Recent IPO Cobram Estate Olives Ltd (ASX: CBO) share price is unmoved today despite the company reporting robust FY21 results.

How did Cobram perform in FY21?

Key financial highlights for the year ending 30 June 2021 include:

- Sales revenue of $140.0 million, remaining on par with FY20

- Earnings before interest, tax, depreciation and amortisation (EBITDA) of $70.3 million, up from a loss of $19.7 million in FY20

- Net profit before tax of $32.6 million, up from a loss of $32.7 million in FY20

- Cash generated from operations of $22.1 million, up 70%

The strong performance was the result of positive sales growth in its core Australian operations in addition to its growing US activities.

Some of these gains were offset by a negative EBITDA contribution of $5.3 million by the Wellness division, which struggled to grow sales because of pandemic related headwinds.

Positively, the company achieved prospectus guidance across EBITDA figures and cash from operations. However, it missed on sales revenue and net profit forecasts.

Why is EBITDA, profit and cash up by so much?

It can be a little tricky analysing Cobram’s results due to the 2-year harvest cycle skewing annual results.

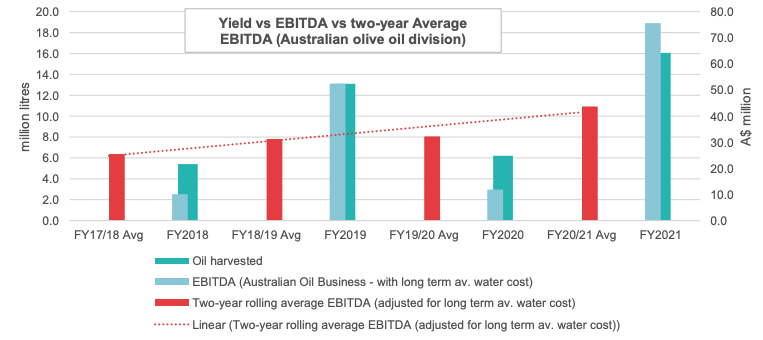

The business experiences a high-yield year and then a subsequent low-yield year due to the seasonality of grapes. As a result, EBITDA fluctuates year on year (seen in blue).

FY21 was a high-yield year and thus resulted in strong financial performance. Conversely, FY20 was a low-yield year that reported not so strong numbers.

To smooth out these fluctuations, the business provides EBITDA numbers on a rolling two-year average (in red). This better represents the underlying earnings of the business.

Cobram recorded a rolling two-year average EBITDA for its Australian operations of $43.7 million, up 36% from FY20.

What’s next for the Cobram share price?

Management is expecting sales to increase in FY22 as consumer demand for high-quality extra virgin oil grows.

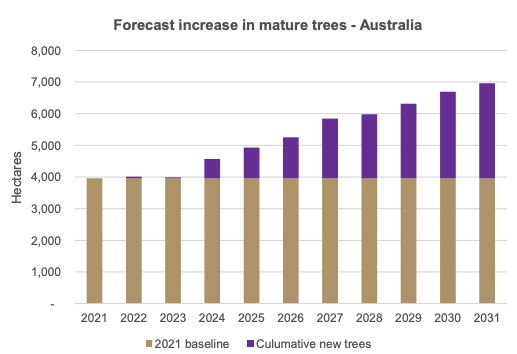

Similarly, the two-year rolling average EBITDA is expected to keep increasing as its grove profile matures.

For reference, 39% of the total Australian planting are not fully mature therefore providing a long growth runway.

My take

Overall, this was a solid result by Cobram Estates.

The company is making inroads into the United States and Wellness division is narrowing its EBITDA loss.

Moreover, the Australian operations remain robust with a lot of growth left to go.

Since debuting in August, the Cobram Estates share price has hovered around the $2.00 mark.

Today’s result was largely in line with the prospectus therefore the muted share price was expected.

Management now faces the tough task of continuing to communicate the two-year olive cycle as the company enters a low-yield production year in FY22.

This will likely result in an ugly FY22 performance, however should not be lost amongst the more important rolling two-year EBITDA cycle.