The Australia and New Zealand Banking Group Ltd (ASX: ANZ) share price is currently at pre-pandemic levels. Will the ANZ share price continue to climb on the shoulders of the buy-now-pay-later (BNPL) sector?

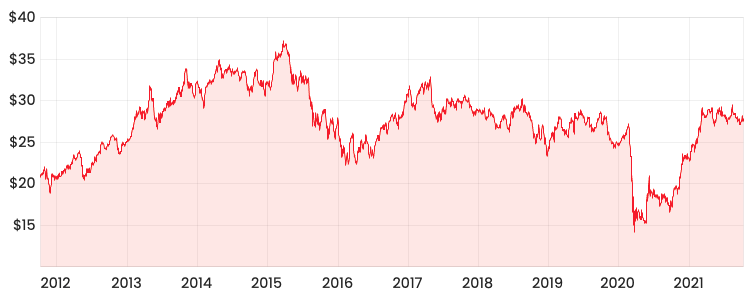

ANZ share price

Can’t beat them? Join them!

The big 4 bank finally listened to its customers and gone full circle in joining the BNPL fad in a deal with Visa Inc (NYSE: V).

As reported in the Australian Financial Review, ANZ’s chief executive Shayne Elliott viewed BNPL in a negative light, criticising the likes of Afterpay Ltd (ASX: APT) and Zip Co (ASX: Z1P) for “regulatory arbitrage”.

Now existing customers are able to pay credit card repayments via instalments but will only be able to use this feature at merchants using Quest payment services.

In saying this, ANZ believes other “merchant acquirers”, including other major banks and Tyro (ASX: TYR) will succumb to pressure from merchants.

How is it different to the pure BNPL players?

Well, Afterpay breaks down instalments into four repayments whereas ANZ will be offering its customers to select either three to six-month terms.

The stats don’t lie

The Reserve Bank of Australia released data on Thursday showing national credit card debt on personal cards had fallen to $18.3 billion, the lowest level since January 2004.

This is a very strong signal that customers are looking to strip debt and BNPL services provide that flexibility.

So, it’s no surprise that ANZ’s rival Commonwealth Bank of Australia (ASX: CBA) released its StepPay offering last month.

My take on ANZ

The banking business has been built on what customers need.

Most people need to open a bank account, obtain a home loan or use a credit card.

The growing trend of customers adopting BNPL services has left ANZ with no choice but to follow suit, otherwise, it’ll get left behind the rest of the pack

Although ANZ’s response has lagged behind others, investors should take comfort that it’s bit the bullet.

One way to value ANZ is using a dividend discount model, which Owen Raszkiewicz explains in detail.