Lotteries retailer and platform provider Jumbo Interactive Ltd (ASX: JIN) has seen its share price drop 10% today despite growing profits in FY21.

How did Jumbo perform in FY21?

Key financial results for the year ending June 3030 2021 include:

- Total transaction value (TTV) of $487.0 million, rising 37%

- Revenue of $83.3 million, increasing 17%

- Underlying earnings before interest, tax, depreciation and amortisation of $48.9 million, up 13%

- Underlying net profit after tax of $28.3 million, up 7%

- Free cash flow of $28.6 million

- Final fully franked dividend of 18.5 cents per share, total FY21 dividends of 36.5 cents per share

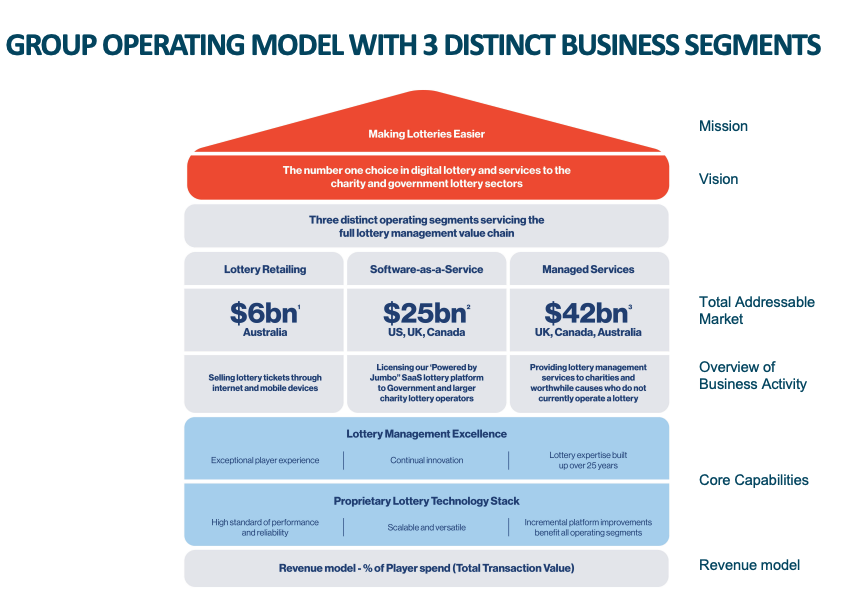

Across its three divisions – lottery retailing, software-as-a-service (SaaS) and managed services, Jumbo recorded growth.

Despite lower average jackpots and few large jackpots, lottery retailing recorded a 15% jump in TTV and a 17.1% jump in revenue.

The nascent SaaS division achieved a record TTV of $104.8 million, up from just $8.7 million FY20 due to several clients going live on the platform.

Jumbo’s smallest segment, managed services, performed admirably with TTV and revenue more than doubling.

The relatively smaller growth in EBITDA was attributed to the newly introduced 1.5% service fee payable to Tabcorp Holdings Limited (ASX: TAH).

Similarly, the lower growth in net profit stemmed from the high amortisation of the Tabcorp services contract.

Acquisition of Stride

Jumbo also announced the acquisition of Canadian-based Stride for $11.7 million.

Similar to Jumbo, Stride provides lottery services for charities.

The company is forecasting to generate $6.5 million of revenue and $2.5 million in profit before tax (PBT).

Where next for the Jumbo share price?

The company did not provide explicit guidance.

However, management believes in the long-term growth opportunities for lotteries globally for which Jumbo should benefit from.

CEO Mike Veverka said:

“FY21 has been a milestone year for Jumbo, as we implemented a new operating model, improved our governance structure and moved from one to three operating segments. The global digital lottery industry shows no signs of slowing down and we will continue to invest in the business to ensure we are ready to capitalise on the medium to long term growth opportunities that lie ahead”.

My take

Overall, I thought it was a great result.

Jumbo shares were up over 30% this time last year. Therefore the 10% fall today still equates to a 17% increase in share price for 2021.

The fact that no concrete guidance was provided likely spooked the market given the lofty valuation Jumbo currently trades on (35x earnings).

I’ll be having a closer look after reporting season to get a better read on the Jumbo share price.

If you’re interested in learning how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.