducing debt an important step

GUD’s share price has waned since its acquisition of APG in 2021, falling from a high of $12.90. As aforementioned, this is partially due to the supply chain issues impacting the supply of vehicles in the country causing earnings estimates to miss expectations.

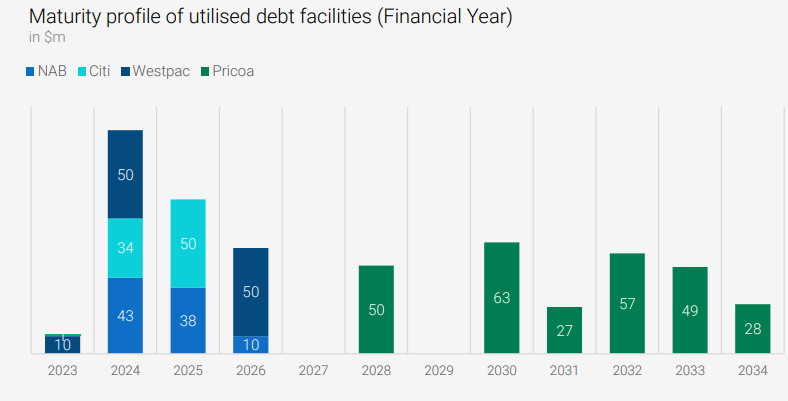

A secondary concern has been the significant amount of leverage on the balance sheet, with ~$474 million in net debt. As such, we believe investors should be pleased with the update providing a much-needed capital injection, particularly as maturities fall due as early as January 2024.

Source: Company presentation; author supplied.

Source: Company presentation; author supplied.

Final thoughts on GUD shares

GUD appears to fly under the radar when compared to its listed peers Super Retail Group Ltd (ASX: SUL), ARB Corporation Ltd (ASX: ARB) and Bapcor Ltd (ASX: BAP), which all own competing brands within the automotive market.

We believe that the GUD share price may benefit from a re-rating by the market if it can prove out the earnings base of its APG acquisition, pay down debt and continue to make value-accretive acquisitions.