The childcare operator G8 Education Ltd (ASX: GEM) share price is up 1.10% after the company provided a trading update.

GEM share price

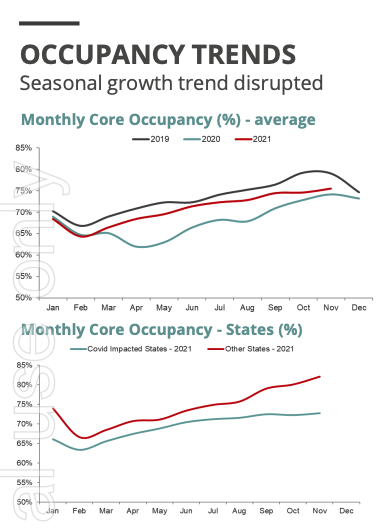

Pandemic continues to impact occupancy

Recent trading has favoured G8 as New South Wales and Victoria emerge from extended lockdowns.

Subsequently, core occupancy is at 76.5%, marginally above 2020 but still 2.1% below 2019.

Regional areas continue to perform better than their urban counterparts.

To illustrate, CBD locations are down 29.6% compared to pre-pandemic levels whereas rural centres have had a 3.1% increase.

From a geographic perspective, the ACT is the most underwhelming state, with occupancy 23.4% below 2019.

Conversely, Western Australia is the strongest performing state with an 8.9% increase over 2019.

Scomo to the rescue

Over the past five months, G8 has had 119 centre closures for an average of 7 days per closure.

Each day a centre is closed, it costs the business approximately $3,300. Therefore, G8 has lost about $2.7 million of revenue.

To offset the lost revenue, the government has supported the sector via fee waivers and additional absence days.

Financial update

For the 11 months of CY21, the company has achieved operating earnings before interest and tax (EBIT explained) of $76 million and net profit after tax (NPAT) of $43 million.

Both figures remain ahead of market expectations.

G8 education runs on a 1 January to 31 December financial year, commonly known as a calendar year.

The company’s debt position remains strong, with $17 million in net debt after wage remediation payments of $38 million.

The business also reported Software-as-a-Service costs that have previously been capitalised will be treated as an expense rather than an asset.

This dampens future profit results but will have no net effect on cash flow.

Dividends are expected to resume this year with the first to be paid next year.

Operational update

The Improvement Plan (IP) has rolled out across 223 centres with a further 138 recently added to the program.

The business has 16 greenfield locations reaching the occupancy hurdle of 80%, with the portfolio recording EBIT of $1.7 million.

Six of these centres will be transferred to the core centre portfolio.

The business opened just 1 new centre in CY21. Positively, it expects to open 13 new centres in CY22.

Initially, these 13 centres will drag EBIT down by $5.5 million, however, it will become more profitable as occupancy increases.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.