The share price of Perpetual Limited (ASX: PPT) went up by more than 4% today, following its third-quarter (Q3) business update last Friday. Let’s look into its quarter performance and what it means for the Perpetual share price.

Perpetual is an Australian funds management business. It acts as the investment manager for a number of strategies but it also provides financial advice and trustee services.

Some of its key competitors include Challenger Ltd (ASX: CGF) and IOOF Holdings Limited (ASX: IFL).

PPT share price

Perpetual keeps growing

The company advised its total assets under management (AUM) was $95.3 billion as at 31 March 2021.

This is comprised of $71.6 billion for the global arm, which surged by 8% and $23.7 billion for the Australian operations, up 4%.

Perpetual notes this is mainly attributed to positive market returns and strong investment performance.

The Australian equities team along with Barrow Hanley’s global investments teams performed particularly well. Perpetual acquired Barrow Hanley in July 2020.

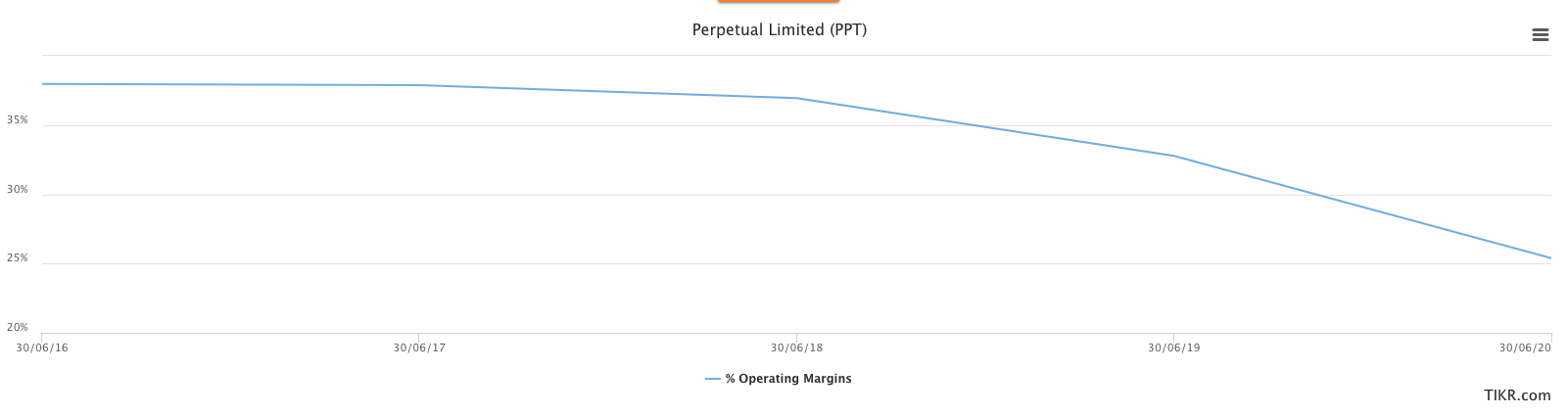

AUM is rising but operating margins is falling

Whilst it’s usually encouraging to hear about recent growth, it’s also important to understand recent trends.

In the case of Perpetual, even though AUM has been growing, its operating margins have gone the other way in the last four financial years.

Why is operating margins falling?

The employee headcount has consistently grown at Perpetual since FY16. And when you think about it, hiring more analysts and professional staff is what drives growth.

Administrative and general expenses also grew over this time period, which often happens when a business tries to keep growing its AUM.

It appears Perpetual recognised this in FY20 as it spent $13 million on carrying out a review of its operating model. This was done to achieve expense reductions and invest in technology.

My thoughts on Perpetual

In my eyes, the acquisition of Barrow Hanley is a bit concerning as it suggests Perpetual is struggling to generate organic growth.

When you combine this with falling gross and operating margins, it doesn’t look particularly attractive. Especially when you assess it through the lens of the Rask Investment Philosophy.

As a result, I think it’s important to monitor whether the operating model review is translating into cost efficiencies.

I think there are better ideas like Pinnacle Investment Management Group Limited (ASX: PNI) that is exhibiting growing gross and operating margins.

If you are interested in other ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.