The price you pay for a share of a company can largely determine the sort of returns you can expect over the course of your investment. Here are two quality ASX shares that come with an expensive price tag.

Pro Medicus

Health imaging company Pro Medicus Limited (ASX: PME) has been the gift that just keeps on giving. Its recent FY21 results were well received by the market, which revealed double-digit revenue growth on the back of high-value contract wins.

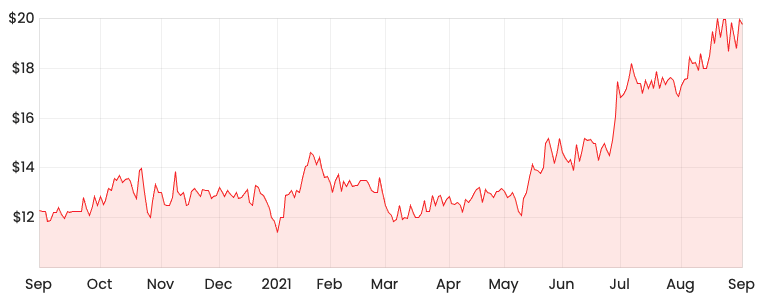

PME share price

The capital-light nature of the business means it can boast huge EBIT margins of over 60%. It’s profitable, debt-free, pays a dividend, and seems to still have a large growth runway ahead of it.

Business quality isn’t in question here, but its valuation on the other hand is worth taking a look at.

With a market cap of over $6.2 billion today, that puts its shares at over 190x its latest underlying earnings – well and truly into nosebleed territory.

Most of the shareholder returns over the past few months have been the result of this multiple expanding rather than underlying earnings growth. So in other words, the valuation growth is outpacing its profit growth.

Objective Corporation

Another expensive-looking ASX share is software company Objective Corporation Limited (ASX: OCL). Its shares are up a huge 61% over the past six months.

OCL share price

Objective Corp has a suite of products that streamline efficiencies across bureaucratic activities.

In its recent FY21 results, it revealed that net profit after tax had surged 46% to $16.1 million.

With its $1.8 billion market cap, this puts its shares on around 117x FY21 earnings, also not exactly in bargain territory.

Having said that, it’s generating around $74 million in annualised recurring revenue (ARR). If you decide to value its shares against this metric, it seems much more sensible at around 25x ARR.

Similar to Pro Medicus, shareholder returns have largely been the result of the market being willing to pay more for every dollar of earnings. This isn’t necessarily a bad thing, but I’d personally like to see some more evidence of the business growing that could potentially justify its valuation.