EROAD Ltd (ASX: ERD) creates technology hardware and software solutions to manage vehicle fleets, ensure regulatory compliance, improve driver safety and reduce costs.

Originally listed on the New Zealand stock exchange in 2014, EROAD opted to pursue a dual-listing on the Australian stock exchange in September 2020. The company raised $53 million to strengthen its balance sheet and pursue potential acquisitions.

While software for truck fleets isn’t the most trendy investment, I believe the business is well-positioned to capitalise in its three key growth markets of New Zealand, North America and Australia.

Secular tailwinds

The shift to electric vehicles and improvements in fuel efficiency is great for the environment however not for government budgets. Most governments charge fuel taxes to pay for roads and infrastructure. For example, in Australia, a fuel excise tax of $0.427 cents per litre is charged. This tax is estimated to contribute $49.36 billion to the federal budget over the next four years. As petrol-powered vehicles reduce, so will the associated tax revenue. In order to supplement the lost tax revenue, governments are turning to road-use based charging where EROAD’s solutions can assist.

While it may seem archaic, many truck fleet operators use manual timesheets or spreadsheets to keep track of driver and vehicle movements. The industry is undergoing a digital transformation, where EROAD’s products not only reduce administration but provide actionable insights such as notifications for maintenance.

Moreover, using telematics solutions such as EROAD improves safety outcomes. Its expected in the medium-term, electronic logbooks will be mandated in Australia and New Zealand to monitor and subsequently reduce driver fatigue. In North America, many insurers mandate video telematics in each vehicle in order to offer fair premiums.

Quality and prudent management

Steven Newman is the current Chief Executive Officer (CEO). He previously co-founded Navman where he held the roles of CEO and Chief Operating Officer. He holds 13,067,936 shares equal to about 16% of the company, making him well aligned with fellow investors.

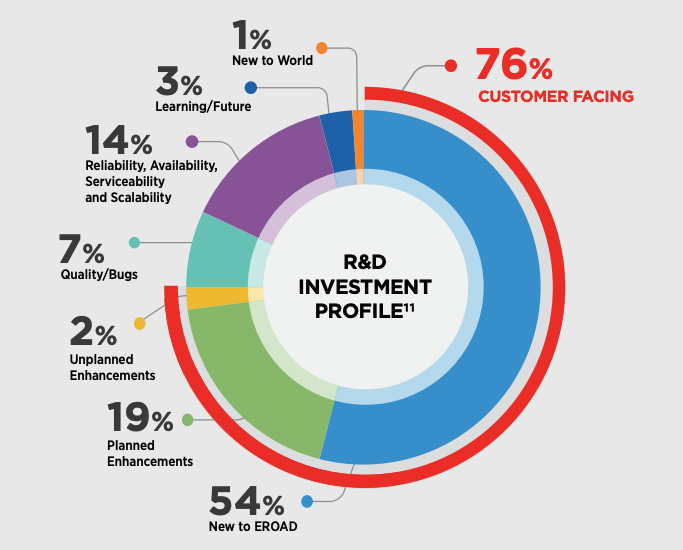

Management is transparent regarding growth aspirations and building shareholder wealth. Approximately 24-27% of revenue is spent on research and development to create new and improved products. The company could be more profitable, however, management is reinvesting back into the business to expand market share.

From an outsiders perspective, the company seems to have a positive workplace culture with a 4.1 out of 5 rating as per Glassdoor. Reinforcing this point was the management’s decision to “retain talent and keep the business whole” rather than offering redundancies when sales growth stalled due to COVID-19.

Attractive business model

A customer will opt to either purchase or rent EROAD’s hardware to install in its vehicles. Then EROAD will charge a monthly software fee to access the fleet through the cloud. The standard contract length is 36 months after an initial trial period.

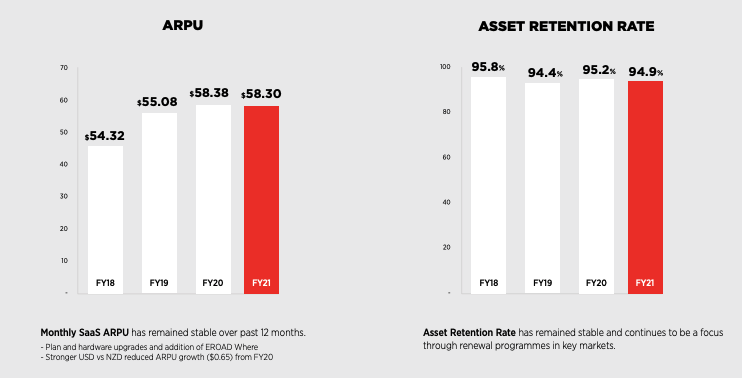

EROAD’s customers display high customer loyalty illustrated by the 94.9% asset retention rate. The product offering of hardware and software is extremely sticky once customers have implemented EROAD across its backend systems. Additionally, EROAD is able to upsell products to customers. For example, a customer using EROAD Fleet Maintenance may complement this with a subscription to EROAD Fuel Management or EROAD Idle Reports.

Final thoughts

EROAD has suffered during COVID-19 with the inability to visit existing and potential customers due to lockdowns. As economies reopen, the business should return to double-digit sales growth. Management noted a strong pipeline of enterprise customers in North America, in addition to returning to pre-pandemic growth of at least 9,000 units per annum in New Zealand. While still in its infancy, Australia has an enterprise pipeline of between 15,000 and 20,000 committed vehicles over the medium term.

Moreover, with $57 million in cash, the business is well capitalised to acquire any competitors or new technology.

With structural tailwinds, strong management and attractive economics, I think EROAD is one to keep an eye on in 2021.

For more ASX growth shares ideas, here is my latest report on Australian Ethical Investment Limited (ASX: AEF).