The information technology sector hasn’t been the place to be on the ASX in recent weeks.

Since the start of the month, the ASX technology index (XTX) has declined by nearly 12% due to big losses from large capitalisation ASX tech shares such as Afterpay Ltd (ASX: APT), Altium Limited (ASX: ALU), Appen Ltd (ASX: APX) and Wisetech Global Ltd (ASX: WTC).

I’ve never quite understood the logic behind how closely we mirror US markets on a day-to-day basis. It would be hard to argue that some companies are intrinsically worth significantly less purely from what happened the night before in overseas markets.

Some of these dips may present opportunities. While catching a falling knife can be dangerous, now could be the time to add some ASX growth shares to your watchlist. Here are three ASX tech shares that are looking good at these levels.

Altium

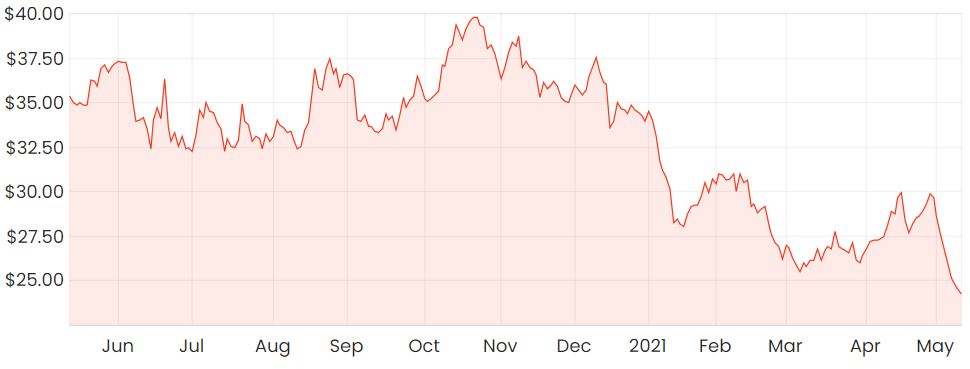

Software provider for printed circuit boards (PCB) Altium is beginning to look a lot more attractive at these levels. Its shares have fallen a whopping 18% since the start of the month alone.

ALU share price

Altium’s a company that’s been priced for growth for a while now, but its recent half-year results weren’t enough to please investors. Now, with the added threat of potential inflation and rising interest rates, it’s put tech companies like Altium in the crosshairs.

The good news is that many of the challenges the company is up against appear to be transitory at this stage and the long-term thesis remains unchanged in my view.

Thanks to its capital-light business model, Altium is a highly cash flow generative business that’s able to deploy capital where it sees fit.

Its most recent development is Altium 365 – a cloud-based platform that allows multiple users to collaboratively work on a single project in real-time. With over 5,000 current users, the company is trying to tap into a large addressable market to drive further growth.

Management’s targeting US$500 million in revenue by 2025-2026. For context, it reported revenue of $189 million in FY20.

For some more reading on Altium, click here to read: The Altium (ASX: ALU) share price could be in the buy-zone. Here’s why.

TechnologyOne

Staying on software companies, TechnologyOne Ltd (ASX: TNE) has gone through a healthy pullback recently. Its shares have dropped nearly 10% since the start of the month.

TNE share price

TechnologyOne develops and sells mission-critical enterprise software on a global scale. Due to the stickiness of its compelling product offering, it’s able to boast an incredible customer retention rate of 99%.

The company is debt-free and usually expenses all maintenance and research on its income statement. Around 22% of annual revenue was spent on research and development costs in FY20.

Similarly to Altium, it’s currently transitioning its customers from an on-premise licence model to a more flexible Software-as-a-Service (SaaS) model. Around 85% of its revenue is on a recurring basis, but it plans to grow this number further as more customers are migrated.

Technology One also seems to have a decent runway for further growth opportunities. It’s currently expanding into the UK market which is estimated to be roughly three times as large as the Australian market.

If you’d like to learn more about Technology One, click here to read: Why I like Technology One shares.

Aussie Broadband

While more of an infrastructure play, Aussie Broadband Ltd (ASX: ABB) is one that’s worth watching in my view. Its shares have fallen around 15% recently. Still, this isn’t too bad considering its shares listed on the ASX last year at just $1 per share and currently trade for $2.60 at the time of writing.

ABB share price

One of the reasons why I think Aussie has a bright future is because it’s still such a small player in an industry that’s been dominated by the incumbents like Telstra Corporation Ltd (ASX: TLS) and Optus.

With Aussie’s estimated 4.2% market share, I’d much prefer to back the smaller player rather than the larger companies that now have to fight to retain their share of the market.

That’s not the only reason I’d back Aussie though. It’s managed to build a strong reputation amongst its users from a commoditised product, which is quite commendable on management’s behalf.

Aussie is popular amongst its users for offering a fast and reliable service with quality customer service – a quality that is often highly underrated.

For some more reading on how Aussie’s been performing recently, click here to read: Report in: Why I’d watch Aussie Broadband (ASX: ABB) shares over Telstra.

For some more share ideas, I’d strongly recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.