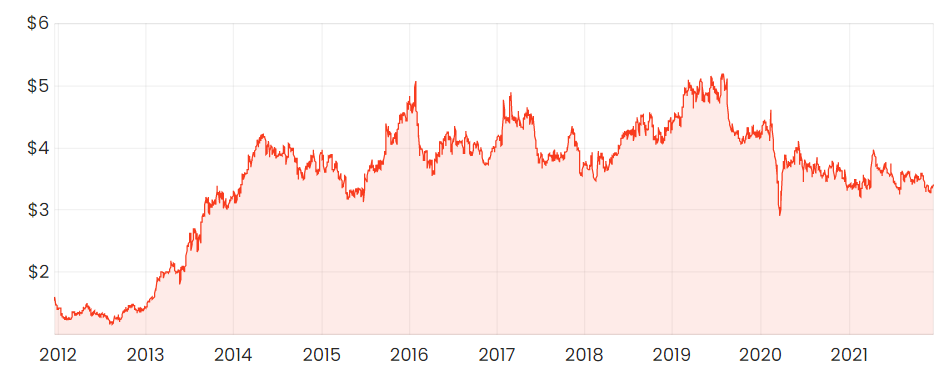

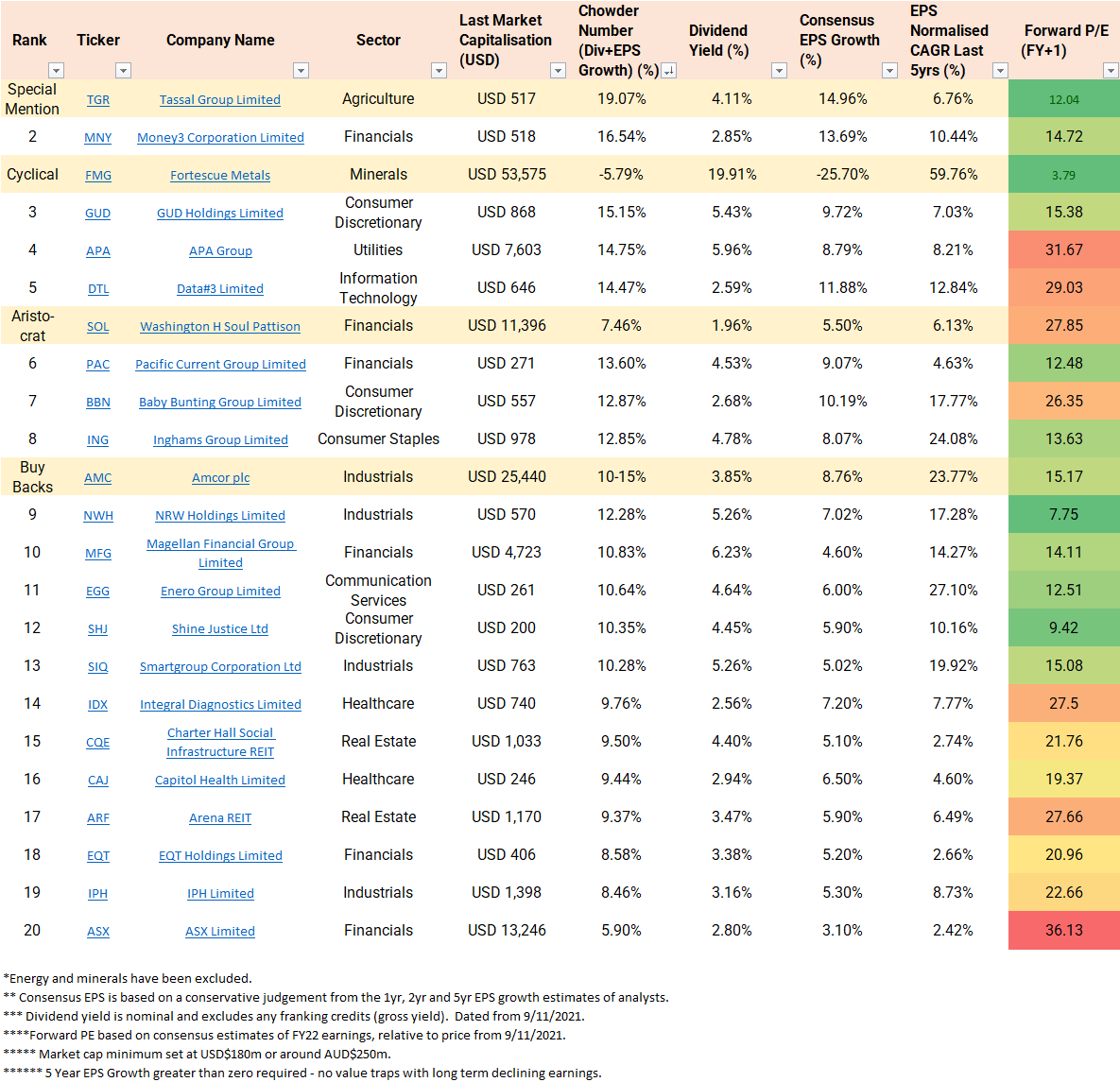

Tassal Group Limited (ASX: TGR) is Australia’s largest aquaculture firm and is a special mention for the dividend growth investor list. Tassal is paying a reasonable 4.11% gross dividend yield. Analysts are predicting 14.96% EPS growth over the next five years, giving a whopping 19.07% Chowder Number.

TGR share price

What does Tassal do?

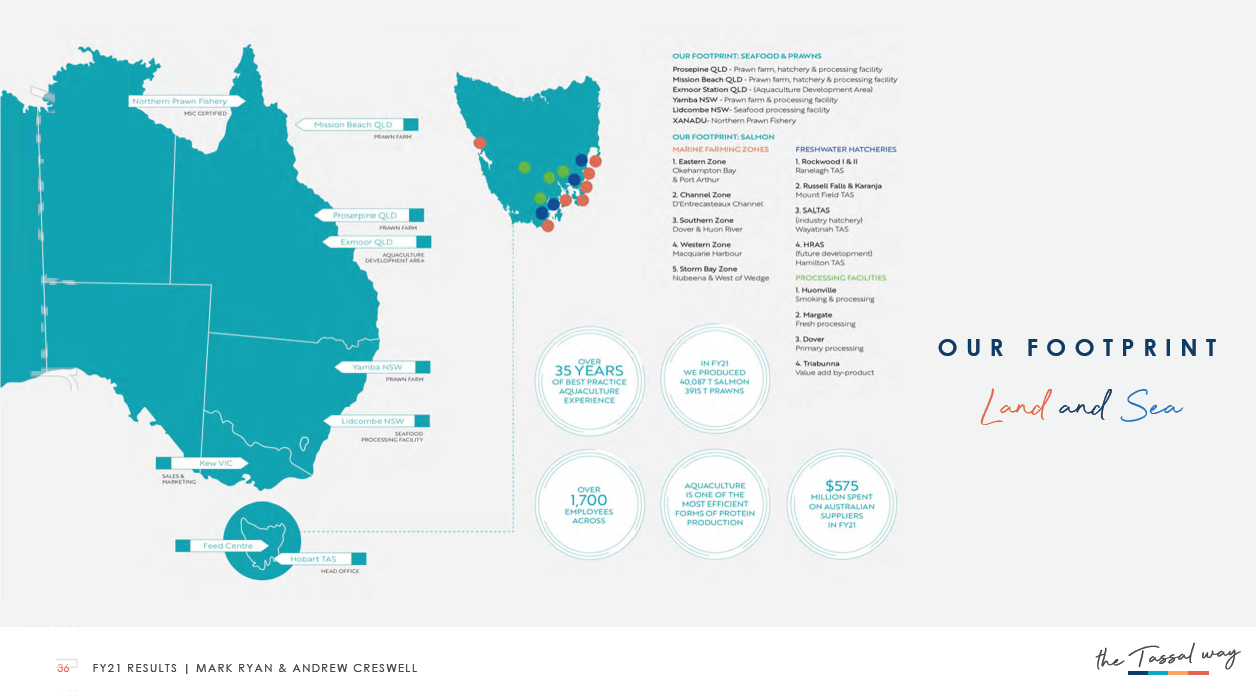

Tassal is a Tasmanian-based aquaculture company that has been listed on the ASX since 2003. It is Australia’s largest producer of Tasmanian-grown Atlantic salmon, competing against Huon (recently acquired by JBS Foods) and Petuna (privately owned).

Tassal acquired De Costi Seafood in 2015 to improve its distribution channels. Shortly after, Tassal acquired Fortune Group in 2018 and black tiger prawns became its second major product.

