Writing in absolutes is fraught with danger. But I’m going to go out on a limb and say recent IPO PEXA Group Ltd (ASX: PXA) is the best Australian business on the ASX.

Market darlings such as Pro Medicus Limited (ASX: PME), Xero Limited (ASX: XRO) and Macquarie Group Ltd (ASX: MQG) have better growth prospects abroad.

But from a purely Australian lens, I think PEXA beats even the cream of the ASX crop.

From paper to digital

PEXA is the glue that holds the entire Australian property settlements system together.

Traditionally, property settlements was a cumbersome and painstaking process of manual documents being couriered from office to office.

PEXA digitises this process, through its PEXA Exchange platform.

One central cloud software that now connects conveyancers, financial institutions, the Reserve Bank of Australia, land title and state revenue officers.

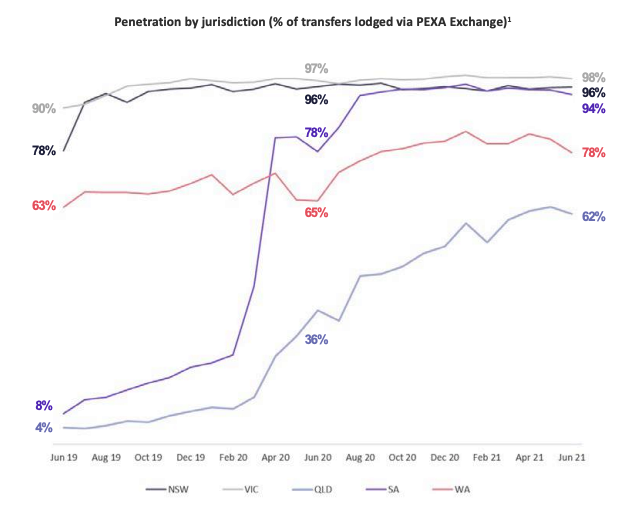

It has a monopoly foothold in New South Wales, Victoria and South Australia. Meanwhile laggards Western Australia and Queensland continue to adopt the software.

A true monopoly

The government effectively created the PEXA monopoly by nudging each state revenue and land office to sign up to the platform.

Subsequently, PEXA doesn’t have any meaningful competition.

Laws to open up the Exchange have been slated by 2023. But at its annual general meeting management, PEXA expressed that the regulator’s timeline is unlikely achievable:

“Notwithstanding, we and the technical experts within the working groups, believe that 2024 is more realistic yet still very challenging”.

As with any monopoly, competition will eventually come knocking. But PEXA’s first-mover and network advantages make it incredibly difficult to displace.

Branching out

As mentioned in the intro, PEXA doesn’t have a significant growth profile abroad like other businesses.

The reason is that it takes a very long time to get every government department, land office and bank to the table and willing to adopt a central system.

Despite this, PEXA is making inroads to use its software abroad in the United Kingdom. However, this remains at a testing stage.

Other growth levers the company is pulling is through PEXA Insights, where it’s providing real property data to industry participants.

Additionally, PEXA Ventures – its investment division – is considering three property-tech solutions to enhance the core Exchange platform.

Accelerating into FY21

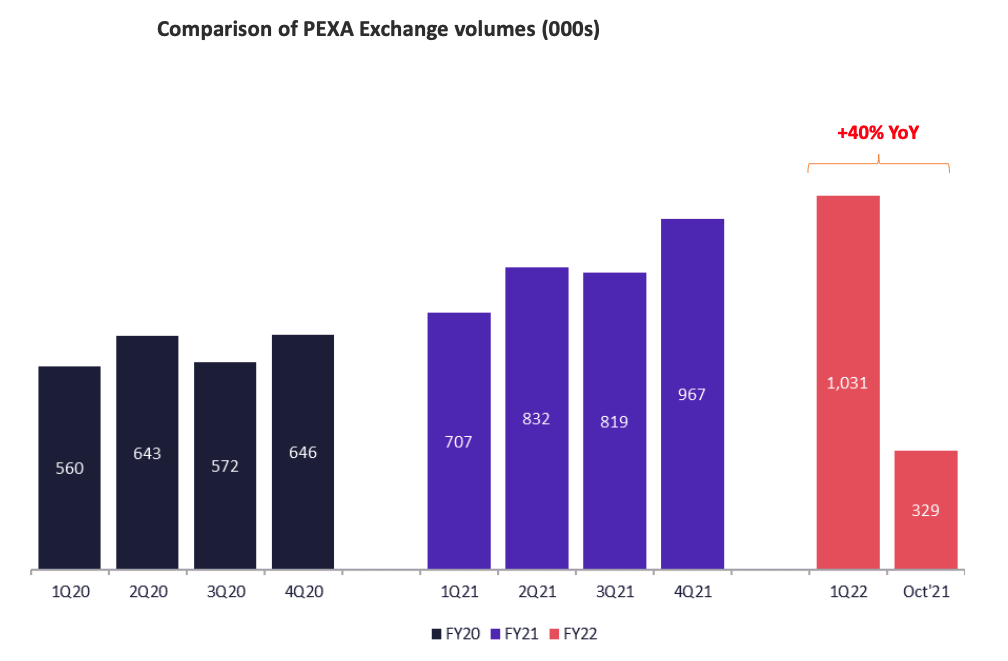

PEXA has made a strong start to its first full year as a publicly listed company, with transactions processed for the first four months up 40% on FY21.

This growth is particularly impressive given the extended lockdown in New South Wales and Victoria over the same period.

Subsequently, the company has reaffirmed its prospectus guidance including:

- Revenue of $246.9 million, up 12% on FY21

- PEXA Exchange EBITDA of $126.3 million, up 14% on FY21

- Group EBITDA of $107.6 million

- Net profit after tax of $19.6 million, after a loss of $5 million in FY21

Final thoughts

PEXA is by no means a cheap company, trading on an EBITDA multiple above 24. But I think the valuation is justified given its monopoly foothold on digital settlements.

On any market pullback, I’ll definitely be looking to add PEXA to my portfolio.