Alternative fund manager Qualitas Limited (ASX: QAL) will begin trading on the ASX tomorrow after the company completed a $735 million initial public offering.

Shares in the company were issued at $2.50 per share in the IPO, valuing the business on a 3% dividend yield.

Fund managers aren’t exactly the hottest commodity at the moment. But here’s why Qualitas might buck the trend and deserve a spot on your watchlist.

A different kind of fund manager

Qualitas is an alternative fund manager in the commercial real estate space (CRE) with $4.2 billion in funds under management (FUM).

It was founded in 2008 by Mark Fischer and Andrew Schwartz.

Both remain key pillars within the company as Global Head of Real Estate and Chief Investment Officer/Managing Director respectively.

The business has 13 funds in total, with five specialising in CRE debt and eight across private equity real estate.

It lends or purchases ownership in a range of CRE assets including:

- Investment properties

- Construction projects

- High-density (apartment, units) dwellings

- Pre-development land

- Built-to-rent projects

It has a specific focus on logistics, manufacturing, staples and convenience retail assets that display defensive income characteristics.

The business also undertakes situational and opportunistic deals in joint ventures, recapitalisation and distressed situations.

In many ways Qualitas is a jack of all trades, looking to secure returns across a spectrum of CRE situations.

Overall, the various funds have performed strongly, with all private equity and private debt investments recording over 10% annual returns for the past 5-years.

No sell down

The business raised $335 million as part of its IPO to fund co-investment in existing and new funds.

Qualitas often uses its own capital to initially purchase a CRE asset, and then later spin that asset off into a fund for external investors to benefit from.

No directors or management sold a single share, indicating strong shareholder alignment.

The rise of alternatives

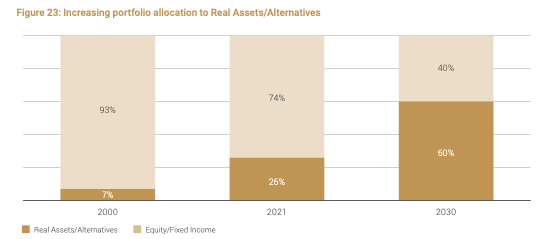

With investors earning zero in term deposits, low returns in bonds and public equity markets at all-time highs, alternative assets have become a growing slice of an investor’s portfolio.

Portfolios on average consist of 26% in alternative assets. This is projected to increase to 60% by 2030.

Alternative lending has also been a particularly fruitful space, as traditional lenders such as the big banks focus principally on mortgages.

Things to keep note

The company currently has a concentrated list of clients. A sovereign fund represents 29% of all FUM while a private bank provides another 25%.

If either were to reduce or pull mandates, FUM would materially suffer.

With all fund managers, the business is linked to its underlying assets. Typically, CRE assets are linked to the economic cycle.

Should a downturn occur, this would materially impact performance.

Finally, the business is priced for growth. It expects a net profit after tax of $15 million in FY22.

On a price-to-earnings ratio, the business is trading 46 times forward earnings.

Final thoughts

The Qualitas IPO is certainly one to keep an eye on.

Management is well aligned, it’s in a growing industry and has performed admirably over the last five years.

For now, I’ll be adding Qualitas to my watchlist and seeing how it fares in its introduction to public life.

If you enjoyed this short 2-minute guide, consider signing up for a free Rask account and accessing our full stock reports.