The rise in iron ore prices has propelled BHP Group Ltd (ASX: BHP) and Fortescue Metals Group Limited (ASX: FMG) shares upwards.

However, a 25% increase in export charges will leave a sour taste in BHP and Fortescue shares.

BHP share price

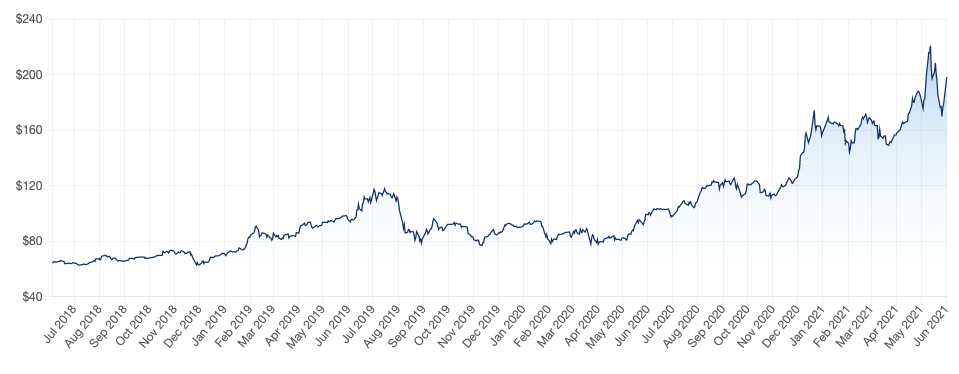

FMG share price

Iron ore boom

Iron ore is Australia’s single largest export and BHP is the second largest exporter with Fortescue behind in third place.

The price of iron ore is hovering around all-time highs as seen below.

This has been driven by a drop in supply and higher demand.

The fall in supply was mainly driven by the adverse impact of a dam collapse and COVID on Brazil, which is the second-biggest exporter of iron ore in the world.

As a result, Australia has come in Steven Bradbury-like by becoming the only substantial supplier of the key steel-making ingredient.

WA government lifts royalties

Whilst BHP and Fortescue continue to ride the macroeconomic tailwinds, the West Australian government has decided to ride on their coattails.

The WA government has increased the export charges by 25% at Port Hedland. This will apply to every tonne of iron ore shipped.

According to the Australian Financial Review, the Port Hedland Industries Council was not consulted about this fee hike.

BHP and Fortescue are members of this industries council.

What now for BHP and Fortescue

The aforementioned events like natural disasters and the pandemic illustrate how influential these external forces have on the fortunes of iron ore companies.

So, I think it’s important for investors to consider what external risks are being considered by BHP and Fortescue.

It’s quite possible for Aussie iron ore companies to suffer similar fates.

As you can see, BHP and Fortescue are quite cyclical and dictated by market forces. I would prefer to find businesses that have the potential to build a wide moat and raise prices.

If you are on the hunt for small-cap ASX shares, you may want to check out the Rask Rockets Beyond program.