Despite the recent sell-off in the tech sector, cloud-based accounting software company Xero Limited (ASX: XRO) hasn’t fared too badly.

Xero’s shares were up 2.25% yesterday, presumably due to anticipation surrounding its FY21 results, which will be revealed to the market today.

Since last month, Xero’s shares have only fallen by around 7-8%, which isn’t too bad compared to some of the other tech-heavy names such as Afterpay Ltd (ASX: APT), Zip Co Limited (ASX: Z1P), Altium Limited (ASX: ALU) and Appen Ltd (ASX: APX).

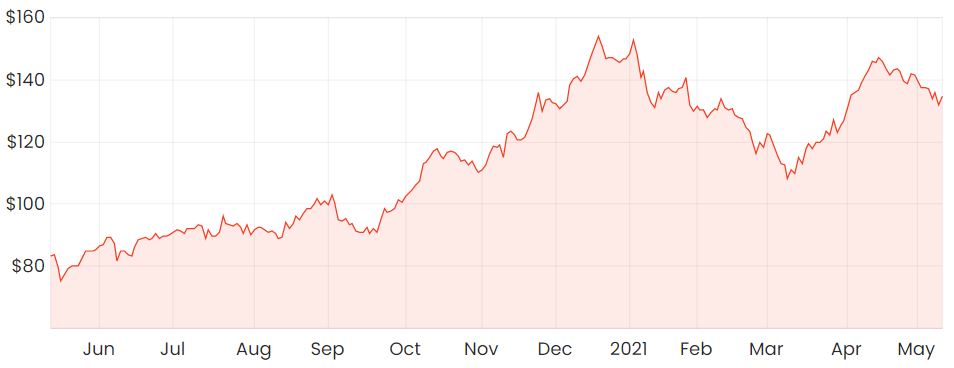

XRO share price

What has Xero been up to lately?

Due to Xero’s strong free cash flow generating ability, it’s recently been able to make multiple bolt-on acquisitions that further build out its app ecosystem.

In March, Xero announced it would acquire Planday – a workforce management business that has over 350,000 staff across Europe and the UK. When integrated with Xero, Planday will add value by providing a real-time view of staffing requirements and payroll costs.

Shortly after this acquisition, Xero then went on to announce it had acquired a Swedish-based company called Tickstar, which will allow Xero to enhance the functionality of its transactions thanks to Tickstar’s e-invoicing infrastructure.

Why we like Xero

Xero has grown to become a formidable competitor in its industry that aligns well with our Rask investment philosophy. This is partly due to its compelling product offering and competitive advantage through its network effects.

The broader thematic of cloud-based software is another reason to like Xero, and there’s a potential reopening play as new businesses emerge around the world from COVID-19, which could provide an additional tailwind in the coming years.

Additionally, the direction the company is heading with its acquisitions seems to make a lot of logical sense. Planday, Tickstar and Waddle appear to complement its core accounting offering nicely. And while they might not add significant amounts of value on their own, I think the real value will come from the overall network effects and the cross-selling opportunities.

This will have a positive effect on important metrics such as Lifetime Value (LTV), which is the gross margin expected from a subscriber over their lifetime – as well as Average Revenue Per User (ARPU).

For an explanation of some of these Software-as-a-Service (SaaS) metrics, you can click the article below.

https://education.rask.com.au/2020/02/12/saas-valuation-multiples-video-explainer-example/

Summary

Xero’s shares don’t come cheap, so investors likely have high expectations for the future. It will be interesting to see what happens after the release of its full-year FY21 results.

For some more reading, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.