Tasmanian Atlantic salmon

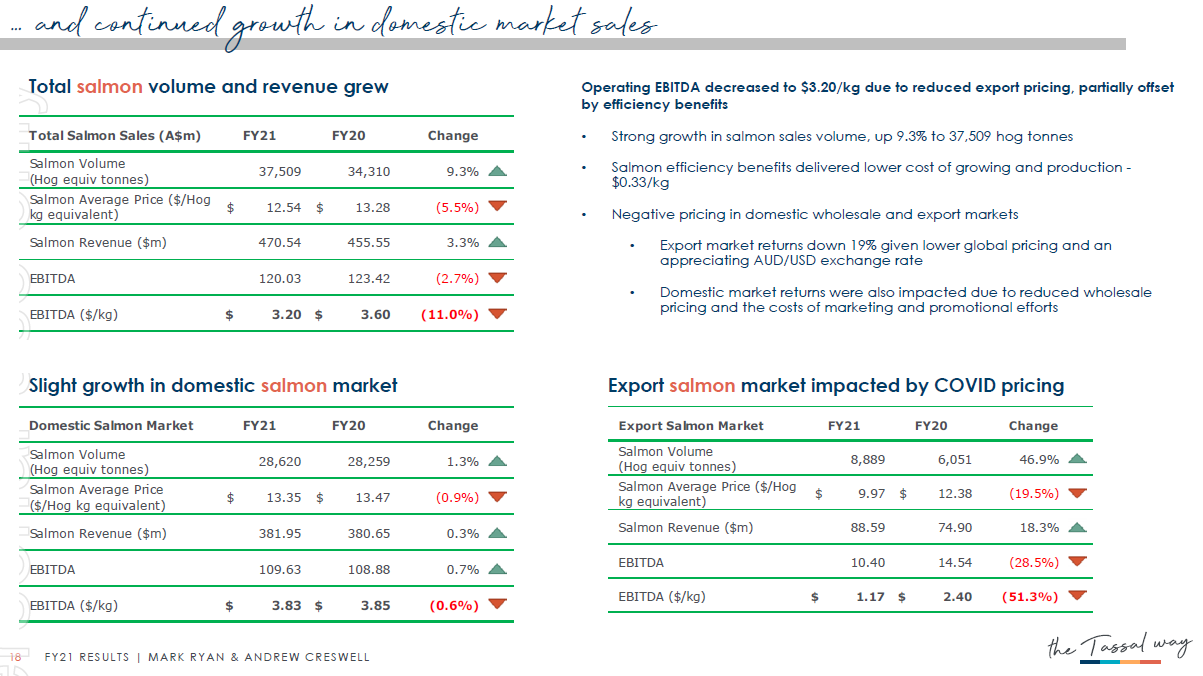

Tassal harvests ~40,000 tonnes of Atlantic salmon per annum, with a target of 45,000 tonnes by 2030. Domestic retail accounts for ~50% of sales. This includes Tassal-branded fresh and smoked salmon, and white-label fresh salmon for the likes of Coles (ASX: COL) and Woolworths (ASX: WOW). These large volume contracts typically have lower margins.

Domestic wholesale (e.g. restaurants) accounts for ~20% of sales and has the highest margins. Exports make up the remainder and has volatile volumes, prices, and margins. Covid has impacted both domestic wholesale and exports, though the outlook for 2022 and beyond is positive.

