The Webjet Limited (ASX: WEB) share price is rising this morning after the business released its first-half results.

Currently, the Webjet share price is up 0.72% to $5.63.

WEB share price

Webjet take off post-lockdowns

Key results achieved for the first half ending 30 September include:

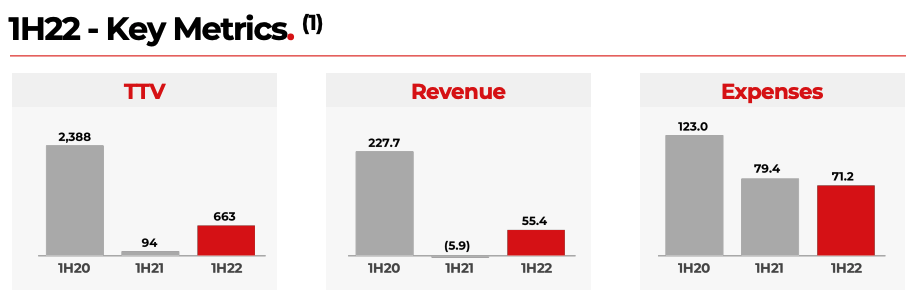

- Total transaction value (TTV) of $663 million

- Revenue of $55.4 million

- EBITDA loss of $38.2 million

- Cash reserves of $446 million

- Deferred interim dividend of 9 cents per share

While the business is still behind pre-pandemic activity, it has improved noticeably in FY21.

TTV is up 6-fold, revenue is now positive and expenses have been slashed.

In fact, Webjet estimates at normalised trading, it will have stripped out 20% of its costs after the business slimmed down over the pandemic.

WebBeds – its accommodation platform for business to business customers – has been profitable since July with volumes up to 63% of pre-pandemic levels.

Domestic activity in North America and Europe have been the key drivers, with more key markets yet to reopen.

Webjet online travel agency (OTA) returned to profitability in October 2021 as border closures in New South Wales and Victoria ease.

Subsequently, the business has delivered a monthly cash surplus of $3.5 million, compared to a $5.5 million cash burn throughout FY21.

This has given management confidence to pay out its deferred dividend from FY20.

In other news, Online Republic – its cars and motorhomes search platform – has been rebranded as GoSee.

More growth ahead

Webjet’s positive first-half momentum is accelerating with third-quarter trading above that of the second quarter.

Management noted that in addition to existing markets coming back online, it has expanded its geographic presence resulting in a bigger growth opportunity than before the pandemic.

Furthermore, as more customers move from in-person travel agents to online, Webjet OTA will be a direct beneficiary.

“Based on our current trajectory of outperforming the market in our WebBeds and Webjet OTA businesses, we believe we will be back at pre-Covid booking volumes by the second half of FY23 – October 2022 to March 2023”

My take

Webjet looks to be on the correct flight path.

I agree with management it will be a better business post the pandemic. But the significant capital raising Webjet undertook to keep the lights on has significantly diluted shareholders.

For more on this, check out why I’m avoiding Webjet and Flight Centre (ASX: FLT) shares.