The close of trade on Thursday marked another down day for ASX tech shares.

The local technology index fell 5.04%. Meanwhile, the broader S&P/ASX 200 (ASX: XJO) settled at a loss of 1.77%.

So what’s going on with ASX tech shares? And when will the bleeding stop?

Joyless January

Today’s market declines have only added to the recent pain of investors.

Popular ASX tech shares under fire during January include:

- Zip Co Ltd (ASX: Z1P), plunging 33%

- Realestate.com.au owner REA Group Limited (ASX: REA), falling 21%

- Family safety app Life360 Inc (ASX: 360), down 27%

- Market darling Xero Limited (ASX: XRO), sliding 29%

The primary reason for the slide in shares, particularly technology, is interest rates.

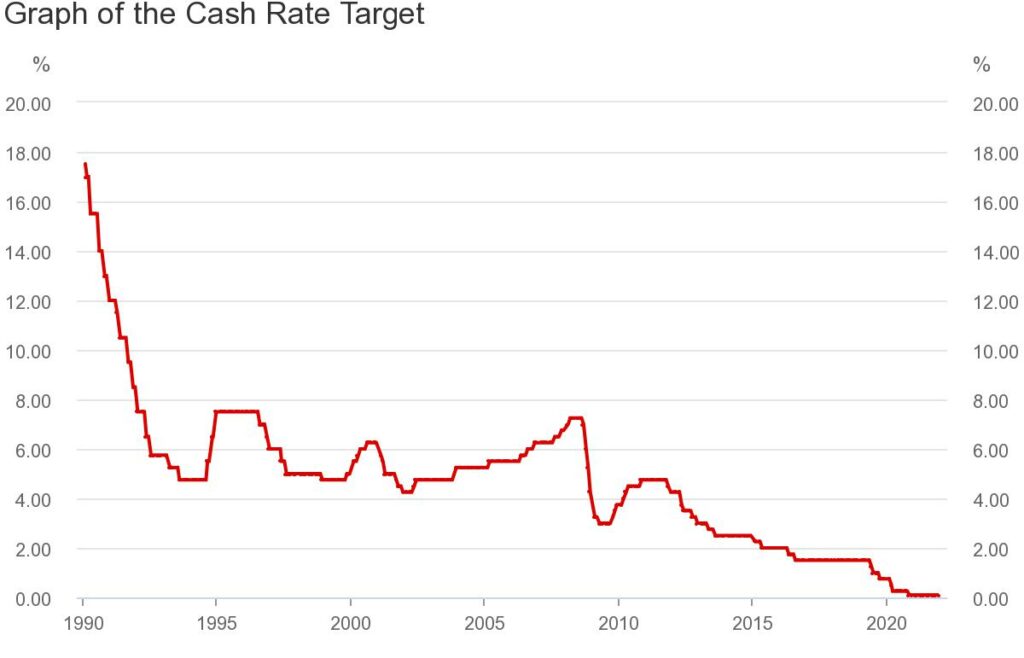

For decades, interest rates have been on a downwards trend.

But the boat looks to be turning around.

Overseas reserve banks such as the US Federal Reserve has indicated it intends to hike rates in March, putting a dampener on share markets including the ASX.

Why increase rates? Inflation.

Inflation in simple terms is the rise in the cost of goods such as petrol, groceries and power.

In the latest quarter, Australia recorded underlying inflation of 2.6%, the highest figure since 2014.

It’s even worse in the US, which recorded a 7% jump in inflation. It’s the biggest jump since 1982.

When inflation runs too high, Australians (and the world) lose purchasing power. You can buy less with the same amount of money.

To pump the brakes on inflation, central banks increase interest rates. It incentivises households and businesses to save rather than spend.

By slowing the purchasing of goods and services, the hope is that inflation will return to normal levels.

So what does that have to do with ASX tech shares?

Valuation 101

The value of a business is the profit generated and returned to shareholders from its activities.

Often with ASX tech shares, profit is yet to be returned to shareholders.

Excess cash is reinvested back into the business to build a customer base or product.

The idea is that profit will be returned in future periods.

When interest rates rise, those future profits are not worth as much.

Why’s that?

Let’s say interest rates are 1%. You can park your money in a bank account and earn a guaranteed return of 1%.

Or you can invest in an ASX tech share and earn 10%.

But let’s say interest rates rise to 5%. Would you still be happy with that 10% tech share return? Or would you want a higher return?

Most likely you’d want a higher return. Or, you’d demand a lower price for that ASX tech share.

That’s what we’re seeing at the moment. Lower prices of ASX tech shares, to compensate for rising interest rates.

When will the bleeding stop?

Your guess is as good as mine.

I have no idea when it will turn around. But market gyrations are the price of entry.

In the long run, I’m confident ASX tech shares will be bigger and better.

In years and decades, the current market blips will be an afterthought.

If you’re looking to learn more about valuations, investing and receive head honcho Owen’s weekly market update, consider signing up for a free Rask account.