Australia’s largest prawns

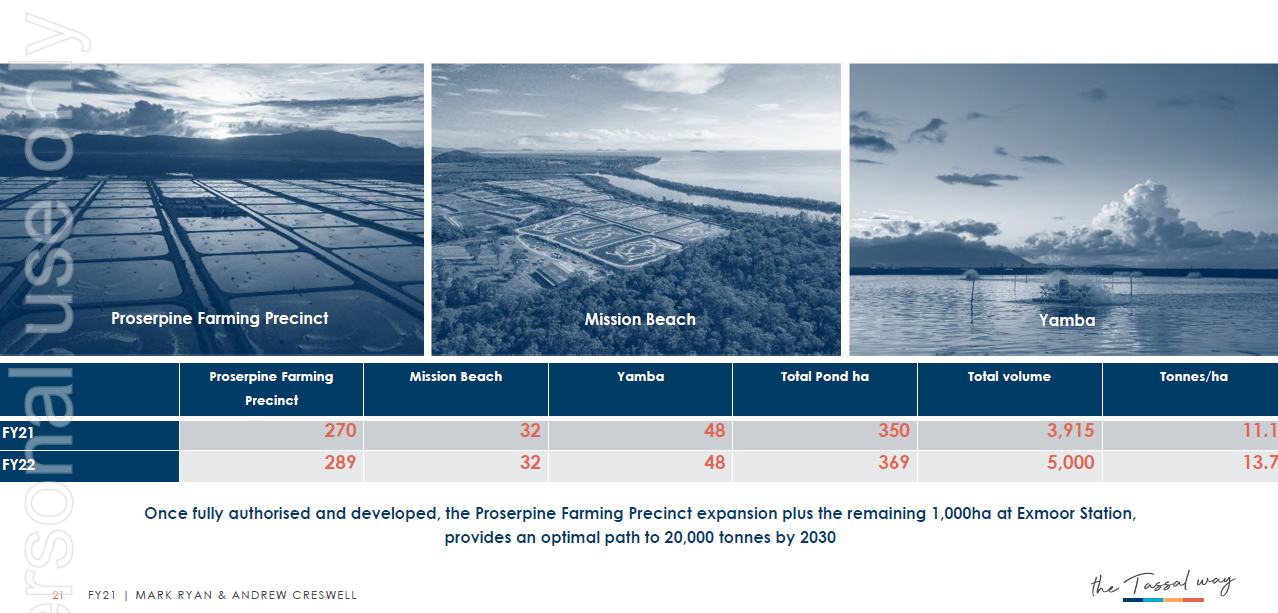

The Black Tiger Prawn is native to Australia and grown on land in reticulated aquacultural systems thanks to CSIRO’s research. This differs from marine-grown salmon, which raises ESG concerns.

Prawns margins are double that of salmon. Volumes have grown from 453 tonnes in FY19 to 3,915 tonnes in FY21. Plans are for 5,000 tonnes in FY22 and 20,000 tonnes by 2030. This looks likely with the capital expenditures mainly in place.

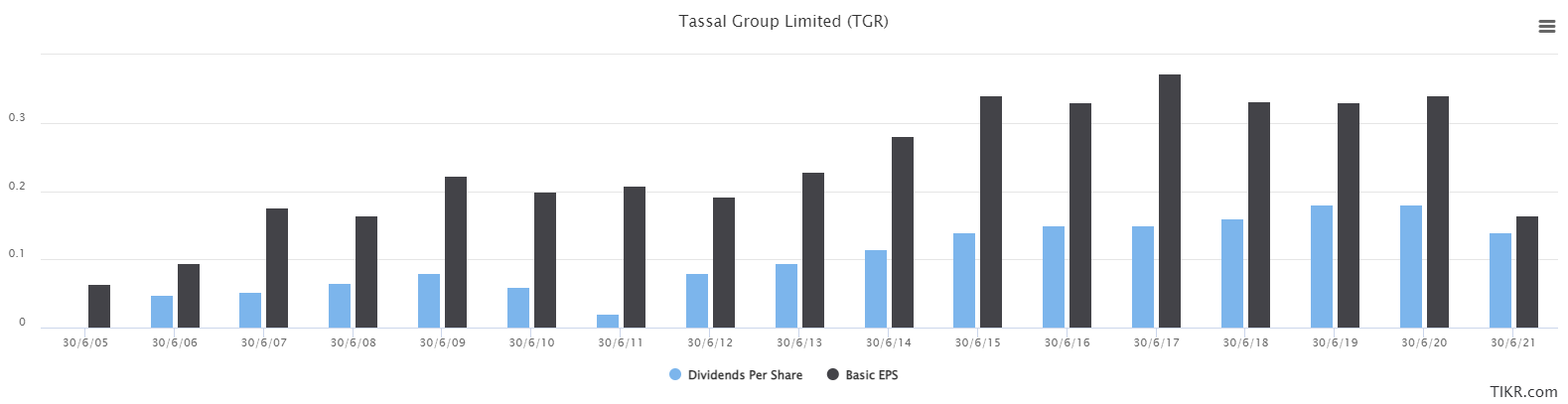

Dividends

Tassal did not make the dividend growth investing screener because earnings were cut in 2021 due to covid. However, looking back over 15 years, the trend has been positive with dividends growing at a 9.87% compound annual growth rate (CAGR) from 2006 to 2020.

Looking to forward returns

Tassal’s salmon business will only grow at 2-3% CAGR, though margins will likely improve in 2022 as conditions return to normal. However, prawns are expected to grow at ~20% CAGR over the next decade – increasing from 10% of EBITDA in 2020 to 50% by 2030.

