The BrainChip Holdings Ltd (ASX: BRN) share price launched as high as 14% in morning trade after announcing its second patent in as many months.

Currently, the BrainChip share price is up 7.25% to $1.78.

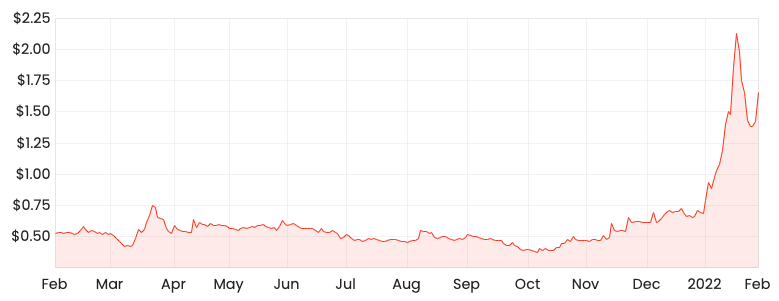

BRN share price

What was announced?

BrainChip released an announcement to the ASX that it has been issued with a US patent for“Method and a System for Creating Dynamic Neural Function Libraries”.

The patent protects BrainChip’s intellectual property against competitors copying or developing similar technology.

Despite rising 114% in 2022, here’s why I’m avoiding BrainChip (ASX: BRN)

It also signifies to potential customers and partners that the technology is the first of its kind.

BrainChip claims to have created a neuromorphic processing chip, which mimics the human brain (hence the name BrainChip) in artificial intelligence applications.

Commenting on the patent, CTO and founder Peter van der Made said:

“Patents are a hallmark of a company, symbolizing the innovation and advantages that differentiate its products and solutions from competitors in the marketplace”

Patent portfolio expansion

US Patent 11,238,342, the name ascribed to today’s patent, provides protection over:

“the basic structure and function of a digital neuron consisting of multiple synapse circuits connected to a soma circuit in analogy to a biological neuron where a soma (i.e. neuron) cell receives its inputs via multiple synapses”

The patent is an extension of past patents US 8,250,011 and US 10,410,117.

BrainChip now has eight US patents registered in addition to one patent in China.

A further 21 patent applications are currently outstanding in the US, Europe, Canada, Japan, Korea, Australia, Brazil, Mexico and Israel.

My take

Generally speaking, companies use patents to protect competitors from stealing their ideas, designs, processes or property.

Today’s patent was actually filed back in 2018, therefore it’s been over three years for BrainChip to get it approved.

Such is the process of achieving ‘ownership’ over a technology.

It signals manufacturing, meaningful revenue and profits may still be years away for a company like Brainchip.

As a result, BrainChip remains incredibly high risk.

Notwithstanding the patent announcements, it still has several hurdles to jump through.

For that reason, I’ll be admiring from the sidelines for now.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.