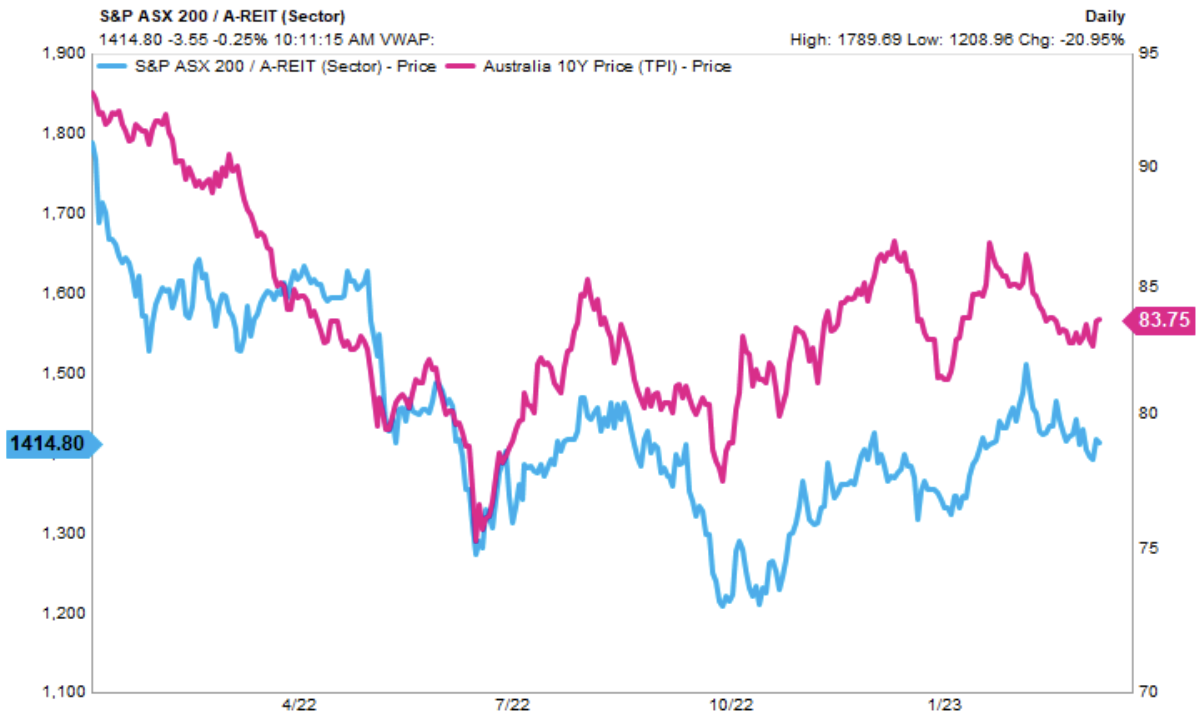

The DEXUS Property Group (ASX: DXS) share price is down ~21% while interest rate expectations and inflation have driven the S&P/ASX 200 Real Estate Sector down ~21% from highs in early 2022.

However, with bond yields moderating (i.e. prices rising) in our view, we see a value opportunity in high-quality office assets.

Return to the office

Our view is the ‘work from home’ thematic appears to be trending back towards increasing hours in the office. No, not back to pre-pandemic levels, but there are some positive signs for office owners.

According to JLL, national office vacancy remains broadly flat at 14.2%. However Melbourne’s CBD fringe lead demand nationally for the second consecutive quarter, with vacancy rates declining to 14.4% (vs 10-year average 10.5%).

imilar CBD-fringe outperformance is observable in parts of Sydney, Perth, and Brisbane with most CBD vacancy upticks impacted by increasing supply, rather than slack demand.

Why Dexus?

Dexus, invests in office and industrial assets and are developing some large and well-known projects around Australia (think Atlassian Centre in Sydney, 80 Collins Street in Melbourne, 240 St Georges Terrace in Perth, 25 Martin Place in Sydney, and more).

Dexus will manage ~ $44 billion in property assets under management, once the acquisition of Collimate Capital completes and also have $17.8 billion of property on the company’s own balance sheet with a pretty attractive and large pipeline of development projects.

Dexus has historically sat above the market occupancy rate due to its high-quality offices in prime locations. At its 1H23 result, DXS maintained high occupancy levels of >95%.

DXS share valuation discount

The market is only valuing Dexus’ assets at ~ 70c in the dollar (meaning its shares trade at a ~30% discount to book value).

There is a risk these valuations are, in part, over-stated, and capitalisation rates have further upside (+14bps in 1H23). But so far most of the impact of high bond yields has been offset through positive rental income growth.

We think DXS shares trade at too large of a discount to net asset value and offer a margin of safety should valuations compress further.

In the short term, upcoming updates on the property funds management division could be a catalyst for the stock to move higher, though we see a real opportunity for long-term holders looking for an attractive entry into a high-quality REIT.

DXS trades on a 12.3x forward price-earnings ratio (P/E), a substantial discount to the historical average of 16x over the last 5 years, and almost the cheapest its been relative to peers.

The stock is changing hands at a ~ 6% sustainable dividend yield. And a ~12% discount to the consensus price target.

Dexus has a conservatively geared balance sheet. Relative to peers, 25.6% gearing provides only modest exposure to the increase in funding costs.

Takeaway for the Dexus share price

We think that at the current discounted share prices, Dexus investors are effectively paying ~$13.5 billion for $17.8 billion of real assets and related investments (basically debt free). Meaning, there is no value ascribed to the funds management business, which could be worth a few billion dollars as a standalone basis.