The Amcor CDI (ASX: AMC) share price sold off 10% on Wednesday after downgrading guidance. Amcor is a consumer packaging business that operates through flexible (soft plastics) and rigid (hard plastic containers) packaging segments for fast-moving consumer goods.

Amcor guidance downgrade

Announcing its quarterly results to the market, Amcor cut guidance of adjusted EPS and free cash flow ranges to 72-74cps and $US800-900 million, respectively. Lowered guidance now represents FY23 EPS growth of -11% to -8%, down from previous guidance of -4% to +1% EPS growth.

Amcor’s sales in the March quarter stayed relatively flat, edging down -1% to $US3.67 billion, so most of the damage has occurred on the cost side. CEO Ron Delia said market dynamics prompted the company to “take decisive price and cost actions” to recover inflation and cut costs.

Dividend unchanged

Amcor declared a quarterly cash dividend of 12.25 US cents per share, unchanged from the previous quarter and up from 12.00 US cents in the same quarter last year. Dividends have historically grown at 8.5% CAGR since 2003.

The Amcor share price is underpinned by exposure to defensive end markets with 96% of Amcor sales relating to the food and beverage industry and other consumer markets which should not suffer too much in the case of a global recession.

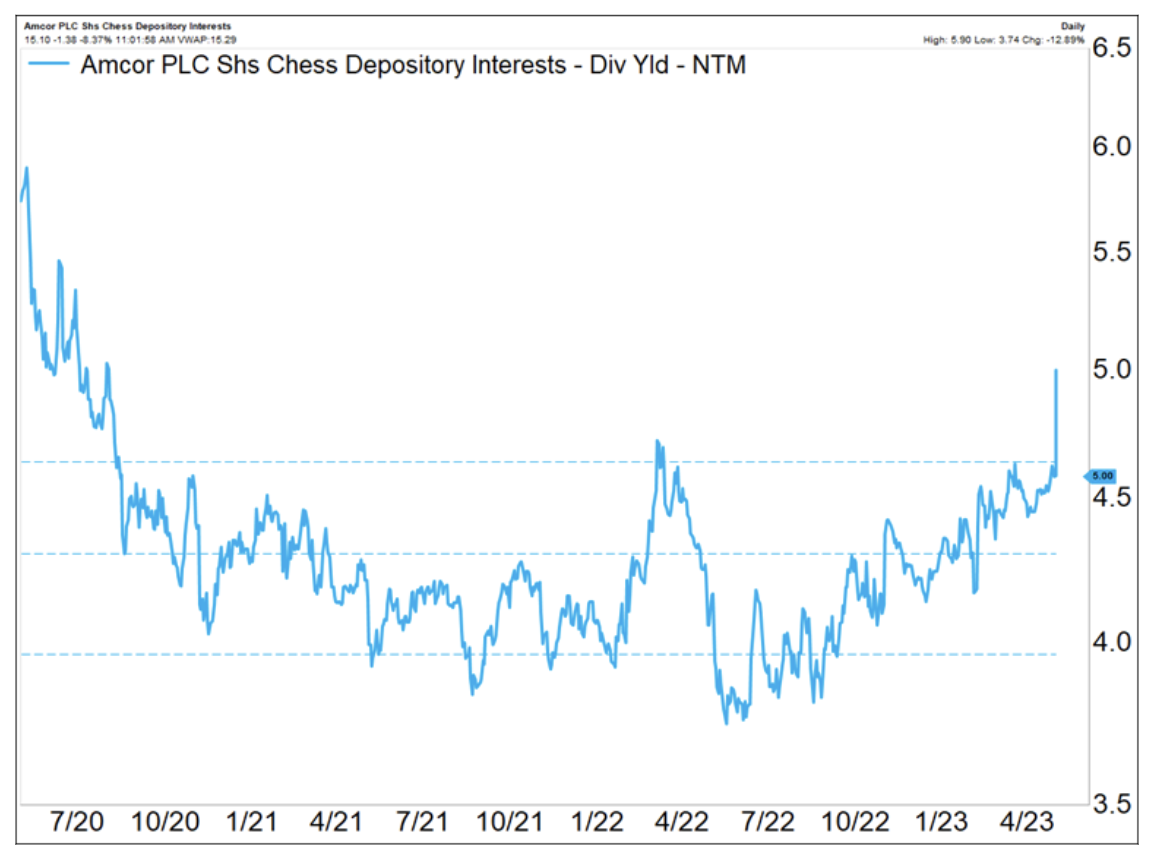

Balance sheet flexibility allows Amcor to reinvest into the business for organic growth, pursue acquisitions and share repurchases/dividends as appropriate. Shares currently yield approximately 5% (unfranked) when looking at forward estimates, which looks high historically speaking.

Amcor: A defensive business

Amcor’s dominant market position should enable price rises to customers, thereby protecting profit margins going into FY24, despite being slow moving so far. We think a ‘buy when others are fearful’ approach works well for these high-quality, defensive, blue-chip ASX businesses.

To put Wednesday’s 10% fall in the AMC share price into perspective, in its 25-year listed history, that’s >9,000 trading days, only 3 times have Amcor shares moved more than 10% in either direction in a single day. Amcor is typically a low-volatility ASX share.

Buy, hold or sell

The Amcor share price is towards the bottom end of its 3-year historical trading range of $15 to $18, so we think Amcor offers reasonable capital upside, with stable earnings and a ~5% dividend yield.