According to management, the most likely third pillar will be seaweed – specifically, the native asparagospis, which can reduce methane emissions in livestock by up to 60%.

Valuation

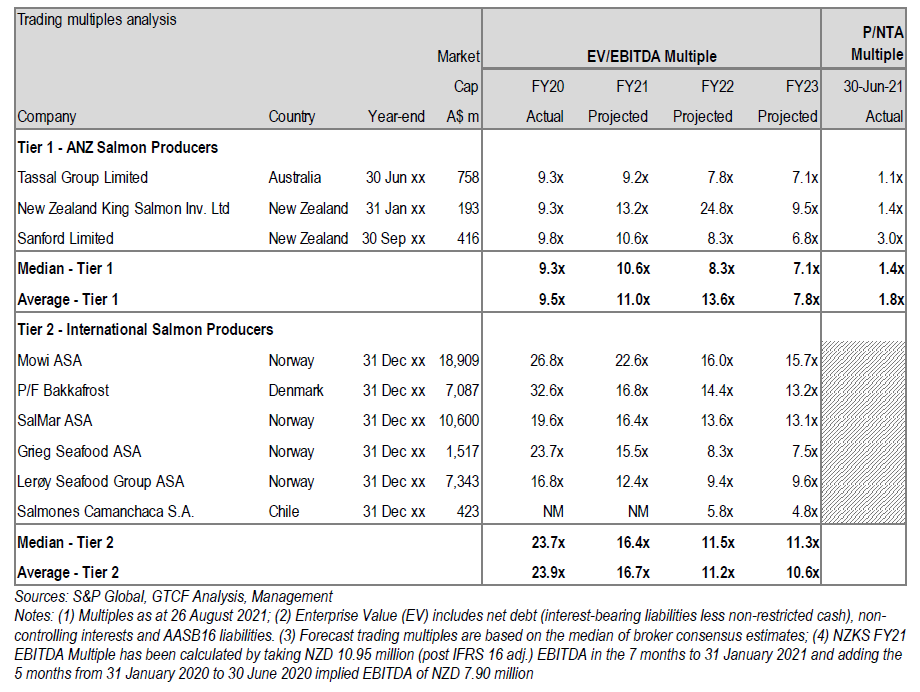

Tassal trades on valuations that are around 40% less than Huon recently sold for. Tassal is on a forward price to earnings of 12 and is optically cheap when compared with international and domestic peers.

Risks

ESG concerns with salmon farming in Tasmania have resulted in threats of boycotts. So far this has not impacted financials but has likely depressed the share price. Investors need to research and decide for themselves if aquaculture is right for them.

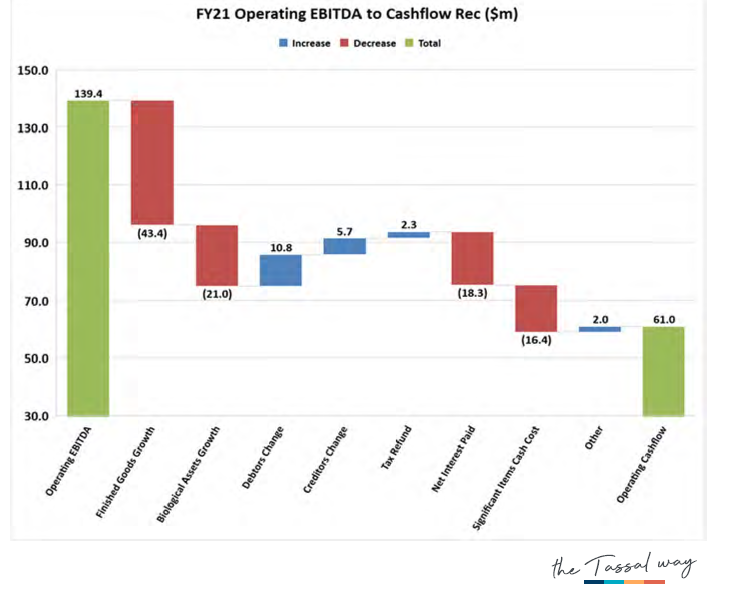

The other risk is the discrepancy between EBITDA and cash flow. Operating profits are being invested in growth capital expenditure, though management expects this will reduce from 2022. This needs to be monitored.

Final thoughts

Aquaculture is a key pillar of global food security and continues to replace wild-caught fish. Despite ESG concerns, Tassal is a leader in a growing industry, paying a good dividend and has a long runway of growth ahead of it.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.